Iron Ore Demand Rollercoaster

Poor Chinese steel production since 2H21 will likely come to an end once the Winter Olympics finishes and winter air pollution controls ease. Steel production could be weighted towards the middle months of the year in 2022 as Q1 sees the Olympics and Q4 may see a slowdown to meet annual targets alongside winter heating restrictions. These middle months of the year could well see record highs for steel output. It's likely that during this year the total housing stock under construction will contract as completions outpace new starts, this will weigh on rebar demand. However recent government stimulus will likely counteract some of this lost demand as infrastructure projects pick up. Iron ore stocks have stabilized over the past 2 months, and will likely start drawing down over the coming months, this could well provide a needed buffer should supply disappoint.

Covid & Rains Upsetting Iron Ore Supply

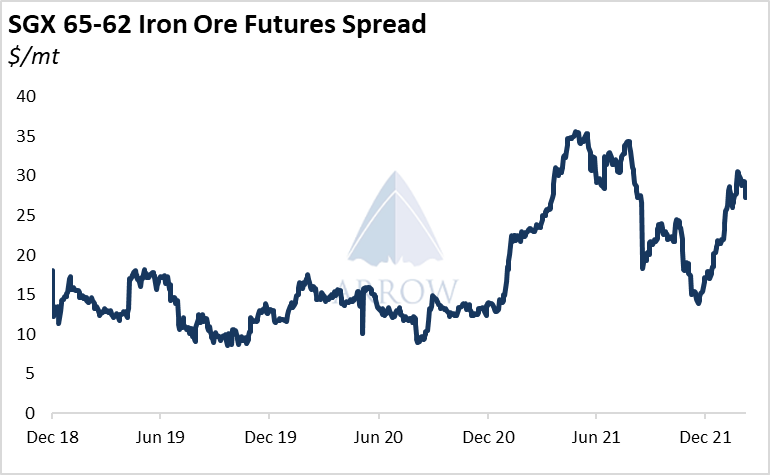

In Eastern Australia, the spread of covid, alongside rains, has hampered coal logistics, leaving YoY exports in January flat, and much below 2020 & 2019 levels. This is whilst Western Australia is maintaining Covid border restrictions and iron ore exports reached the highest ever for January. There have already been outbreaks at Pilbara mines, and the risk of further outbreaks is high. Any easing of state border restrictions will likely lead to labour shortages from Covid outbreaks, however these restrictions are also limiting the pool of available labour as you cannot freely cross state borders. It's a catch 22 situation and will endure over 2022. In Brazil, poor weather has meant disappointing exports so far this year, however miner annual guidance is unchanged. Strong premiums for higher iron ore grades should keep Vale focussed on their “value-over-volume” strategy, yet high iron ore prices fully incentivise maximising exports across grades.

High Coal Prices Supporting Volumes

The global energy shortage keeps thermal coal prices high and exporters keen to pump out strong volumes, coking coal prices are around record highs too. The two biggest coal exporters for the Capesize segment are Australia and Indonesia. Indonesia had the coal ban, whilst rains & Covid affected output in Australia. If we look at Capesize coal volumes excluding Indonesia & Australia we see January preliminary volumes grew 25% YoY (that figure is 7% across all vessel classes). The issues hampering exports from Indonesia & Australia are not structural issues, and therefore we expect volumes to pick up swiftly.

Fundamentals Holding Up

If we look under the hood of preliminary data for January, things are looking alright. January Capesize tonne-miles for Brazilian iron ore was down a whopping 19%, however a 3% growth across the rest of the market mean YoY tonne-miles were a shade under flat. It’s also worth noting here that average Capesize DWT at anchor (congestion) was up 16% in Jan 2022 vs Jan 2021. Which is perplexing as a key reason for the January rally in 2021 was attributed to congestion. Jan rates averaged $22k in 2021 vs $13k in 2022. So in 2021 there was less congestion, roughly the same number of tonne-miles, yet the index averaged 70% higher than 2022. The bullish Chinese congestion story of 2021 clearly outperformed the bearish Brazilian weather story of 2022.

Chinese steel production will likely see modest growth this year as the government takes a more measured approach to output controls, and this should bolster iron ore prices and keep the whole cost curve well above water. Therefore importantly for the freight market, cargo supply is key to watch. Iron ore volumes out of Brazil continue to be at risk over the coming months, and out of Australia Covid risks abound throughout 2022. Even with the poor Brazilian volumes, the Capesize fundamentals are doing fine so far this year. Whilst there are risks to Australian output from Covid, Capesize tonne-miles should post YoY growth throughout the year. The current FFA curve is pricing Q2-Q4 25% below where it settled in 2021 and although hopes of another $86k index print might be premature, once the Q1 doldrums ease and sentiment flips, the market will be well positioned for another strong year.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar