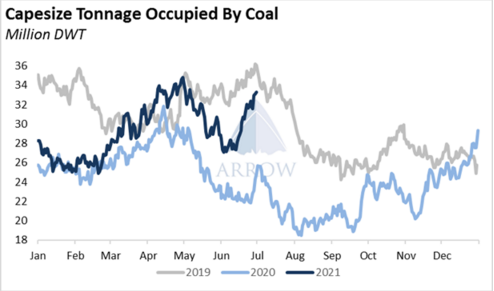

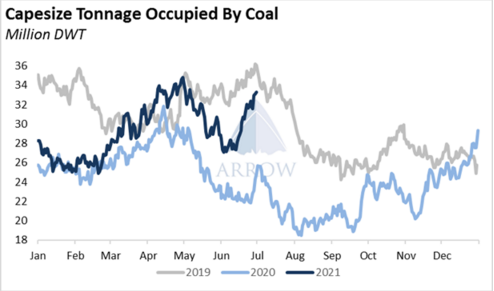

We previously mentioned in our reports how coal could be the dark horse of the dry cargo market in 2021. We are starting to see this unfold as seaborne coal volumes are rising, and with smaller vessel classes occupied with booming minor bulks & grains cargoes, Capes are taking most of these growing volumes.

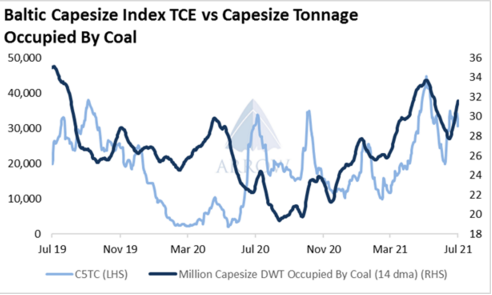

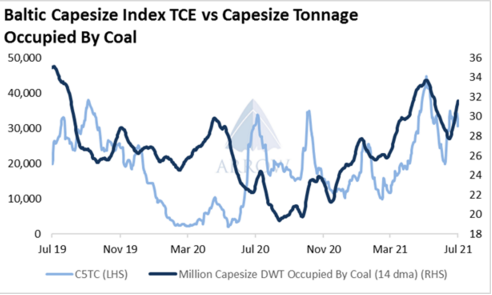

We can see this relationship playing out as the correlation between the C5TC and the DWT of Capes which are carrying coal have maintained a very high correlation in Q2 – this indicates that growing coal volumes are a key factor driving the index.

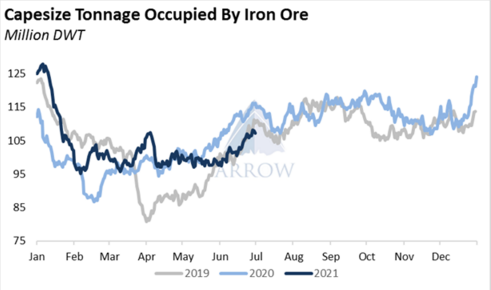

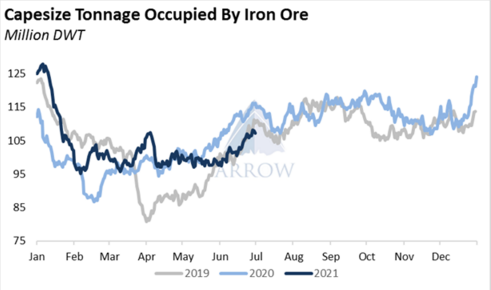

The seasonality of iron ore freight demand is driven by Brazil as they ramp up production during the dry season. This typically results in Q3 being the strongest month for Brazilian iron ore exports. Conversely with coal, Q3 tends to be one of the weaker quarters for Capesize exports.

Looking forward to 3Q21 what does this mean? If Brazilian iron ore exports comfortably exceed 2020 levels in Q3, and if Capesizes continue to participate heavily in the (long haul) coal trade, then we expect the Capesize market to experience further pockets of substantial tightness this year.

With coal prices at the highest level in a decade, we can expect export volumes to increase, and if this happens and volumes defy the usual Q3 slump, then these coal cargoes will be competing with iron ore cargoes at a time when Brazilian exports typically peak.

With coal and iron ore prices at such heights, freight as a percentage of delivered prices remains at low levels, which indicates that freight rates have much more potential upside before causing demand destruction.

On the supply side of the market, there are signs that supply is increasing. Capesize speeds have increased, which increases supply. Congestion & Covid related inefficiencies have also hampered the market recently, which will release an impulse of supply as they unwind. Since the peak in May, Capesize congestion has fallen by around 15 million DWT, a massive easing of congestion and a key bearish factor should it continue falling. However congestion is still above 2020 levels, and with the delta variant sweeping Asia, it could push higher.

The Capesize index hit nearly $45k in Q2. We view the Capesize fundamentals to be tighter in Q3 than in Q2, and therefore see a reasonable chance that the index can push those levels again. Alongside our view on the Capesize market, with the latest USDA forecasts for Brazil grain exports dropping markedly, we see the Q3 Cape/Panamax spread at around $1,000 to be undervalued. Our eyes are fixed on Brazilian iron ore exports, coal trade flows and inefficiency unwinding.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar