Vale released its 3Q21 production report last night. Its iron ore fines production totalled 89.4 Mt in 3Q21, 18.1% higher than in 2Q21 and 0.8% higher than during the same period last year.

Sales volumes of iron ore fines and pellets totalled 75.9 Mt in 3Q21, which was in line with 2Q21.

There was approximately 13mt gap between production and sales in 3Q21, which was unusually high. Vale said this was because;

(i) Vale's value over volume approach, by reducing the sales of high-silica iron ore products in September due to market price level; and

(ii)Transiting inventories across the supply chain, which is expected to revert in 4Q21, depending on market conditions.

While they kept their full year production guidance unchanged at 315-335mt, they said it is more likely that production will be in the lower half of that range. That is because they will reduce the production of high-silica low margin products by 4 million tonnes during Q4.

Vale added that they would reduce their offerings of low-margin products in 2022 by 12 to 15 million tonnes if the current scenario did not change.

High-silica iron ore is more difficult to process and requires higher use of coke. Since coking coal and coke prices are at or near record highs, demand for high-silica iron ore price has been falling significantly over the past few months.

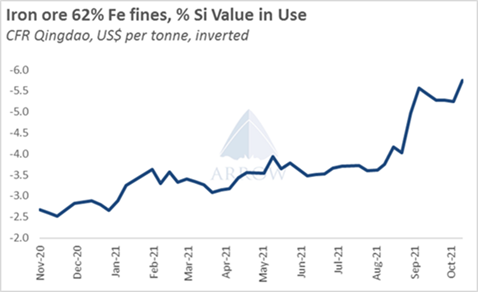

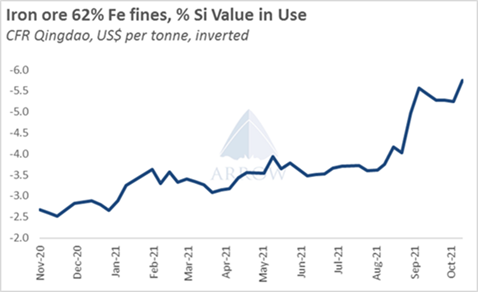

The chart below shows iron ore 62% Fe fines, % Si Value in Use, cfr Qingdao, $/tonne, in other words, the discount high-silica iron ore is getting relative to the benchmark 62% Fe iron ore. It has doubled since the beginning of the year.

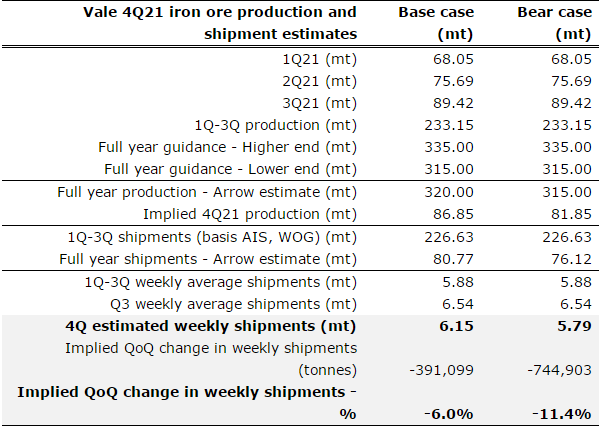

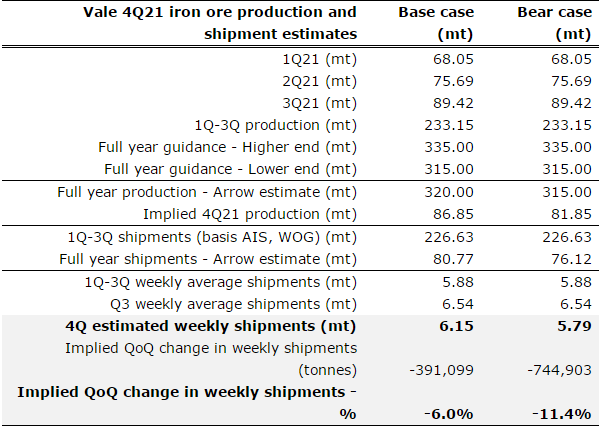

Lower production and sales will have significant implications on shipment volumes during the rest of the year. Based on Vale's latest guidance, and assuming full year production of 320mt, we estimate that Vale's weekly shipments will fall by about 6% quarter-on-quarter, from 6.54mt per week in 3Q21 to 6.15mt per week in 4Q21.

However, volumes could be even lower given the demand headwinds. Steel production in China has dropped substantially over the past few weeks due to power supply shortages, production cuts and overall weak demand. Iron ore consumption is falling in line with steel output, which is evident in the sharp weekly increase in iron ore port stocks (up 4.6 million tonnes last week)

If we assume Vale's full year production at 315mt (lower limit of its guidance), then weekly shipments in Q4 could be more than 11% lower than the Q3 average.

In either case, lower iron ore shipments in Q4 will likely reduce Vale's spot capesize requirements, and could put pressure on capesize earnings in the coming weeks. That being said, the impact on rates will also depend on tonnage supply, which is still looking tight in the short term. Therefore a sharp correction is unlikely.

Below is our estimates of Vale's Q4 shipments, both based on 320mt full year production (Base case) and 315mt full year production (Bear case).

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar