A confluence of factors across energy markets is strengthening the outlook for seaborne thermal coal demand, as demonstrated by soaring prices.

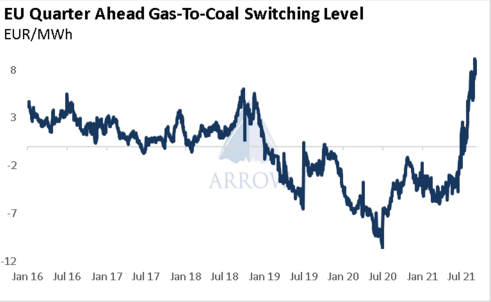

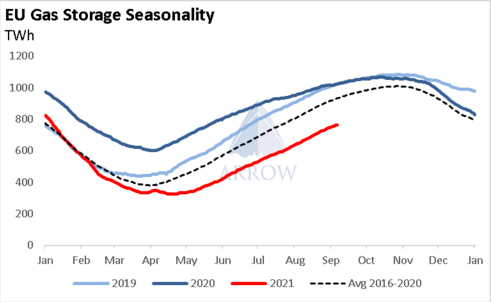

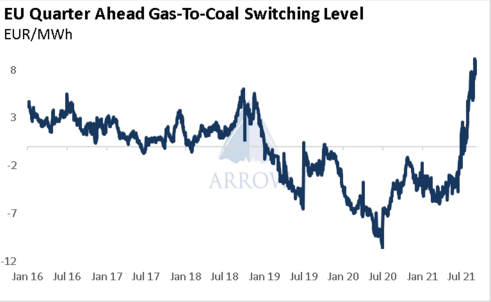

The rally in gas and power prices has drastically improved coal’s relative profitability, current forward prices for 4Q21 and 1Q22 show coal as much more profitable and therefore suggests greater future coal burn.

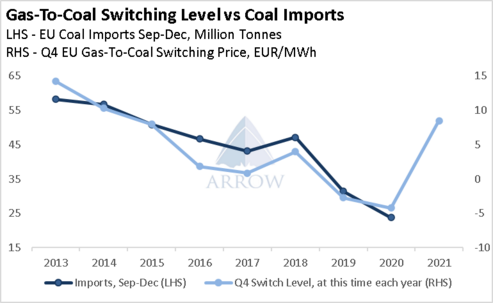

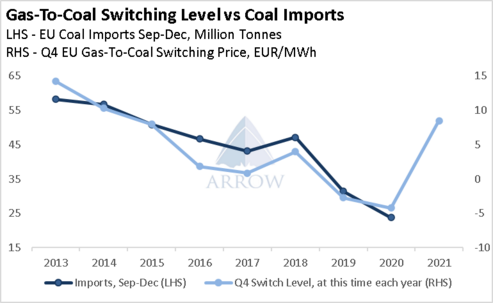

The chart below shows the relationship between the coal to gas switching price for the upcoming winter at the beginning of September each year, alongside the total EU coal imports over the remainder of the year. Current pricing dynamics are highly likely to drive EU coal imports higher.

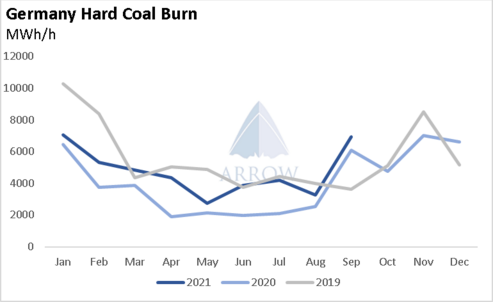

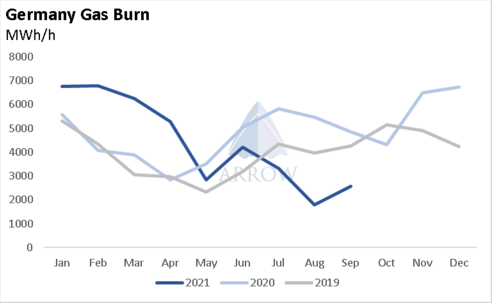

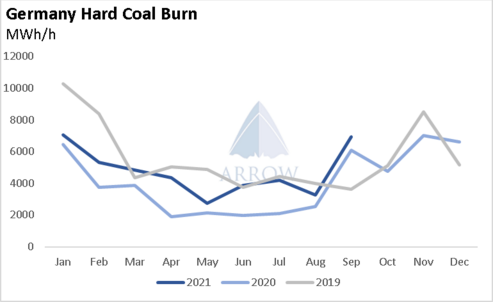

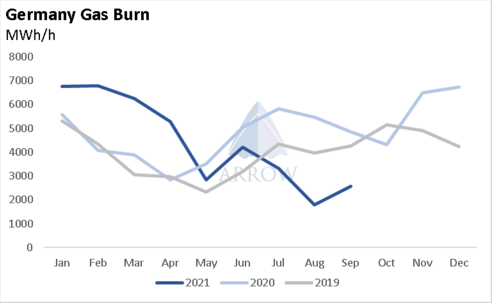

These pricing dynamics are already showing up in the rate of coal and gas burn so far in September.

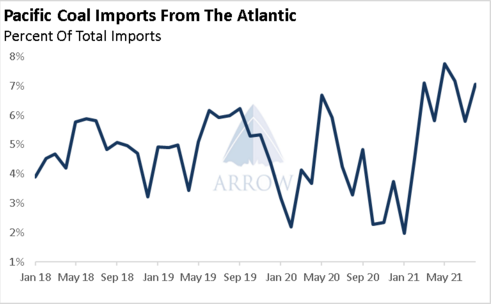

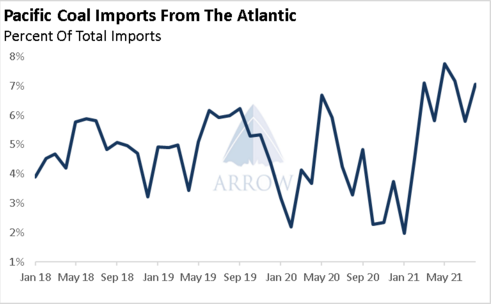

This revival of EU coal burn will dent front haul demand as the Atlantic coal balance tightens, this potential reduction of inter-basin coal cargoes would likely reduce aggregate freight demand. However as recently the Pacific basin has been taking surplus Atlantic coal cargoes, it will be interesting to see how/if Asian importers switch origins.

Turning to Indonesian supply, the government is maintaining a tough stance on the Domestic Market Obligation (which requires miners to sell 25% of output domestically), which may prove tricky for miners who have taken advantage of high coal prices so far this year by maximising exports, and now have to hold back from exports to sell domestically. Furthermore, increasing coal prices has spurred some domestic industry leaders to call for the DMO to be even stricter in order to reduce domestic coal prices. It's unlikely that Indonesian exporters will be able to significantly respond to higher seaborne prices over the rest of the year.

Outside of Indonesia, high coal prices should encourage greater volumes of global coal exports over the coming months, however one issue to note is that growing concern about carbon emissions may hinder this supply response. Government permits, bank financing, shareholder pressure etc. all have the potential to dampen a recovery in supply. On the demand side of this issue, one wonders how European environmental groups may react if they catch on to the fact that coal imports are rising significantly.

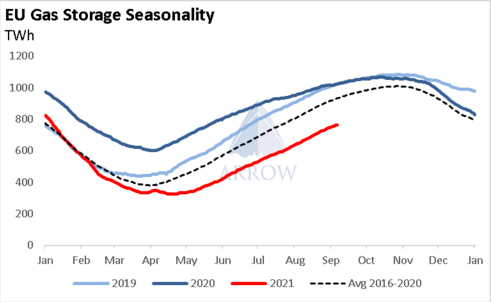

One of the most important, yet currently unknowable factors for coal's outlook is weather. A mild winter would allow the Northern Hemisphere to enter Spring with sufficient reserves for an orderly Summer 2022 restocking season, however a cold winter could empty reserves and prolong the energy deficit.

Overall, coal demand looks set to remain strong over the coming months as the world appears to be short on energy. A potential shake up of trade flows as European demand returns thereby cutting off some Atlantic coal heading East could reduce aggregate freight demand, however the extent of EU demand alongside price arbitrages will dictate how this pans out. Coal supply has a few potential bumps in the road, however high prices should force more coal into the export market, supporting trading volumes. The outlook for coal's freight demand continues to be positive.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar