China's hog industry has transformed over the last few decades as countless unsophisticated backyard farms have been converted into an industry sporting multi-storey farms with AI technology. This switch has been ongoing for decades, but rapidly accelerated in the past 3 years. With this industrialisation has come a big important change: pig food. Figures vary, but we may assume around 30 million tonnes of food waste was fed to pigs pre-African Swine Fever (ASF). Some of this has switched to industrial feed as small farms have been quickly phased out and authorities clamp down on unhygienic feeding practices, and some switching is still likely to take place. This shift in the structure of Chinese demand may explain partially why their grain import demand has been so robust during a period when their hog herd was smaller. It also bodes well for future grain import demand as the ongoing industry restructuring is favouring higher industrial feed usage.

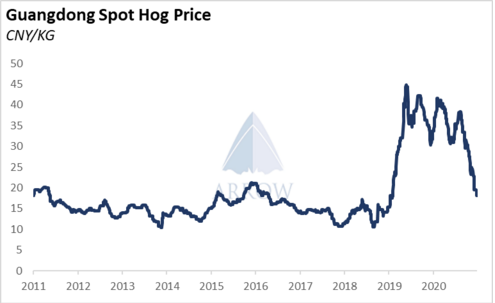

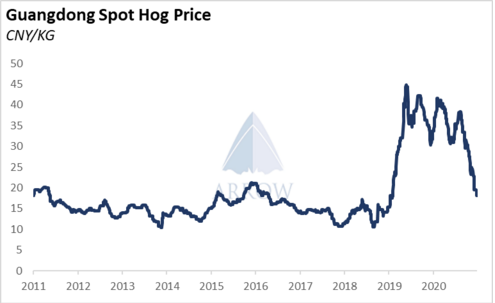

Hog prices have retreated from their ASF plateau from early 2019-2021 indicating that we might be in a new chapter of the industry as supply picks up. ASF outbreaks appear to be isolated, and new restrictions on regional hog transportation alongside existing infection control measures have diminished the spread of the virus.

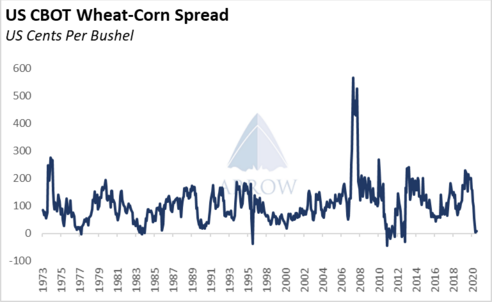

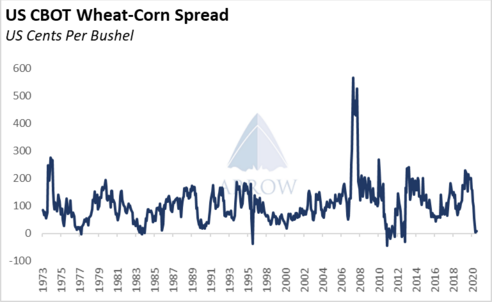

Strong feed demand due to an apparent shortage of corn has left wheat a competitive feedstock in China. There has been widespread reporting of corn/wheat switching as wheat has traded at around parity with corn – an unusual and unsustainable situation due to wheat's inherent superior quality. Industrial feed demand from ‘normal’ feedstocks (soymeal & corn) has consequently been supressed over the past few months. Eventually as the price spread normalises this demand for traditional feedstocks will bounce back, some of which will be imported.

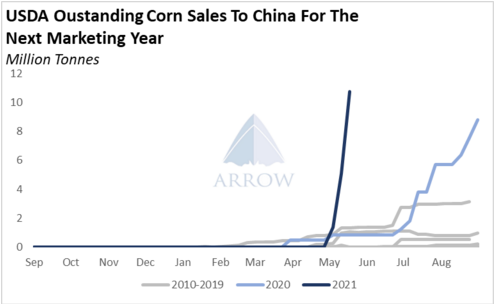

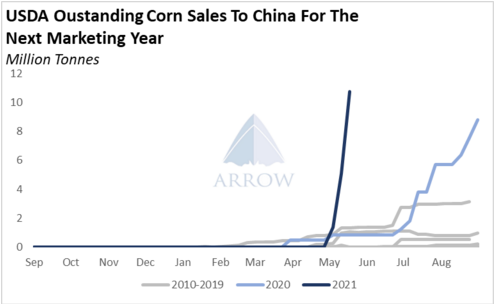

Chinese purchases of corn for the next marketing year further indicate the strength of forward grain demand – these are not stealth purchases to hide their ‘true’ demand, this is a bold statement that they are in the market for a lot of grain. Purchases have easily eclipsed previous records, both in volume and in earliness.

On the other side of the demand equation for grains is biofuels. The journey to net zero carbon emissions will undoubtedly rely on greater usage of biofuels, and this will lend support to the grains complex as higher biofuel prices will keep crush margins elevated. The IEA has forecasted that the biofuels market will grow by 18% between 2019 and 2026.

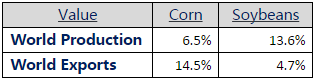

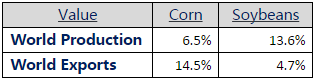

With prompt soybean prices a couple of bucks off all-time highs, and with deferred prices also at healthy levels, production can be expected to increase over the coming years. In fact, producers have appeared so happy with the current price levels that short positions taken by producers on US exchanges has hit an all-time high – producers are locking in prices. The USDA has consequently upped their forecasts for worldwide grains production in their latest WASDE report. World corn production in the marketing year ending in 2022 is expected to grow 6.5% from the level seen in the marketing year ending 2020. And for soybeans this figure is a mighty 13.6%. Whereas for exports, the big growth is in corn as the Brazilian crop recovers next year, whilst soybean export growth is much tamer due to an expected US restocking.

Change between actual in 2020 and projection for 2022, USDA

However, if prices stay high then the incentive will remain for producers to export. If prompt soybeans end up trading at $15 per bushel again next year, many more cargoes would get lured out of the US into the export market. This could be a significant boost to the Panamax segment as fleet growth is lower than potential grain export demand growth.

We are currently in a fascinating episode of commodity price volatility as seemingly every asset class is at some extreme price level and news stories appear in our feeds we recently thought impossible. The grains market has played a key part of this. Who thought African Swine Fever would kill over half of the Chinese hog herd, and then less than 2 years later the Chinese are clearing out Brazilian & US grain silos causing prices to approach all-time highs? Our view is that structural Chinese grain demand has materially improved over the past few years and consequently the purchases we are seeing, especially in corn, are no longer anomalous, but now habitual. Furthermore, high grain prices are encouraging production growth which is set to continue. These developments will provide a solid backstop to freight rates for grain carriers as tonne-mile intensive freight routes see growing volumes.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar