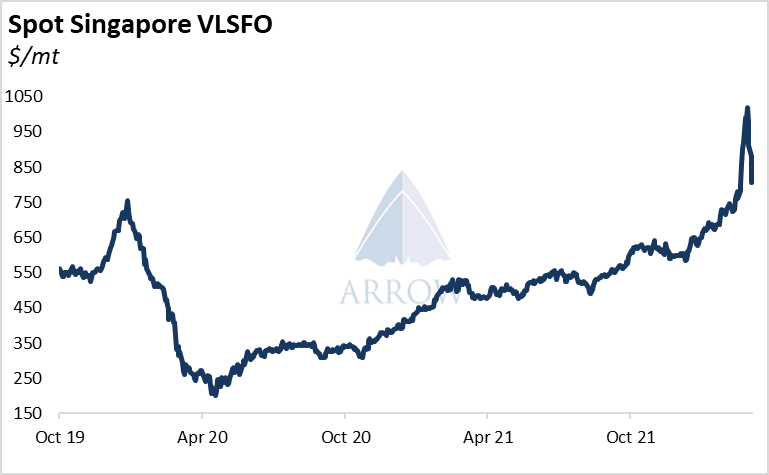

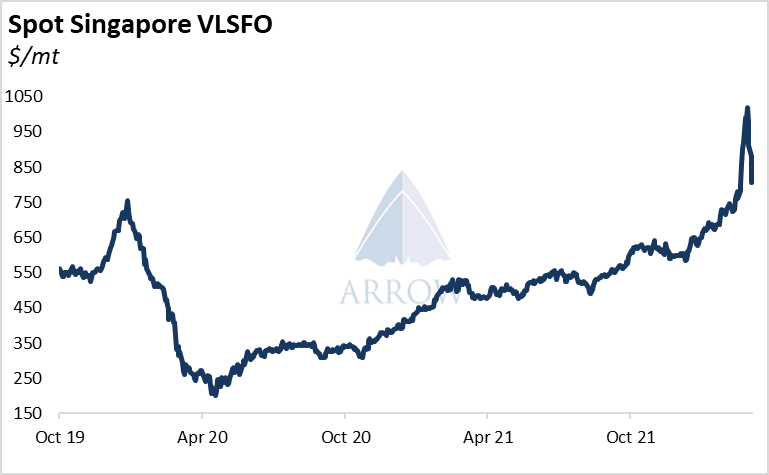

Oil market momentum continues as Brent crude futures trade as high as $139 and calendar spreads are signalling severe tightness. While there’s been wild swings in prices recently, the oil market looks set to remain strong over the coming year and will keep bunker prices elevated.

In a previous report (Arrow to the Point, 27 Jan 2022) we discussed how strong gasoline demand could result in bunker prices being pushed even higher as ‘middle barrel’ feedstock supply remains muted, and we still believe this trend will continue.

Russia is a major exporter of dirty petroleum products (DPP). In 2021, Russia accounted for 18% of global DPP seaborne exports. It also accounted for 14% of fuel oil and a whopping 58% of vacuum gas oil (VGO) shipments.

VGO is a typically niche product and used as a feedstock in gasoline and very-low sulphur fuel oil (VLSFO) production.

Heavy refinery rationalisation in Europe during the pandemic resulted in limited supplies of VGO. Investments are being made for new production capacity in Russia, but it is yet unclear how much of that new supply – if at all - will find its way into the seaborne market over 2022-23.

By contrast, demand for VGO is on the rise. Global gasoline demand surged during the pandemic and is expected to remain high in 2022. Likewise, the strength in demand for VLSFO is set to endure. This fight between gasoline and bunkers could see VGO prices push even higher in 2022. This situation, in turn, would have knock-on effects for gasoline and VLSFO bunker prices as they compete for this increasingly scarce feedstock.

Although bunkers prices do not directly feed into timecharter rates, they have a significant indirect effect on them. As bunker prices go up, vessels require a higher timecharter rate to keep the same speed. When the supply/demand balance is loose and rates are low, bunker prices may have a small impact on the market. However during a tight market when the fleet is required to increase speed to meet demand, higher bunker prices can have a considerably deeper impact.

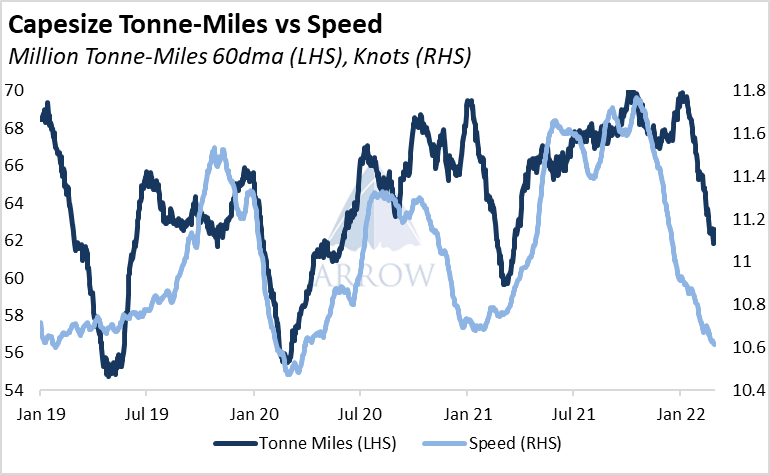

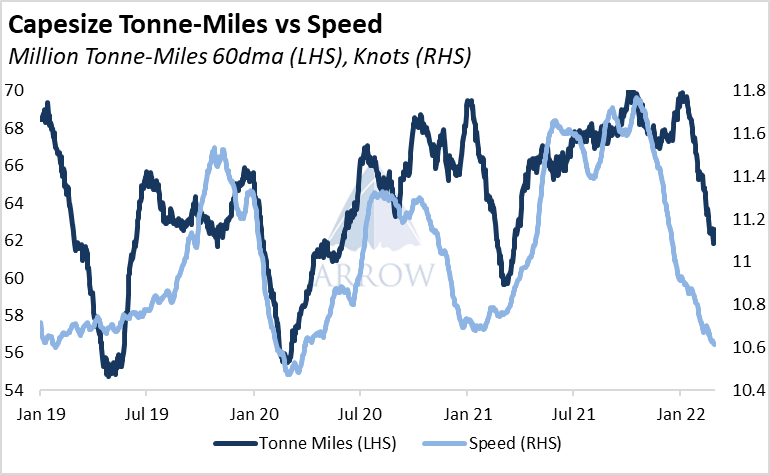

Vessel speeds follow timecharter rates, which in turn are primarily driven by tonne-mile demand. In the usual Q1 slump in tonne-mile demand, timecharter rates drop which brings down speeds. Then later in the year as demand picks back up, speeds push higher.

We may currently be sat in the quiet before the storm. Once freight demand picks up in the middle of the year, timecharter rates will need to rise much higher than in recent years to bring the fleet speed back up. Vessel operators will not increase speeds until the TC/bunker trade-off pays out.

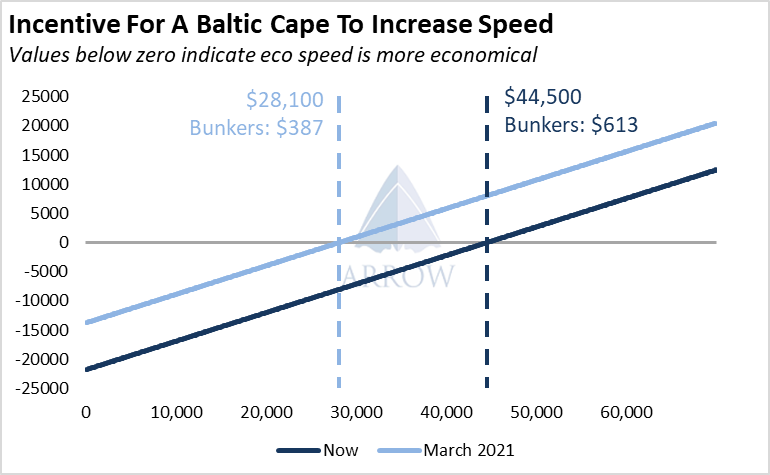

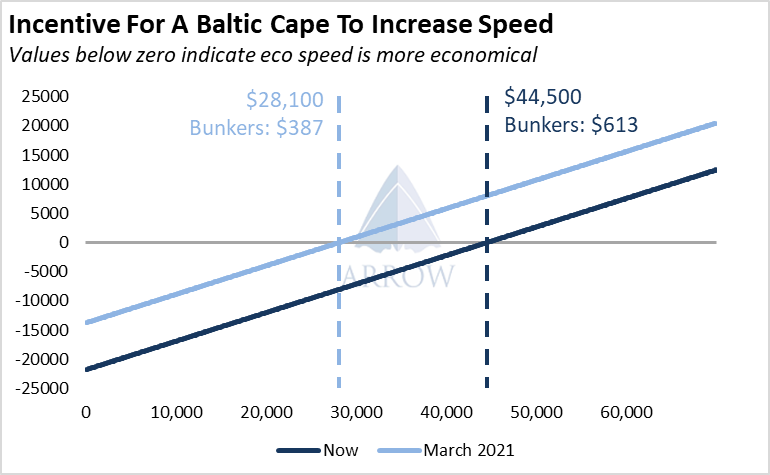

We have modelled how a Baltic standard Capesize vessel will be incentivised to switch to full speed vs eco speed given different bunker prices and timecharter rates. We simply look at the theoretical cost of sailing 1,000 nautical miles on either speed. The result of the calculation gives us the profit or loss of sailing at full speed vs eco speed (cost at eco speed minus cost at full speed) – we can view this figure as the ‘incentive to speed up’.

If we run the calculation on current bunker prices, the eco vs full speed switching level is around $44.5k/day, however this is in stark contrast to last year when the level was around $28k/day.

Whilst this is a simple theoretical calculation, it perfectly highlights how timecharter rates will need to go higher compared to last year for any given supply/demand balance.

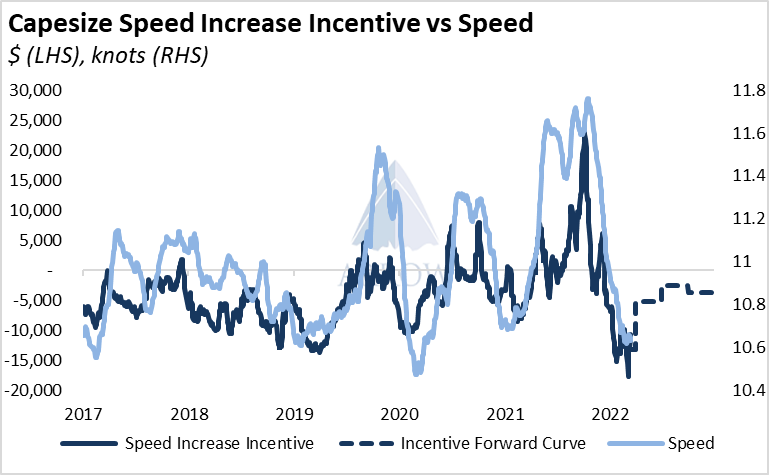

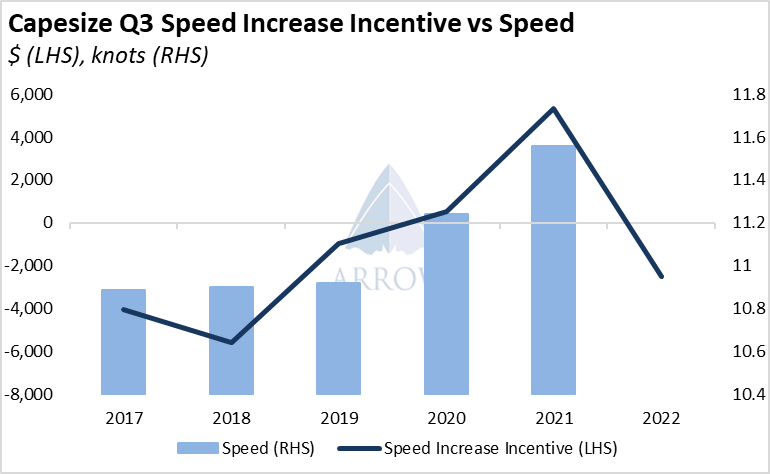

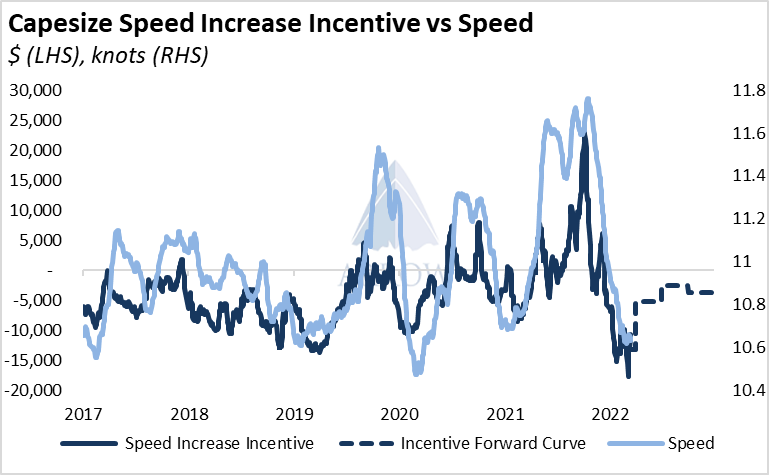

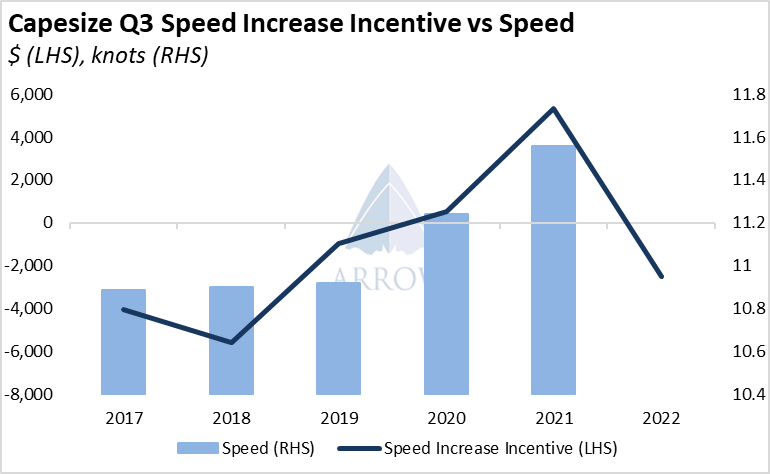

Using historical spot prices, we can view this ‘incentive to speed’ up over time. If we plot this against actual Capesize speed we can see they track each other well.

Now using this calculation on the bunker and FFA forward curves, we can see how, according to the whole forward curve of 2022, there will be only a moderate incentive for vessels to speed up. Given the optimism of the market for 2022, it is very interesting that the ‘speed forward curve’ implies a mild speed increase over the year and is the most bearish for 4 years.

If a tight market later this year materialises and the fleet needs to speed up greatly, then either the freight or the bunker forward curve will need to move. Given the structural tightness in the bunker market, we suspect freight will be the one to move.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar