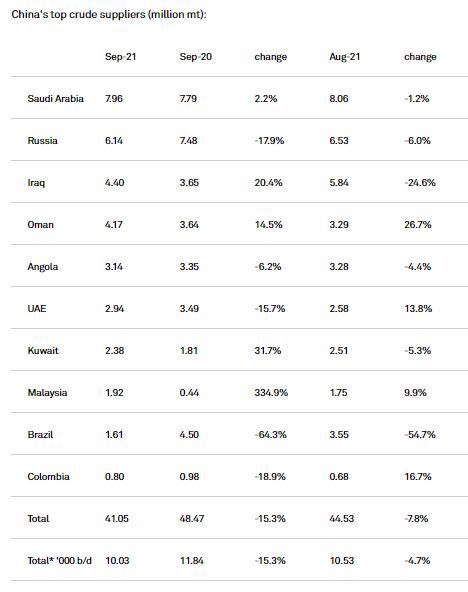

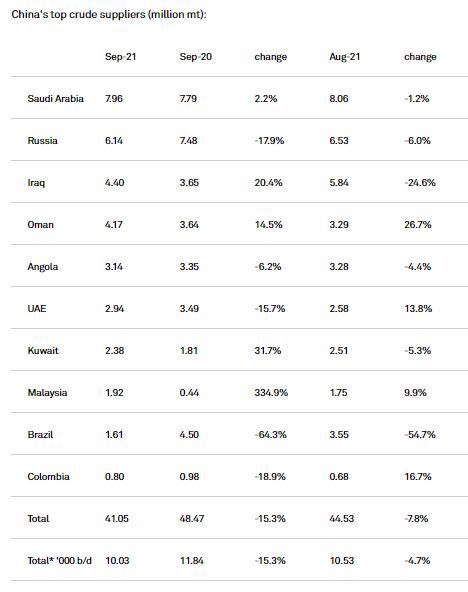

China's crude imports from Brazil slumped 54.7% on the month to near four-year low of 380,000 b/d, or 1.61 million mt, in September, latest data released by the General Administration of Customs showed Oct. 20.

Weak buying from China's independent refineries was the main reason for the decline in September, with the flow unlikely to stay low for the rest of the year, market sources said.

China's crude imports from Brazil were last lower at 1.14 million mt in October 2017, according to the GAC data.

S&P Global Platts' data showed that China's refineries only imported 172,000 mt of Brazilian crude in September, down sharply by 81.4% from August and 94.3% from a year earlier.

Brazil used to be a top crude supplier to the country's independent refineries, following Russia and Saudi Arabia, but lower quality of imports has led domestic refineries in China to look for alternatives, according to market sources.

“Brazilian crudes become lusterless as the producer keeps the popular Tupi for their own consumption, while sending the less favorable Buzios to China,” a crude trader said.

Long voyage of more than 45 days and the delay in crude import quota allocation also prevented the independent refineries to lift Brazilian crude buying for 2021 delivery, refining sources said.

Beijing released the latest batch of crude import quota for 2021 at 14.89 million mt on Oct. 15, two weeks behind expectations.

Moreover, “the cheap Iranian barrels with shorter voyage ate into Brazilian crudes' market share,” the trader said.

Independent refineries took about 1.57 million mt of Iranian crude delivery in September, almost doubled the 875,000 mt in August, Platts' data showed.

China's customs data, however, showed no shipments from Iran in September, as the Iranian barrels were reported as Oman, Oman Light, UAE's Upper Zakum, Malaysian Nemina Blend, Singma Blend or Mal Blend, market sources said.

The country's crude imports from Oman were up by 26.7% month on month to 4.17 million mt in September, UAE imports rose 13.8% on the month to 2.94 million mt, and Malaysian supplies gained 9.9% to 1.92 million mt, the GAC date showed.

Russian shipments to rise

China's imports from Russia are likely to rise in the fourth quarter, as short voyages for the ESPO blend would enable deliveries by year end, while allowing the independent refineries to use up crude import quotas, market sources said.

The ESPO bend's higher distillate yield for the production of gasoil with lower freezing point also make it ideal for winter usage, according to sources.

Russia delivered 6.14 million mt, or 1.45 million b/d, of crude to China in September, down 6% from August and 17.9% year on year, the GAC data showed.

The independent refineries' buying interest in the ESPO blend has surged due to the latest import quota, pushing up the premium for December loading cargoes to $5-$5.7/b against Platts front month Dubai crude assessment, from $4-$4.5/b for November-loading cargoes, Platts reported earlier.

Saudi Arabia remained China's the top crude supplier in September, even as shipments fell 1.2% from August to 7.96 million mt, or 1.88 million b/d, according to the GAC.

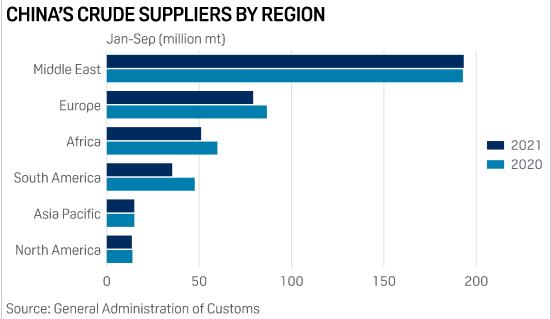

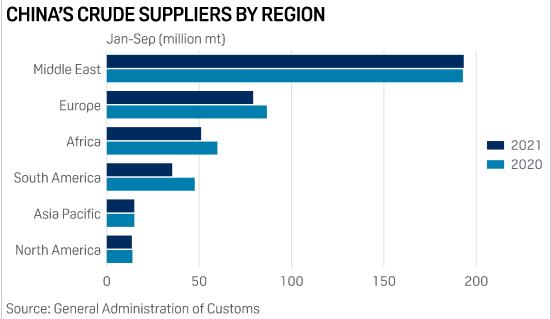

The Middle East's share of China's crude market was at 49.9% over the first nine months of 2021. The volumes from the region were up 0.5% year over year to 5.19 million b/d during the same period.

Latin America's market share fell to 9.1% during January-September, from 11.5% a year earlier, mainly due to lower shipments from Brazil. The region shipped 951,000 b/d of crude to China in the first three quarters, down 25.4% year on year.

China's top crude suppliers (million mt):

Source: Platts

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar