The Baltic Exchange and ZCE will cooperate on developing futures settling against the Baltic Panamax Index in China Photo: Shutterstock

The Baltic Exchange and ZCE will cooperate on developing futures settling against the Baltic Panamax Index in China Photo: Shutterstock

The Baltic Exchange, through its market data subsidiary, Baltic Exchange Information Services Ltd (BEISL), and Zhengzhou Commodity Exchange (ZCE) signed an MOU on 1 September to cooperate on developing shipping derivatives. BEISL and ZCE will work together on the research and development of a futures contract settling against the BPI in China.

The BPI is a composite index comprising five key international Panamax routes. Panamax vessels mainly transport coal, grain and other goods, and are a major force in dry bulk shipping. By weight, more than 90 per cent of dry bulk cargo in international trade is transported by ship. Dry bulk shipping is international in nature, has an active diverse range of participants, and frequent freight rate fluctuations.

The Baltic Exchange's globally recognised benchmarks, indices and shipbroking best practices are well respected by international markets. BEISL has regulated status under the UK Financial Conduct Authority and our benchmarks are audited, verifiable and completely independent.

Established in 1990, ZCE offers futures and options products covering the field of agriculture, energy, chemicals, textile, construction materials and metallurgical industries. As the largest futures and derivatives exchange in China and the seventh-largest globally, ZCE's cumulative trading volume was 2.6 billion contracts in 2021.

Mark Jackson, Baltic Exchange CEO, said: "The Baltic Exchange is delighted to collaborate with ZCE as we look to develop our presence in China and support new market participants in trading derivatives which reference Baltic benchmarks. The BPI futures will provide a new freight risk management tool for Chinese shipping enterprises. Growth in the bulk freight derivatives markets has in turn long-term benefits for the entire maritime community.”

ZCE added: “China is a country with large shipping capacity and trading volume. The scale of its dry bulk cargo shipping fleet and import volumes rank first in the world. Chinese shipping enterprises are deeply involved in the international market and are exposed to freight rate fluctuations.”

Panamax market performance

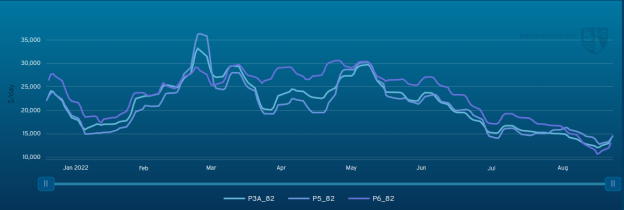

As the second largest type of vessel in the dry bulk sector, the Panamax sector's weighted time charter average across the five routes (5TC) started the year at $25,865. The year’s peak appeared at the end of March at slightly over $30,000 per day. Similar to other sectors with limited activity in the summer season, the Panamax sector is currently struggling at an all-year low, pricing the 5TC at around $12,000 daily. This is however above operating expenses, as well as being the highest amongst other dry bulker vessels.

The 5TC was priced at $12,000 daily at the end of August

The 5TC was priced at $12,000 daily at the end of August

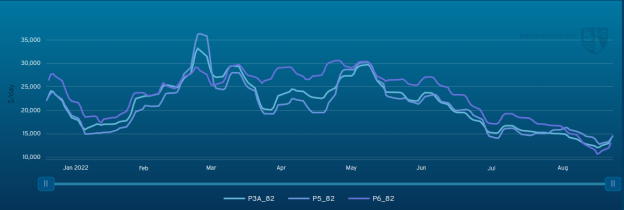

Among the five time charter routes, there are three Panamax routes closely related to the China market: P3 – the NOPAC (North Pacific) route, P5 - the Indonesia round voyage, and P6 - the east coast South America round voyage. To perform these sailings, the vessels are usually delivered in China or Southeast Asia, and load in US east coast ports for grains, in Indonesia for coal, and in east coast South America for grains, with discharge and redelivery to various ports in China.

The P5, P3 and P6 routes that move bulk cargos to Chinese ports

The P5, P3 and P6 routes that move bulk cargos to Chinese ports

P5 is published in Singapore at 1pm China time. P3 and P6 are published in London at 1pm local time, together with another three time charter routes and two voyage routes.

Fluctuations and trends of the P5, P3 and P6 routes in the last nine months to end of August

Fluctuations and trends of the P5, P3 and P6 routes in the last nine months to end of August

A dead cat bounce prognosis (brief recovery in declining price) appeared recently after the market had hit rock bottom. Let’s see what the third quarter brings as many regions approach the winter months.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar