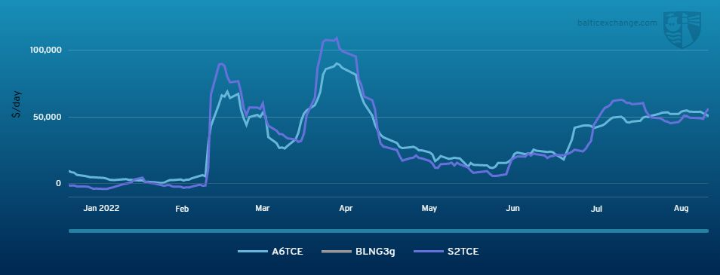

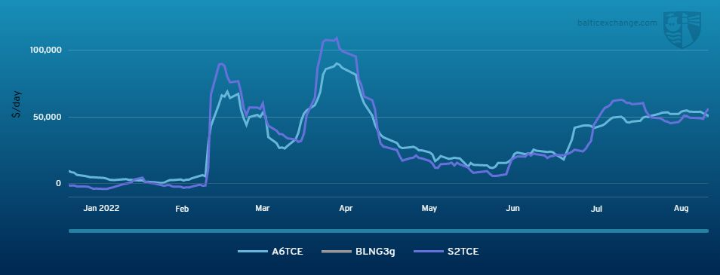

An upward trajectory can be seen in the dirty tanker market on the Aframax A6 time charter equivalent – a collection of six global Aframax routes – and the Suezmax S2 time charter equivalent indices, which has two global routes (see chart below). These two vessel indices represent the seaborne movement of crude or dirty oil products.

Aframax A6 and Suezmax S2 indices show an upward trajectory on these routes

Aframax A6 and Suezmax S2 indices show an upward trajectory on these routes

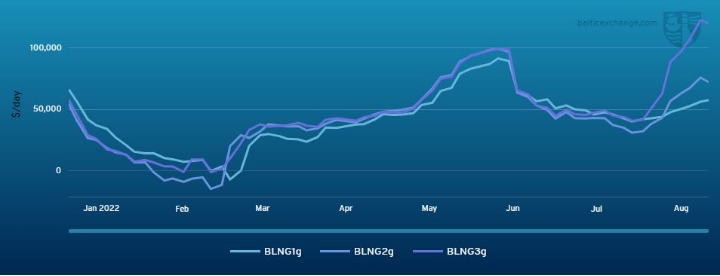

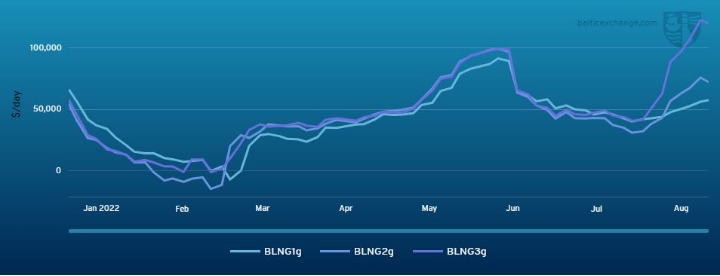

The gas sectors are taking a similar upward trajectory, albeit with an extreme lift from BLNG3 (US Gulf to Japan). The BLNG1 (Australia to Japan), BLNG2 (US Gulf to Continent) and BLNG3 indices are said to have already begun building in value in anticipation of an energy squeeze coming this winter. Security of supply is a primary concern for both Northern Asia and other Northern Hemisphere countries. With the supply of LNG in such demand, transport of the product is key.

Freight rates on BLNG1, BLNG2 and BLNG3 routes are rising

Freight rates on BLNG1, BLNG2 and BLNG3 routes are rising

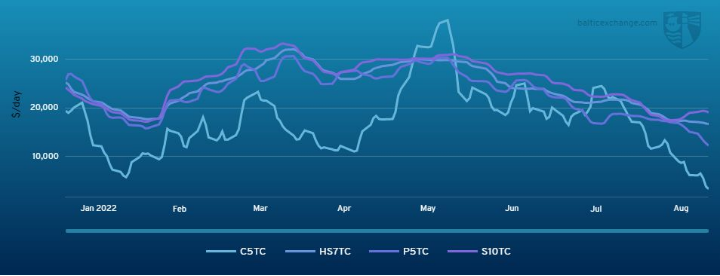

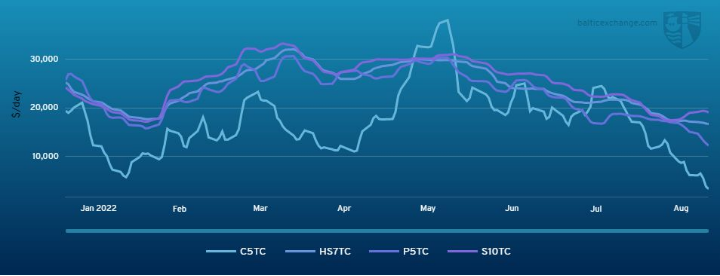

Bucking the trend of the previous two sectors, the Asia freight markets have continued to see a slowdown in the dry bulk freight sectors. Timid demand for bulk industrial products in the construction sector is thought to be one of the main underlying causes. The largest sector, Capesize, is currently trading at sub-operating expense levels while the Panamax, Supramax and Handysize segments are all showing signs of weakness although declining at a slower pace. This area of trading can aptly be considered as ‘entering the doldrums’.

Freight rates in the Capesize, Supramax and Handysize sectors are declining

Spotlight Report

Freight rates in the Capesize, Supramax and Handysize sectors are declining

Spotlight Report

The word ‘doldrums’ has been synonymous with shipping since long before our modern fleet made their first voyages. It is a term that was coined to represent areas along the equator where vessels would often find themselves without a gust of wind to fill their sails.

In this situation, the vessels were left idle in the water with no means of propulsion. This is a somewhat helpless situation to find oneself in and largely requires only patience to remedy. Wait for the wind!

As freight markets approach and breach the operating expense levels, which is when the revenue earned goes below the cost of operating the vessel, owners are forced to choose between several unsavoury business choices.

Assuming an owner has control of their vessel it is generally accepted that they would not time charter contract their vessel to a charterer while also paying the charterers a rate for the privilege of taking their vessel. Time charter rates going negative, at least from an owner's point of view, should not be possible. There are exceptions to this but that is for another time.

So what are the owners' options when the earnings approach zero return? Well, the first option would be to consider a ‘hot layup’. The vessel is instructed to go to an anchorage location and wait for further instructions. The idea here is to wait out any short-term market lull by not entertaining any business at the currently offered levels. The vessels would incur the full cost of the operating expenses.

When revenues drop below operating costs, owners may consider hot or cold layups

When revenues drop below operating costs, owners may consider hot or cold layups

Looking at this scenario from a demand and supply perspective, the supply of tonnage would now be reduced. This would have a direct impact on the market and if enough owners followed suit, the market may rise.

It may also not rise. Market fundaments may well be stacked against the owners' ambitions. When the market outlook doesn't improve after hot layups have taken place, owners will then consider their ‘cold layup’ options.

Fewer crew are required on cold layups

Fewer crew are required on cold layups

The cost to anchor a vessel for a length of time varies from port to port, however scouting a suitable anchorage will help keep costs down.

Auxiliary engines are run onboard large vessels for all manner of roles including heating fuel, pumping ballast water, or generating electricity for living quarters, for example. This comes at a daily fuel cost which can be turned off to reduce costs.

And then we get to the crew onboard the vessel. A high proportion of daily operating expenses comes from wages. In a cold layup, crew numbers can be reduced to the bare minimum.

But there is an offset here. The ocean takes its toll on vessels and the crew mitigates this wear and tear. Reducing number of crew on board can also increase repair costs in the future.

So now the owner has their vessel in cold layup, saving on operating expenses, yet ultimately holding an expensive asset awaiting global shipping markets to recover. Placing a vessel in cold layup is not taken lightly by any owners as returning from this condition requires making the vessel operational once again including sourcing new crew, which can take time.

Shipping as an industry doesn't stand in isolation. So as a critical component of the world's wider economy, if vessels are trading below operating expense level or being placed into lay up for any length of time, a clear signal can be read into the health of the wider market.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar