Operations along the Colonial Pipeline were halted on Friday following a ransomware cyberattack. The pipeline, which carries about 2.5mbpd of refined petroleum products from Houston to New York Harbor, accounts for about 45% of the US Atlantic Coast's diesel, gasoline and jet supply. Although a number of smaller lines have come back online, all four main lines remain out of service. The company expects a material restoration of operations by the end of the week.

In an attempt to prevent shortages on the US East Coast, the US government relaxed rules on fuel transportation by road across 18 states. However, road transportation cannot fully offset the lost pipeline volumes. Moreover, the number of fuel truck drivers is slashed by nearly a quarter due to the pandemic.

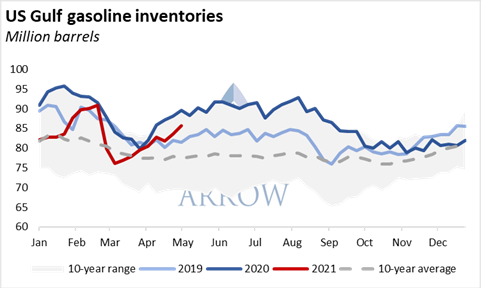

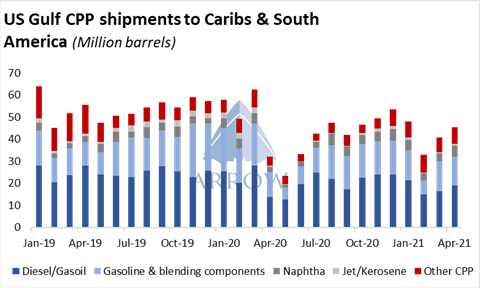

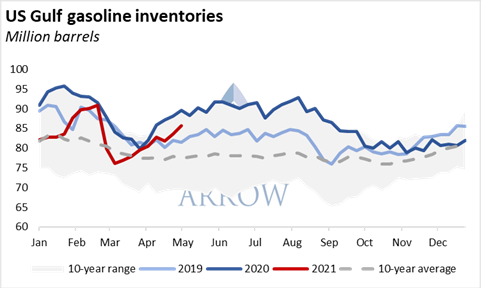

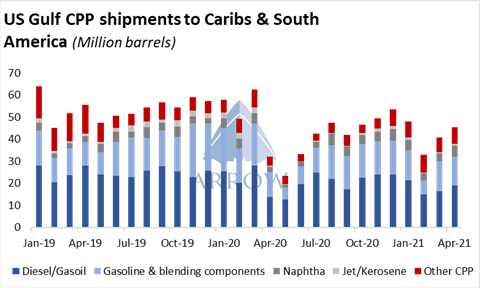

Consumer panic is seemingly leading to fuel shortages in parts of the country. If the situation is not resolved promptly, large CPP volumes will end up stranded in Texas, pushing US Gulf inventories higher. As of end April, gasoline stocks in the region were just 4.3% below the seasonal 10-year highs reached in 2020. Floating storage interest also surfaced on Monday. An increase in storage could exert downward pressure on product prices in the region. While refiners are considering cutting their run rates, lower prices could incentivise exports to Latin America & Caribs, which remain well below their pre-Covid levels.

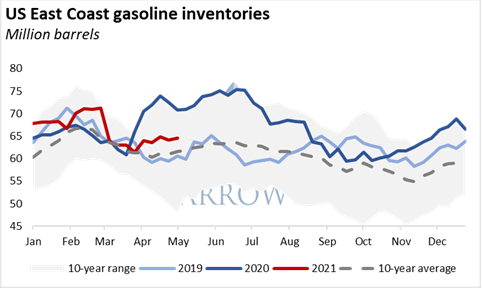

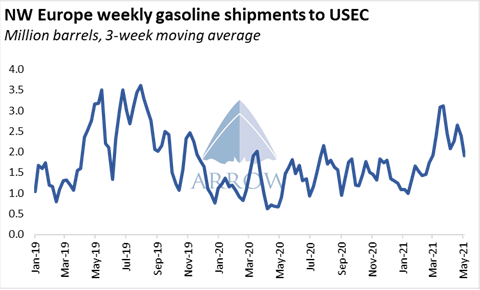

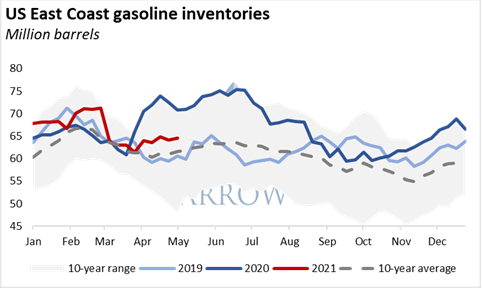

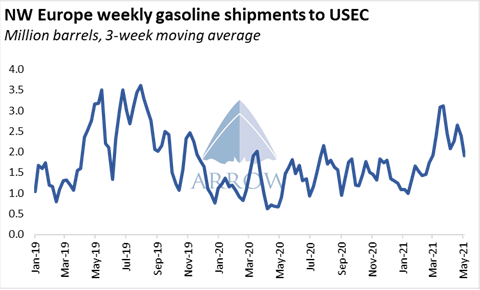

The US driving season is around the corner and the EIA estimates gasoline consumption to average 8.84mbpd over April-September, and peak at 9.1mbpd in August. Meanwhile, gasoline stocks in the US East Coast have normalised and currently stand marginally above long-term average levels. In the event of a lengthy disruption, the 0.7mbpd Plantation Pipeline running from Baton Rouge to Washington DC will not be able to provide the incremental volumes required at the Atlantic Coast. Under such a scenario, buyers in the US East Coast are likely to draw surplus gasoline from Europe, potentially spurring transatlantic fixing activity and boosting MR rates.

Another option to enable additional supply into the US East Coast would be to temporarily allow non-US flagged vessels to carry petroleum products within the Gulf, and from the Gulf up the Eastern Seaboard. On Tuesday, the US Department of Transportation started the work required to consider a temporary and targeted waiver of the Jones Act. The last waiver took place in 2017 in the aftermath of Hurricane Harvey and lasted 7 days. Such a move is highly political and often meets resistance from oil & shipping lobbies.

The market has so far reacted cautiously with just a handful of provisional fixtures from Europe reported. The duration of the closure will ultimately determine the scale of disruption. If the pipeline is fully operational within the next couple of days, the impact should be minimal. Otherwise, it will trigger a domino effect with the arbitrage window for importing refined products from Europe opening up. That said, any potential impact should be quickly reversed once the pipeline is back online.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar