China's unwavering ban on Australian coal continues to disrupt the coal market as trade flows are still adjusting to the new regime. With the summer peak demand season approaching, domestic prices are rallying and all eyes are on Chinese seaborne demand.

In the past months there have been numerous rumours circulating and some price indications that the Chinese ban on Australian coal imports would be somewhat relaxed, however this never materialised. Instead China suffered power cuts due to a lack of thermal coal, and negative steel margins due to a sharp rally in coking coal prices alongside iron ore – a hefty price that most would not expect China would tolerate.

The economic cost of the import ban remains high as international coal is still trading at a significant discount to Chinese domestic coal. Australian coking coal is around $120/mt cheaper than Chinese domestic prices.

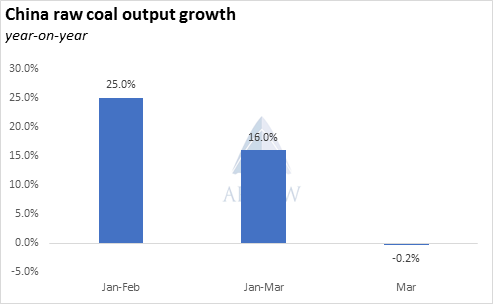

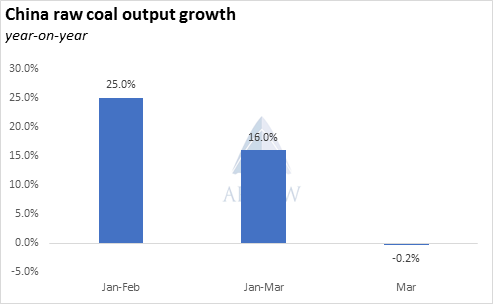

Traders are re-evaluating the supply/demand balance for the Chinese coal market as domestic prices are tracking back up towards the highs over the winter. Q1 domestic raw coal production was impressively 16% higher year-on-year, however production has slowed in March as the immediate demand for coal eased and safety inspections were top of the agenda after more fatal mine accidents.

Rising Covid-19 cases in Mongolia are likely to continue to pressure coking coal imports. Coal truck arrivals from Mongolia to the Ganqimaodu border crossing have all but halted in April.

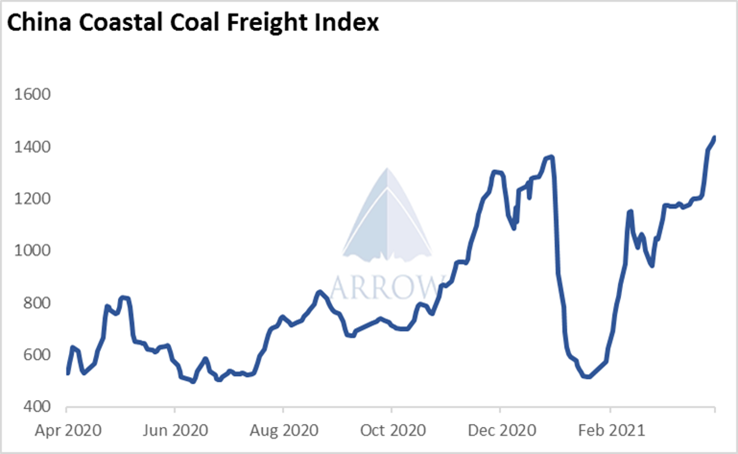

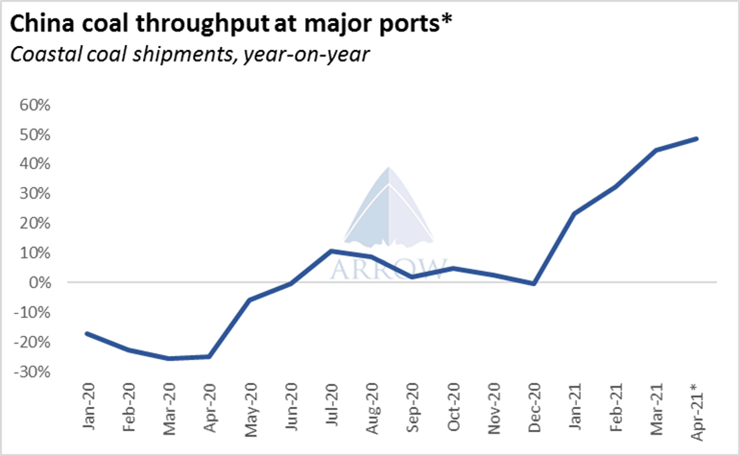

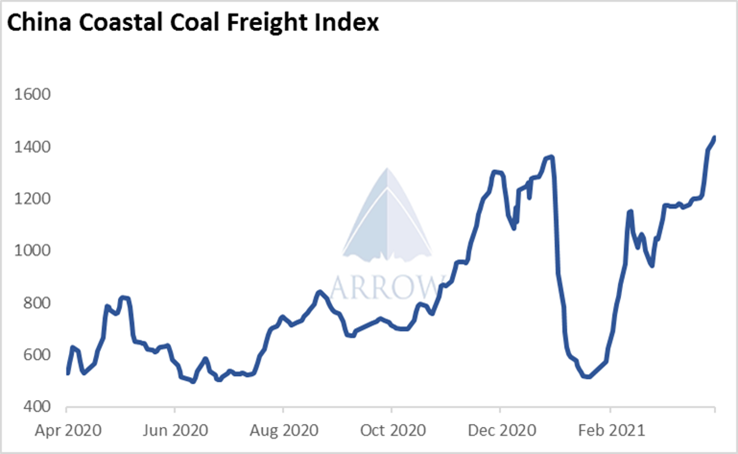

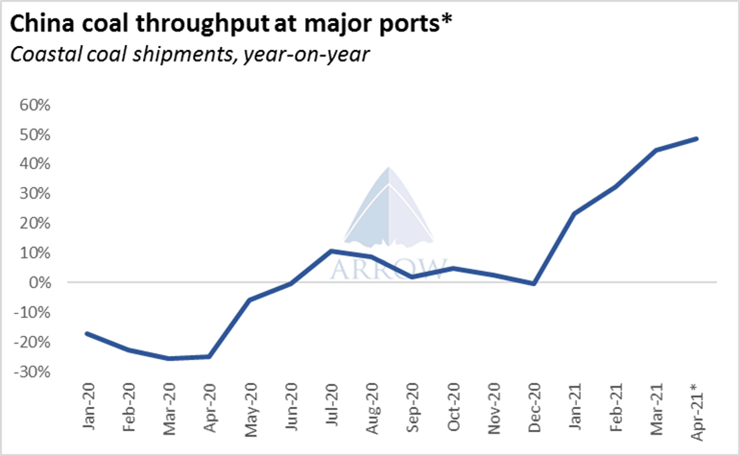

All this has squeezed coastal freight rates as they are now approaching the highs of the winter. Whilst the international freight markets have pushed higher over the past few months, demand for North-to-South coal cargoes is increasing too as the domestic supply picture deteriorates. Coastal coal shipment volumes in March are up 45% vs 2020 and 7.6% vs 2019. Volumes during the first 20 days of April is also up by 49% compared to the same period last year.

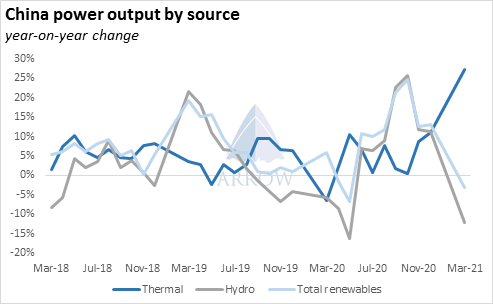

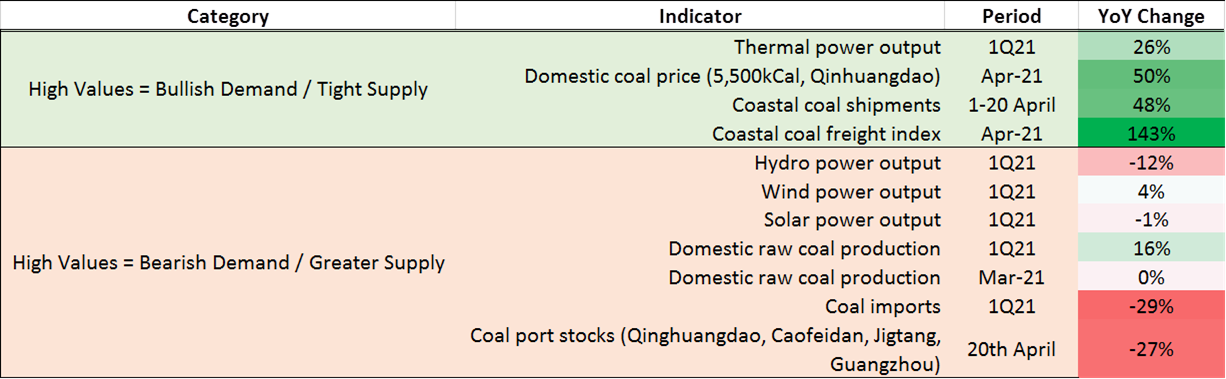

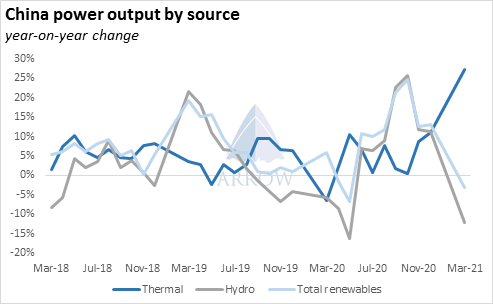

The power generation mix in 1Q21 has pivoted from renewables to thermal output as total combined hydro, wind and solar output was down 3.1% yoy whilst thermal output was up 25.7% yoy.

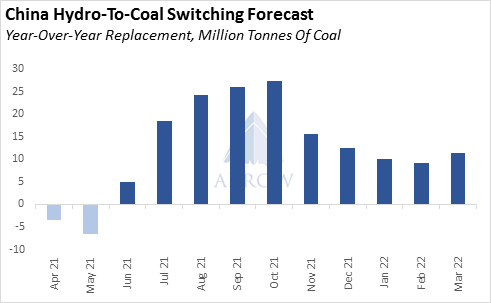

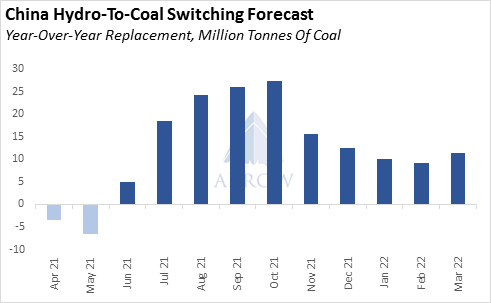

Going forward, hydro output is expected to be lower than in 2020, likely increasing coal demand year-over-year during the summer. Reuters' hydro model suggests that there will be significant hydro-to-coal switching in 2021 compared to last year as the heavy rains seen in 2020 are unlikely to be repeated, potentially adding tens of millions of tonnes to the coal burn this summer.

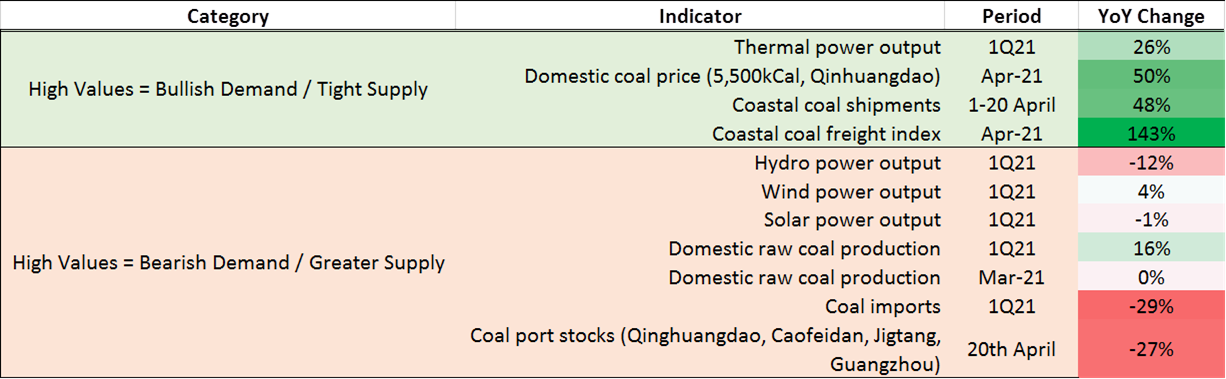

The table below shows a selection of indicators for Chinese coal demand split into bullish/bearish factors. The clear message here is that demand is strong whilst supply is weak.

China appears to be short coal, supply gaps are trying to be filled by turning to the seaborne market and snapping up lots of Indo coal and even stretching out to Colombian and rarely taken South African. With the peak power demand season approaching and land based supply of coal hindered, seaborne coal demand looks set to rise and could be the dark horse of the dry cargo market in 2021.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar