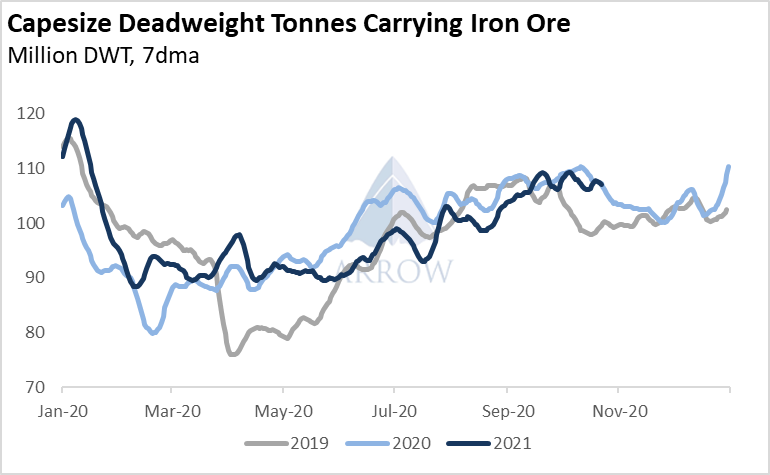

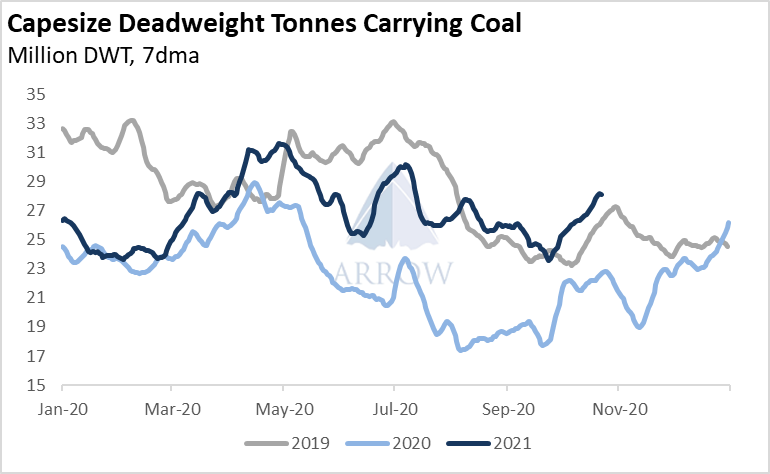

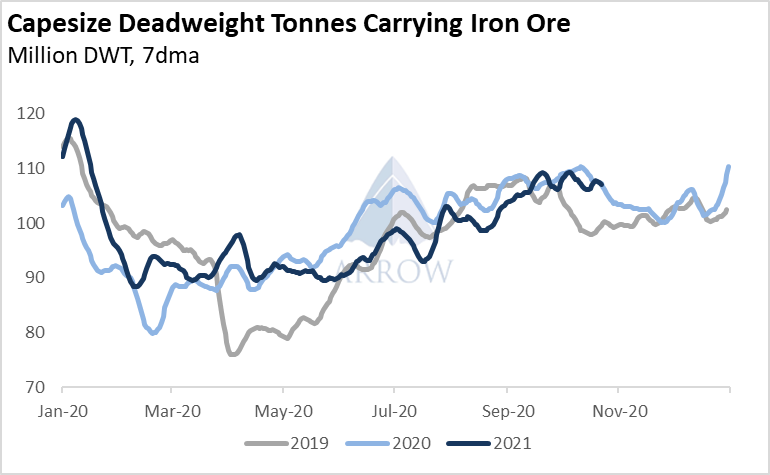

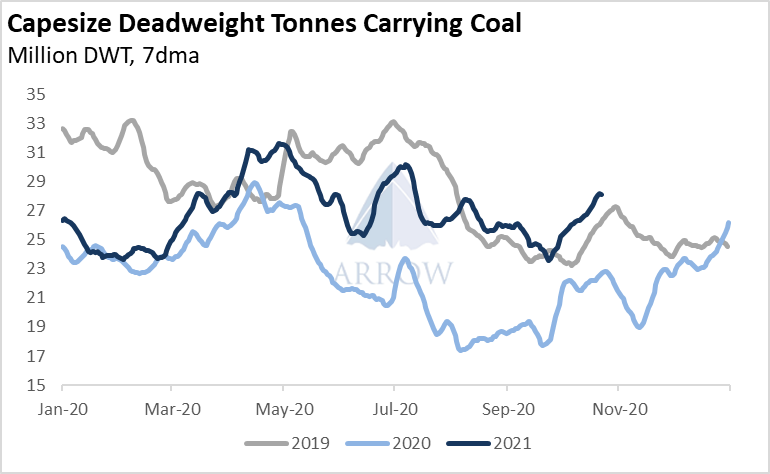

Brazilian and Australian iron ore shipments have eased over the past few weeks. Brazilian exports last week were at the slowest pace since May, a sign that the best is likely behind us for this year. Consequently, iron ore utilization of Capes has dropped off marginally from the highs of early October. Vale have also stated that they reckon their production will hit the lower end of their guidance, indicating the Q4 shipment rate will be around 6% lower than the Q3 rate. However, the improving coal trade is supporting utilization rates as it's taking about 25% more Capesize tonnage than this time last year.

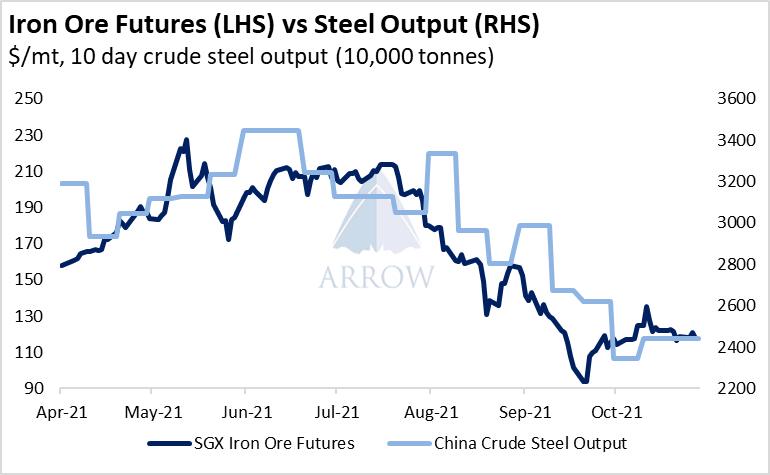

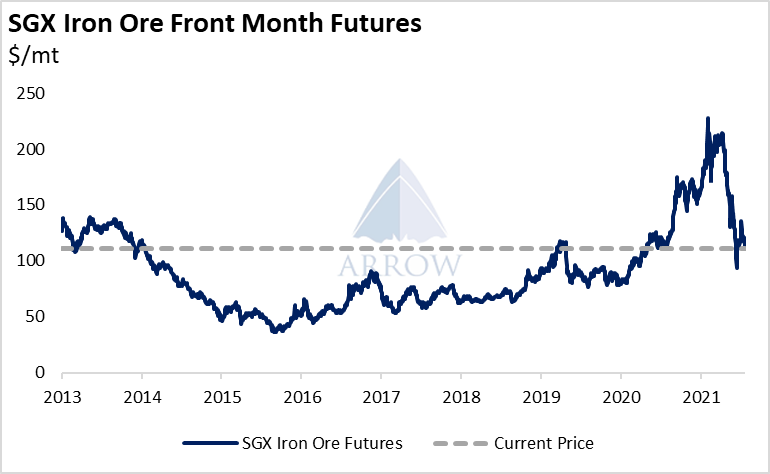

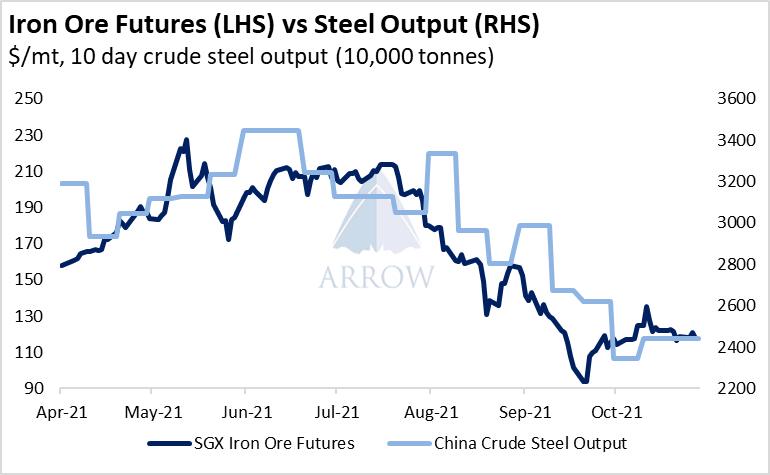

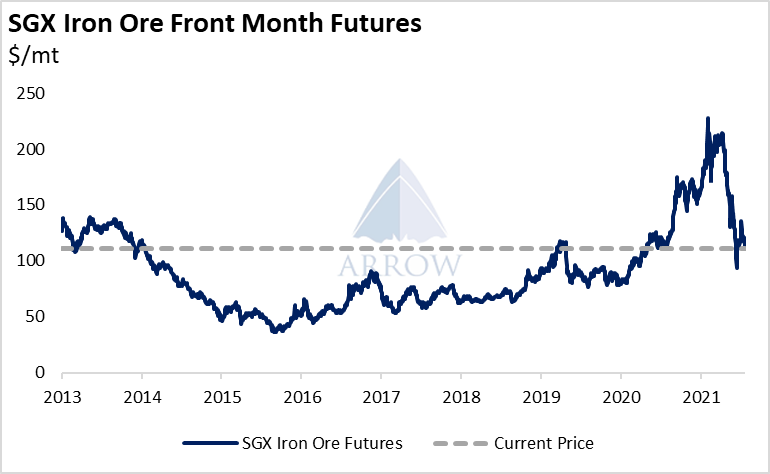

The concerning story for Capesize demand is the Chinese steel sector which is currently being constricted by both energy shortages and government energy intensity mandates. Steel production dropped precipitously throughout Q3, and has stabilized so far in Q4, and the iron ore price has been tracking this drop so far. Yet as steel production is at the lowest seasonal level since 2018, iron ore prices remain at a historically high level, even after the recent crash. These iron ore prices indicate that demand is still doing alright, and the reasonably stable prices during October indicate the seaborne market is in a general balance. However, the building inventories in China point to a surplus, which could continue for quite some time as healthy reserves are built, but at some point this may affect import demand.

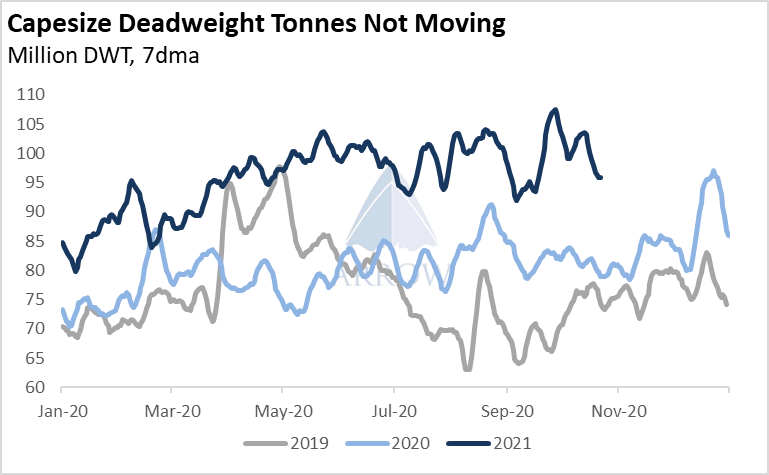

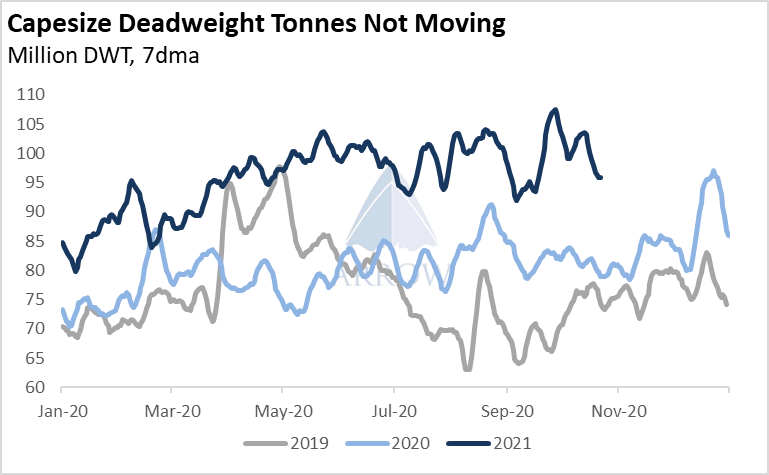

The congestion picture is largely unchanged, inefficiencies across the board are soaking up tonnage leaving vessel supply diminished. China is doubling down on their zero-Covid strategy, which is a source of the current bottlenecks. Yet Australia is intent on easing Covid restrictions, which may change quarantine rules for vessels there.

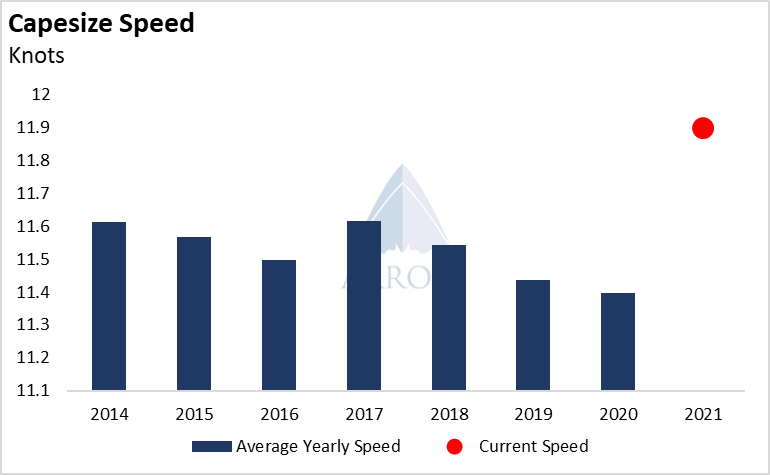

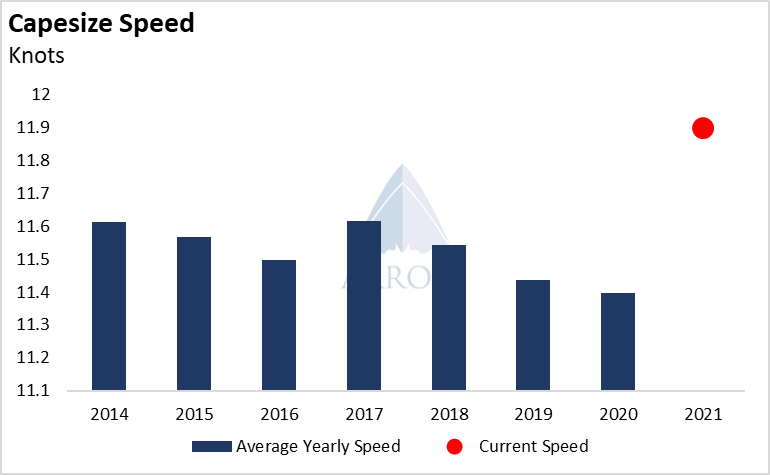

Vessel speeds are currently high and this increases supply in the short run. As volumes dip over the coming months, speeds would need to also drop to balance the market.

Most important of all, sentiment has dropped over the past couple of weeks. Talks of a supercycle are on pause, China watchers are concerned and tanker optimism is stealing the limelight.

Although fundamentals have eased and sentiment has dropped, there's little news over the past couple of weeks to warrant the sell-off in the deferred FFA contracts. The Capesize calendar 2022 contract has taken the stairs up and the elevator down as it has dropped 20% from the highs earlier this month. We all knew about this seasonality in Brazil's iron ore shipments, it came earlier than expected and eased the market tightness, but that doesn't change the broader market outlook.

Whilst developments on the demand side in China are concerning and Vale's exports disappoint, elsewhere the picture remains constructive. A soaking wet towel has landed on the market and put the fire out, however the embers burn strong.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar