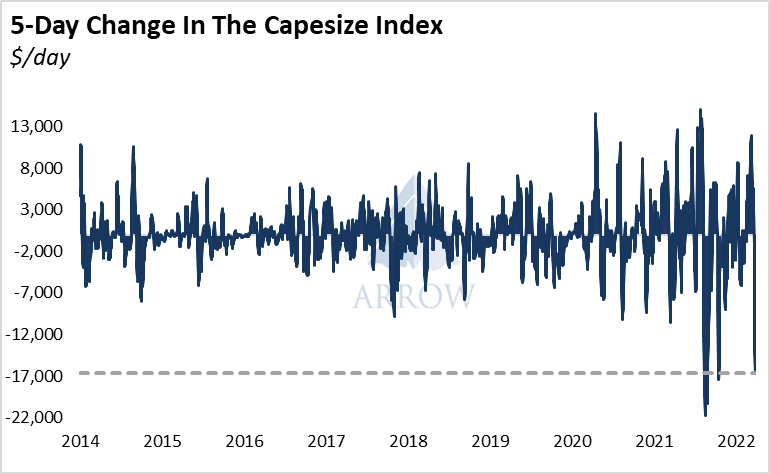

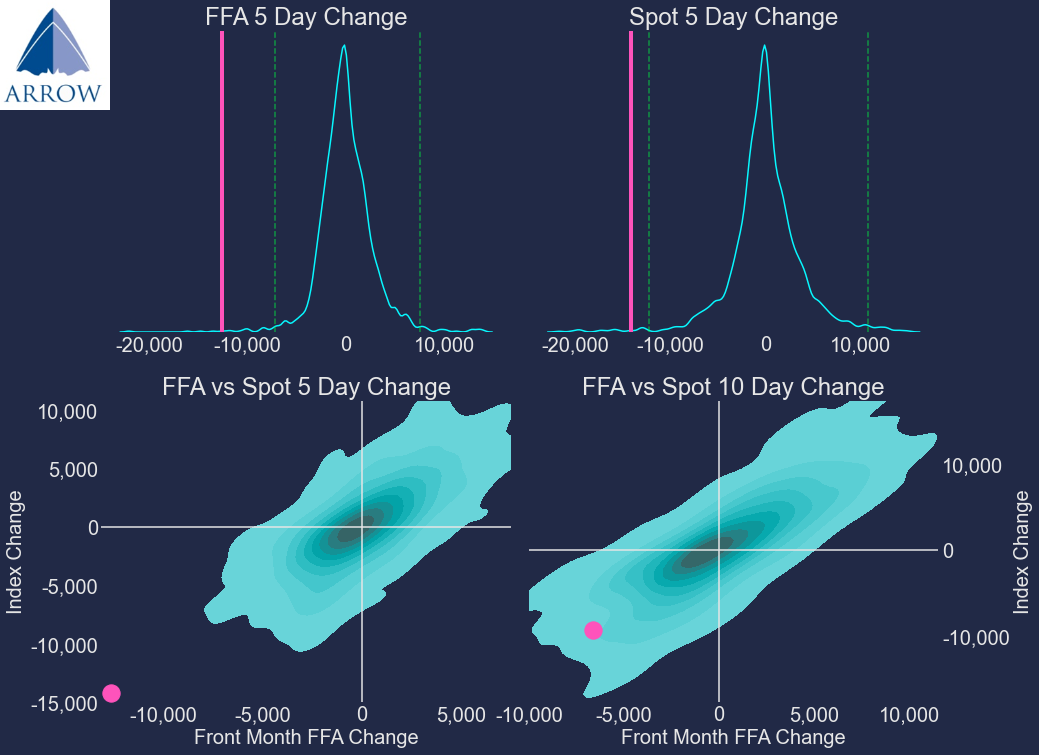

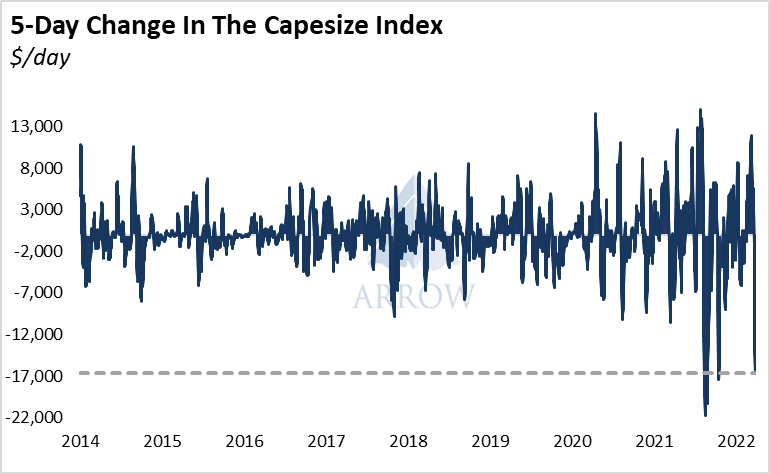

The Capesize index has dropped over $16k/day during the past 5 index days. It's difficult to pin this crash on a single factor, however the strength of the recent rally warranted some kind of technical pullback – however its ferocity has surprised most.

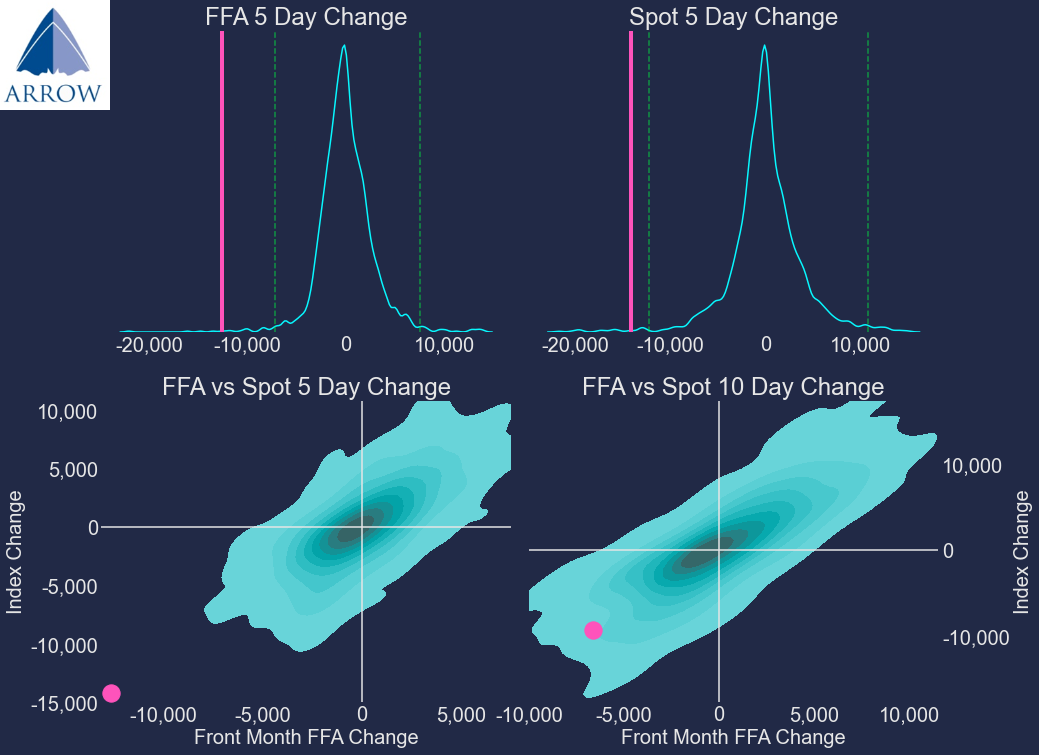

Both spot rates and front month FFAs have experienced a large 5-day drop, outside of the 99% confidence interval. That means last week has been in the top 1% of the most volatile weeks since inception of the 5TC.

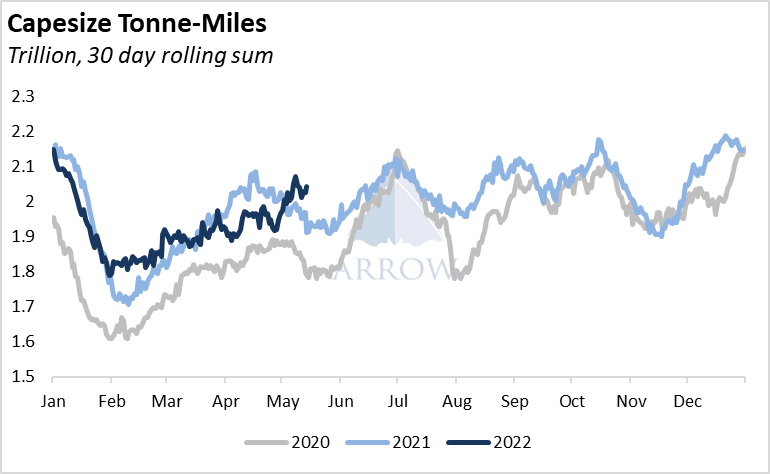

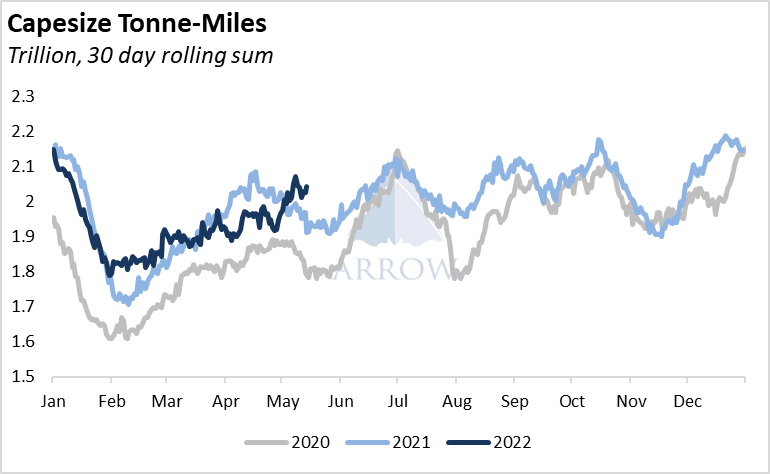

The medium-term supply/demand dynamics are largely unchanged over the past week, and remain positive. Whilst coal and iron ore exports have started the year on tepid note, strong Bauxite volumes have pushed Capesize tonne-miles to a new record seasonal high.

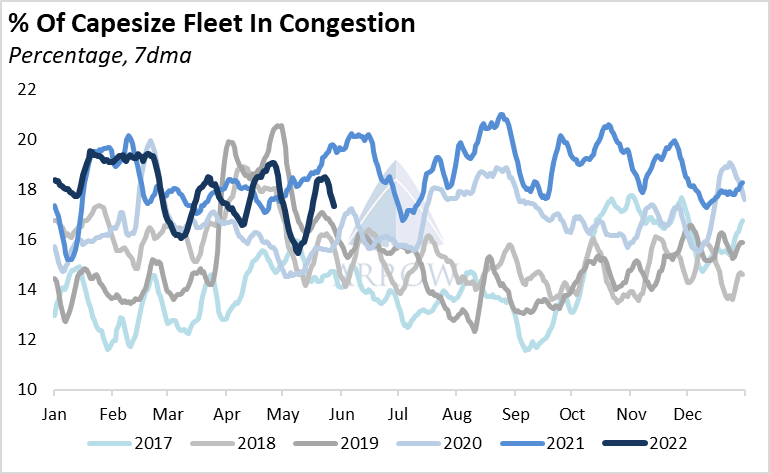

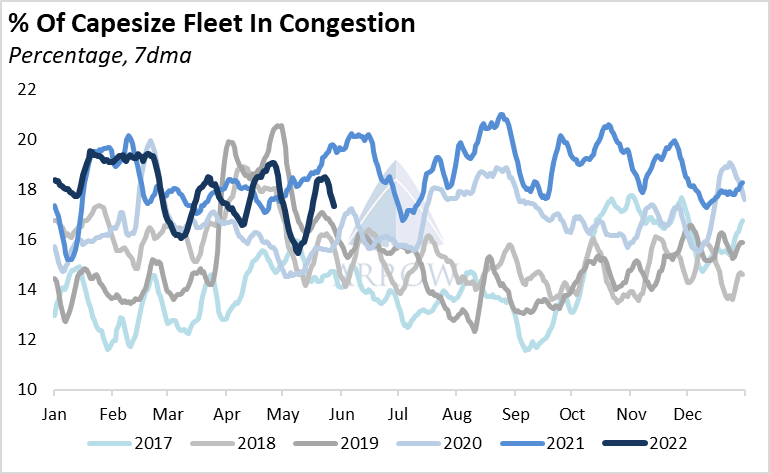

Capesize congestion is lower than this time last year, however still above prior years.

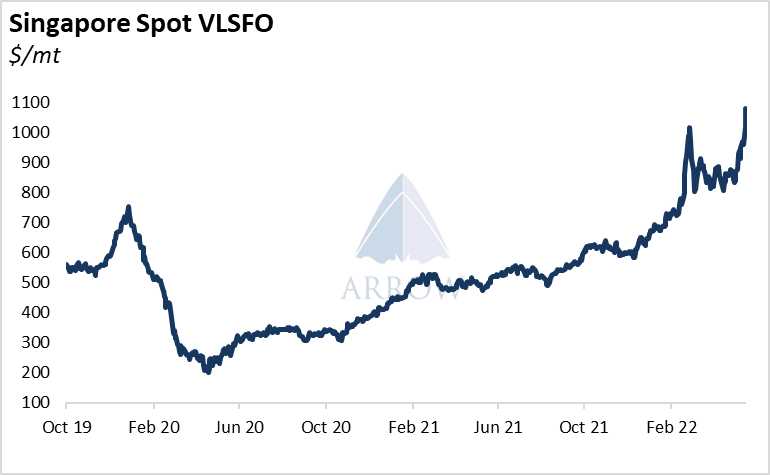

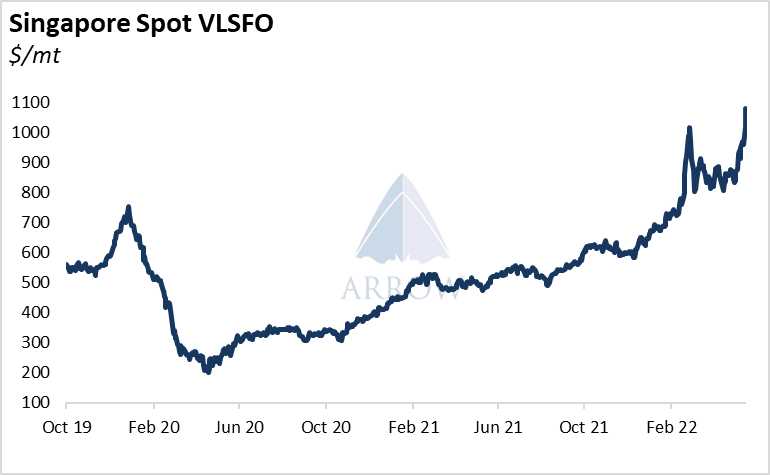

Arguably the most interesting factor looking ahead at the rest of the year is bunker prices. Spot Singapore VLSFO is at $1,081/mt at the time of writing, and this will drag vessel speeds downwards, unless TC rates bounce up. We believe that healthy Capesize cargo volumes during Q3 & Q4 will require the fleet to speed up to a similar level to last year, however with bunkers much higher year-over-year, strong TC rates will be required.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar