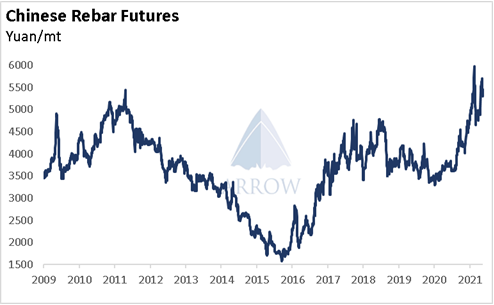

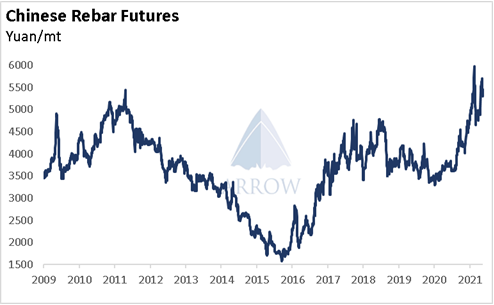

China's talk about steel production cuts is spooking the ferrous complex as iron ore prices have lost 25% over the past few weeks. The plan is for 2021 steel production to not exceed 2020 levels. This implies 2H21 output will be 11% lower than 1H21. The pivotal question is why is China doing this? Emission reductions are cited as the key driving reason, and there's no doubt China wants to reduce emissions & pollution, however other factors are at play. The government has not hidden the fact that it is displeased with current commodity prices, and it has been employing a series of tactics to reduce prices over recent months – taming iron ore prices is clearly another objective.

Taking a high level view of the current situation: China is planning on curbing steel output at a time when prices are very high. The seemingly obvious outcome would be even higher prices. In fact, there could be a 20-30 million mt shortage in the domestic market in 2H21 according to Platts' market sources. If a steel shortage materialized, economic damage would certainly follow. The question on everyone's mind is: how serious is Beijing?

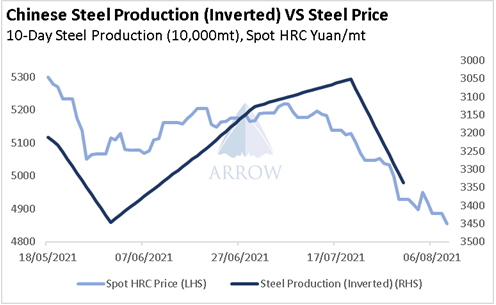

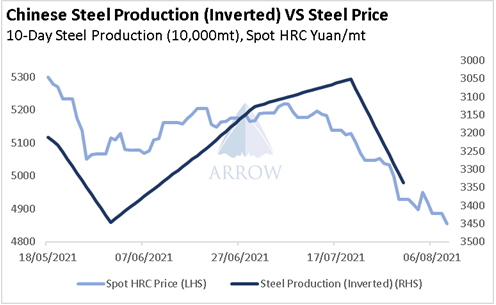

Steel output dropped during June & most of July and there are widespread market reports that steelmakers have been formally asked to prepare plans for production cuts – this has spooked the iron ore market. Whilst this indicates Beijing is serious, there's more to the story.

1) Latest data from CU Steel shows 10-day crude steel output at the second highest ever.

2) Part of the recent softer steel output can be attributed to power shortages which have forced some EAF mills to shut down.

3) China has tried to talk down commodity markets before – and they might just be doing it again. In May, the Chinese government spuriously claimed that “speculators and hoarders” were manipulating commodity prices higher, the following clampdown and heightened oversight caused a significant sell off in key bulk commodity futures. Since then prices have trended higher again as tight fundamentals returned to the forefront. Yet now this new determination to cut steel production has caused iron ore to sell off again.

4) There are some early indications that economic interests will be prioritised over emissions targets as the Chinese Communist Party's Political Bureau has called orderly and scientific decarbonisation methods to be used rather than a “campaign-style”. This narrative may continue to evolve and be used over the coming months to renege on steel production cuts.

Looking ahead, there are two key questions to watch. Is China serious about cutting steel emissions, or is this just a smokescreen for them to reduce iron ore prices? And if they are serious about cutting steel emissions, how much economic damage are they willing to suffer to this end?

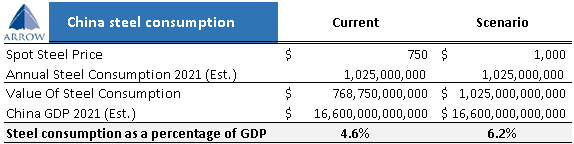

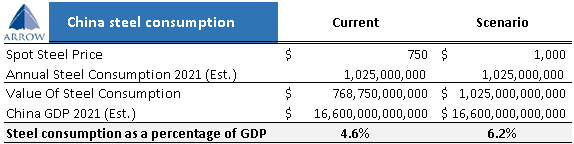

Whilst reducing emissions would be convenient for China, this does not appear to be the key motivation but rather a cover story in order for them to strong-arm the iron ore market back down. Policymakers must be well aware that an 11% reduction in steel output over the 2H21 is incongruent with the expected level of demand and would have economic consequences. A quick and simple calculation highlights how important the steel price is to China:

·Spot steel prices are around $750/mt.

·Assuming China consumes a conservative 1.025bn tonnes of steel this year.

·China's GDP is forecasted to be around $16.6tn this year.

We can work out that steel consumption is very roughly 4.6% of GDP. However if steel jumps to $1,000/mt, this value goes to 6.2%. Whilst this is an over-simplified calculation, it perfectly highlights the fact that the government is potentially playing with fire here.

Furthermore, China's producer price index came in at a soaring 9% in July, an eye-catching number that policymakers would not want to exacerbate with a steel shortage. In light of avoiding inflation, one can expect that policymakers will catch on to the following relationship between steel output and steel prices that has been developing over the recent months.

We have seen China is willing to suffer economic consequences to punish Australia in the coal market, however we are waiting to see if they will be willing to suffer economic consequences for the environment. If steel shortages dent China's economy, and corrective policy measures are not swiftly implemented, it will be a wakeup call to commodity markets that the world's largest commodity consumer has new priorities.

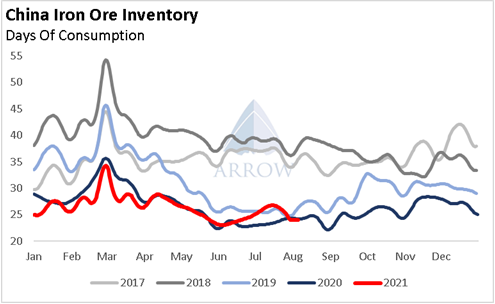

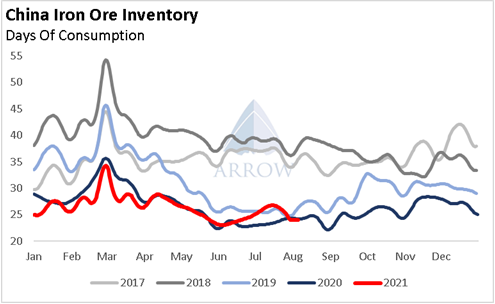

Looking at freight demand, Chinese iron ore imports are more correlated with global iron ore exports than domestic production – China is the marginal buyer. Since 2013 on a rolling 3 month basis, Chinese iron ore imports have a 0.81 correlation with global iron ore exports, and a 0.7 correlation with domestic steel production. Iron ore inventories have bags of room to move higher, and with Beijing's calls for increasing strategic stockpiles, any reduction in iron ore consumption can allow stocks to build. Overall we do not foresee China's steel production policy having a large impact on freight demand over the rest of the year.

Source: Arrow

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar