China has indefinitely suspended the China-Australia Strategic Economic Dialogue, a largely symbolic yet important action which underscores the state of Sino-Australian relations. This now confirms China's stance on Australian coal imports over the medium term – the ban will stay.

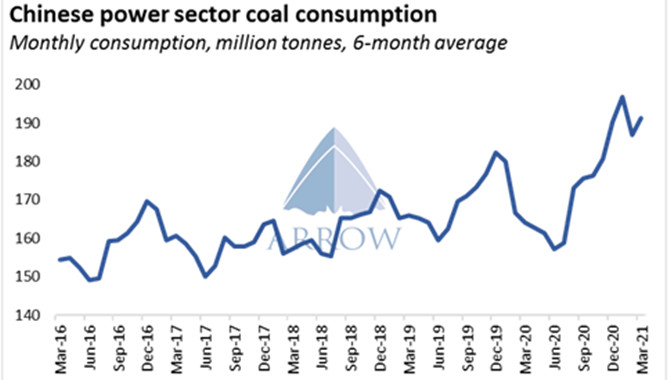

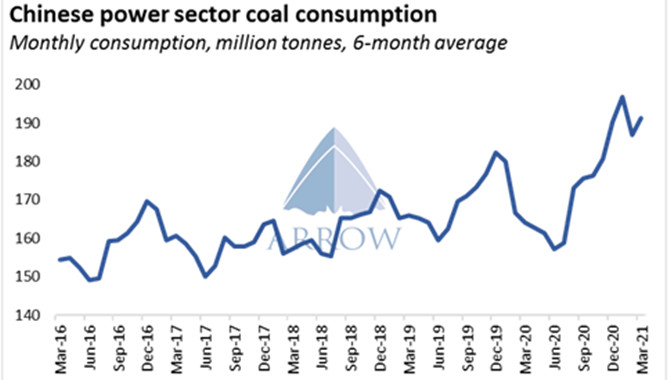

China has now survived around 7 months without Australian coal which suggests that they can continue doing so. In response to the ban, Chinese domestic production has ramped up, Q1 raw coal output was up an impressive 16% year on year, however strong economic growth has pushed up electricity demand resulting in Q1 coal consumption up a whopping 26% year on year – easily outpacing domestic supply growth.

Whilst China is standing resolutely behind the ban, there are a few hints that the current shortage is worrisome:

• Chinese coal futures are about 15% higher than the peak last winter

• Authorities raised trading fees on coal futures

• Numerous coal indices have halted price assessments citing market stability

• Chinese coastal bulk freight rates are at multi-year highs – driven by both intense domestic North-South cargo demand and international rates

• Summer weather outlook is warm and dry – high air conditioning demand and low hydro output

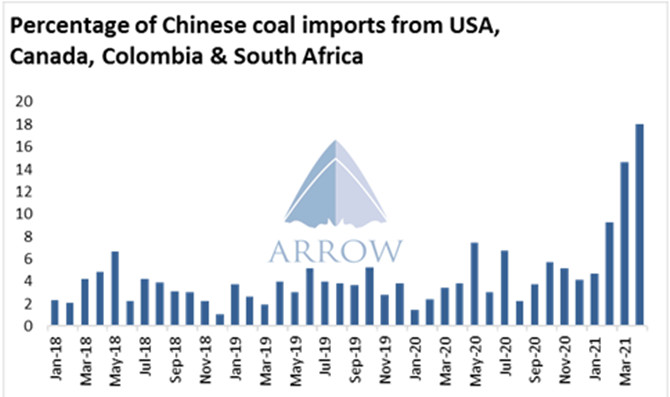

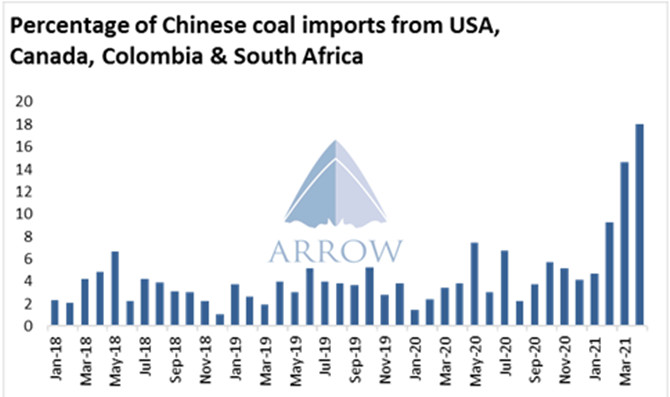

The cost of the ban does not appear to phase the Chinese government as domestic prices are around double FOB Australian prices. And as such Chinese buyers have been stretching out to purchase coal from much further afield. Chinese imports of US, Canadian, Colombian and South African coal have been ramping up recently as Australia's slice of imports is being replaced by new suppliers.

The onset of the pandemic last year saw seaborne coal volumes drop significantly as electricity consumption declined and many coal mining operations were scaled back. So far this year South Africa, Colombia and Indonesia are exporting much less than 2019 levels, USA & Canada are barely above 2019 levels, whereas Russia is much above 2019 volumes.

However now demand has bounced back faster than expected and therefore global coal prices have rallied. Thanks to Australia, global coal volumes have picked up in April 2021 matching levels seen in April 2019, and the price outlook remains positive as China's demand tightens the global market.

With prices supported and China clearly in the market for non-Aussie high quality coal, producers outside of Australia are likely to increase output where feasible, which will support the freight market as many of these incremental tonnes will be tonne-mile heavy. The dark horse of the dry cargo market is going from a trot to a canter.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar