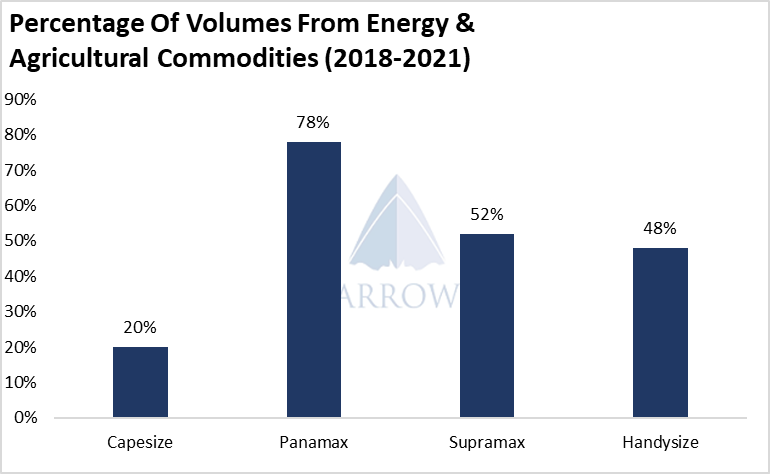

Over the past year, strong cargo volumes on Supramax & Handysize have boosted their earnings considerably. Whilst Panamaxes have fared very well in this market, they have not outperformed the smaller vessel classes as poor coal volumes, changing coal trade routes and a terrible Brazilian corn crop have held back potential. Looking ahead over the next 12 months, we see the potential for the Panamax sector to outperform.

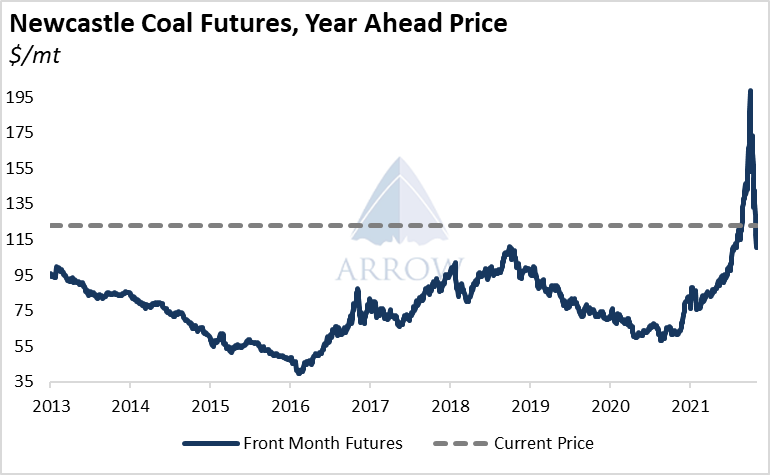

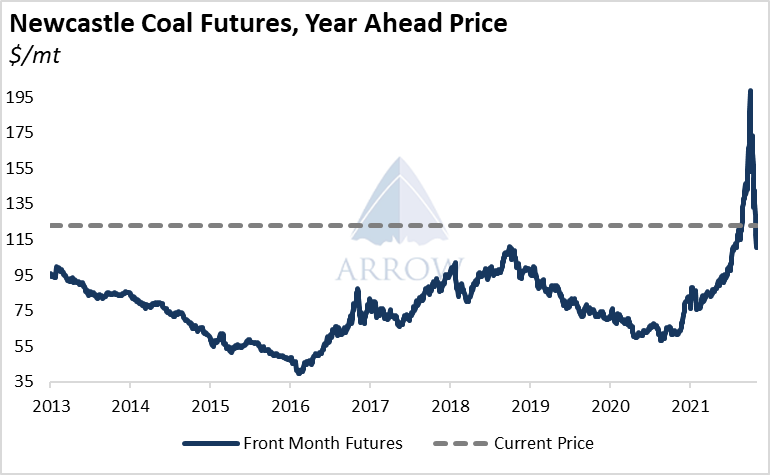

During recent weeks, energy prices have trended down as fears of a devastating shortage have subsided, however prices are set to remain high on a historical basis for the coming year as the world still remains lacking sufficient energy reserves. Using current futures prices Newcastle coal could maintain above $100/mt for years (a reflection of how bullish the futures market is), considering almost all seaborne thermal coal can be profitably produced at this level we expect coal volumes to increase in the medium term. All short-term marginal supply will likely be maxed out over the winter, and the Q1 slump in volumes seen in 2020 & 2021 may not repeat. These growing volumes will lend strength to the Panamax segment, however it's unknown to what extent Capesize vessels will also take these volumes.

On grains, the picture is more opaque. A shortage of fertilizer worldwide could hit crop yields as farmers ration whatever supplies are available to them. On top of this, a La Nina event this year could further harm global crop yields. Lower beginning stocks and higher domestic consumption will limit the exportable surplus from the US, even with large production increases.

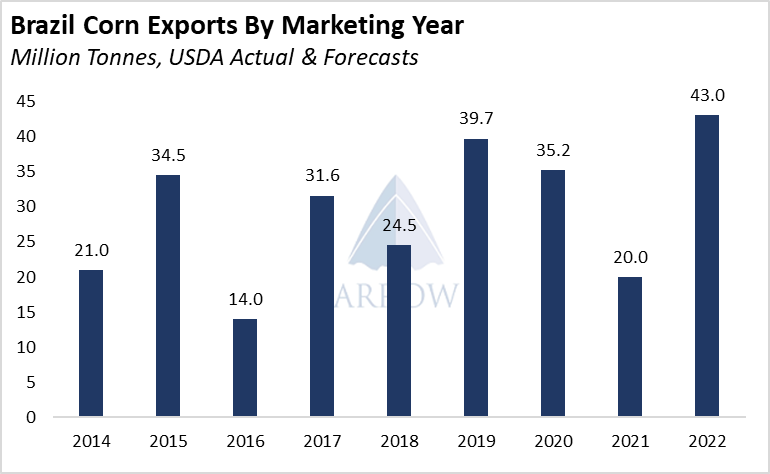

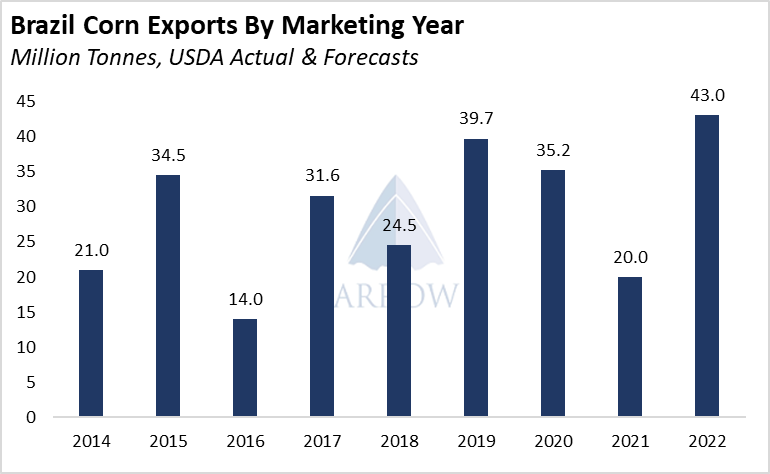

However this picture is not as gloomy as it may seem, as of yet concerns about fertilizers and weather events are speculative, and US grain exports will likely be the second best on record. Additionally, in Brazil, hopes for a better crop this year should see exports of soybeans up 11 million tonnes and corn up 23 million tonnes. As per USDA forecasts, worldwide coarse grain exports will grow 9.6% this marketing year, and soybean exports will grow 4.8%.

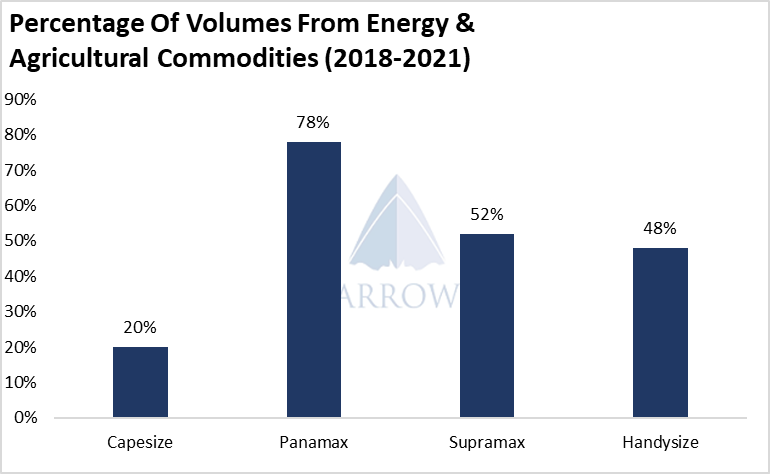

Over the past 4 years, 78% of Panamax loadings were energy & agricultural commodities, far higher than any other vessel class. As detailed above, the outlook for exports of energy & agricultural commodities is positive, and Panamaxes are in the prime position to benefit.

We can envision that next year strong Brazilian soybean & coal volumes tighten the market over the first half of the year, which is then followed by a huge Brazilian corn crop in Q3, a time at which the Capesize segment will also likely find seasonal strength.

The recent sell off in the dry bulk market has afflicted the Capesize segment more than smaller vessels, and we think this pattern will continue. September Panamax shipments excluding grains & coal were up around 19% year-on-year, indicating how growing demand for the segment is broad based. A low orderbook will keep deliveries low next year, however easing congestion could release supply. Whilst there are downside threats, the balance of risks looks favourable for Panamaxes. Q1 looks set to be weaker as it often is, however later next year the stars may align for the Panamax sector to outperform.

Source: Arrow

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar