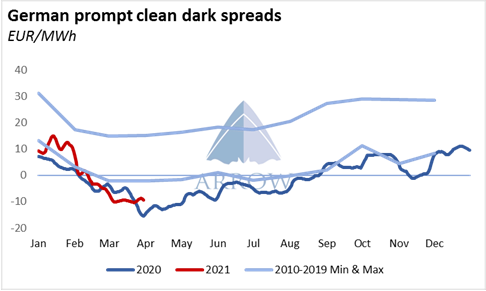

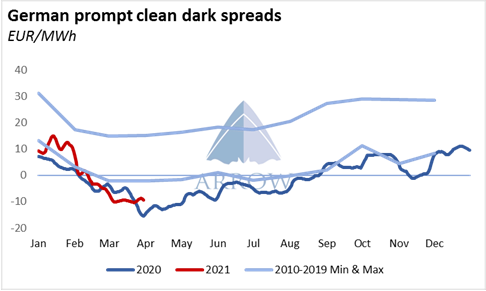

While the EU economy has bounced back from the depths of 2020, the outlook is still poor for 2021 and the recent surge in cases thanks to the UK variant is not helping. The huge hedge-fund backed rally in carbon prices has meant burning coal is significantly less appealing than it has been previously. German clean dark spreads (electricity minus coal and carbon credits) are at pandemic lows as the price of carbon takes its toll. Even though gas and LNG have followed the oil price rally, they remain favoured in the power stack.

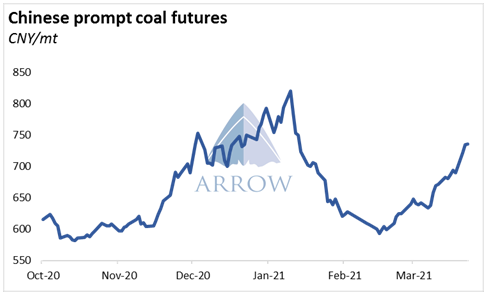

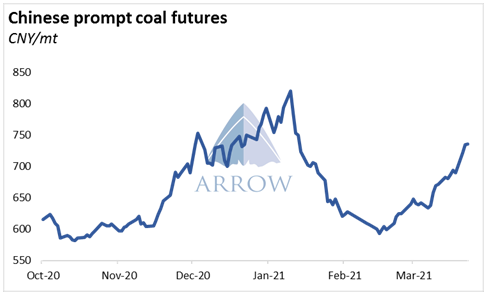

Chinese coal futures have come off the highs of the winter shortage, however they are rapidly catching up to levels seen over the winter when the shortage was becoming apparent. Strong economic activity after Chinese New Year has kept electricity demand high supporting demand whilst the weather was warmer.

Chinese coal futures have come off the highs of the winter shortage, however they are rapidly catching up to levels seen over the winter when the shortage was becoming apparent. Strong economic activity after Chinese New Year has kept electricity demand high supporting demand whilst the weather was warmer.

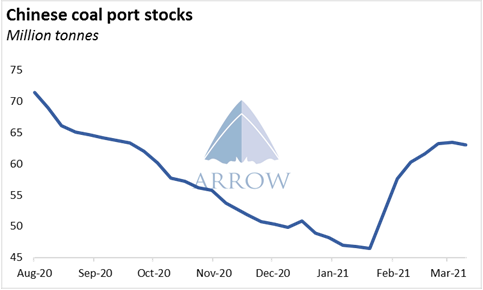

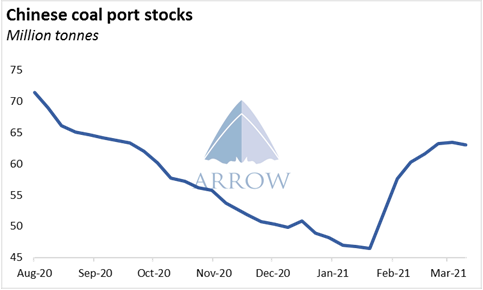

After the winter destocking, Chinese coal stocks have bounced back as large seaborne purchases were arriving as the coal snap ended and coal burn eased. However in the past few weeks the restocking has paused as demand has sustained and high freight rates are disincentivising imports. Given the shortages witnessed over the winter, it is likely that buyers will be prepared for their demand peaks this time around, so further seaborne demand will likely be delayed rather than curtailed. Covid-19 related restrictions on coal trucks entering from Mongolia will likely disrupt land based imports this month, adding pressure on prompt supply.

After the winter destocking, Chinese coal stocks have bounced back as large seaborne purchases were arriving as the coal snap ended and coal burn eased. However in the past few weeks the restocking has paused as demand has sustained and high freight rates are disincentivising imports. Given the shortages witnessed over the winter, it is likely that buyers will be prepared for their demand peaks this time around, so further seaborne demand will likely be delayed rather than curtailed. Covid-19 related restrictions on coal trucks entering from Mongolia will likely disrupt land based imports this month, adding pressure on prompt supply.

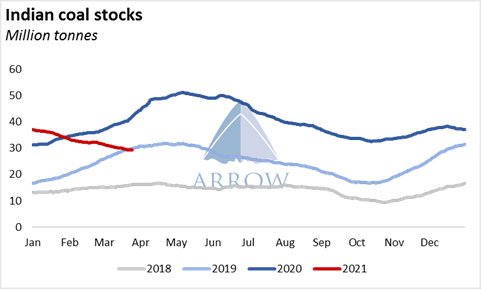

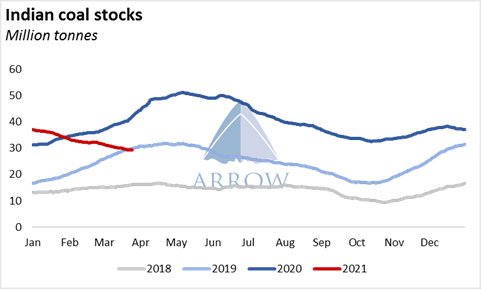

Additionally, Indian coal stocks have been declining over a period when they are normally building before the monsoon season, hinting demand may perk up soon.

Additionally, Indian coal stocks have been declining over a period when they are normally building before the monsoon season, hinting demand may perk up soon.

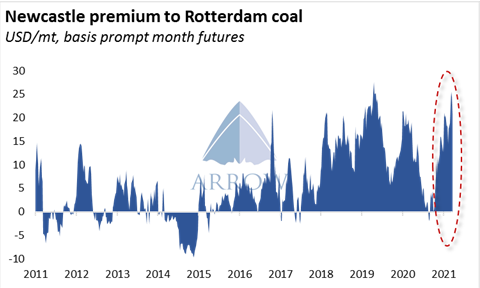

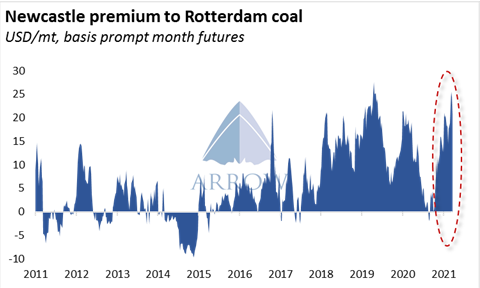

Rotterdam coal is trading at a large discount to Newcastle coal as supply and demand balances continue to differ between basins. On the European side, cheaper gas and high EU carbon prices are pressuring coal burn. Meanwhile in Asia, reduced Australian supply due to recent weather combined with a long standing outage of one of Newcastle’s loaders has supported prices.

Rotterdam coal is trading at a large discount to Newcastle coal as supply and demand balances continue to differ between basins. On the European side, cheaper gas and high EU carbon prices are pressuring coal burn. Meanwhile in Asia, reduced Australian supply due to recent weather combined with a long standing outage of one of Newcastle’s loaders has supported prices.

China's ban on Australian coal has already clearly shifted trade flows. India is buying more Australian and China is buying South African. Although long haul arbs are discouraged by the high freight, this difference in prices between basins will ultimately incentivise Atlantic coal into the Pacific basin if this spread remains wide in the future. So perhaps we will see Asian buyers stretching into the Atlantic to fill any deficit, especially if Europe's ailing demand fails to improve.

OPEC+ agrees to gradually boost oil output in coming months

OPEC+ agreed to increase oil production gradually from May to July, responding to both internal and external pressure to supply more crude to the recovering global economy. Saudi Arabia proposed the supply boost, which would include phasing out the kingdom's voluntary extra 1mbpd supply cut, delegates said. The group's video conference was still continuing on Thursday as ministers hammered out the final details of the accord. The current plan is to boost output by 350,000bpd in May, add the same volume again in June and increase by 440,000bpd in July, delegates said.

Source: Arrow

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar