Ever Given, the 20,388-TEU containership remains aground and the canal traffic is halted. A backlog of more than 180 vessels are reported to have built up as we write this report.

No one really knows how long the salvage operation will last at this stage. However, given the size of the ship it is likely to take some time. Dredgers and tugs have been trying to rescue the vessel since the incident took place, and we understand they were able to partially re-float but the vessel is still very much stuck.

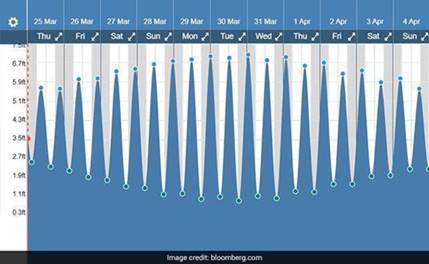

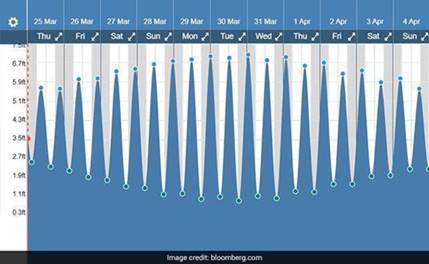

Authorities say that the spring tide expected on Sunday 28

th and Monday 29

th will add 18 inches (46 centimetres) in water depth. High tide would allow for more manoeuvring and support the operation. However, if the vessel is not salvaged by then, it may take a lot longer to re-float as the next high-tide would be another 12-14 days away. The cargo/containers may also need to be offloaded, which would be a major operation in itself and would require specialist floating cranes due to the lack of land-based infrastructure where the vessel has run aground.

Suez Canal spring tide calendar, source: Bloomberg

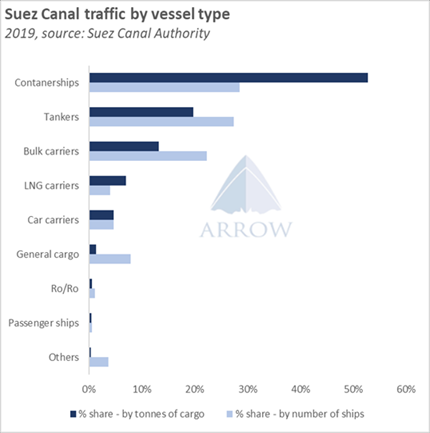

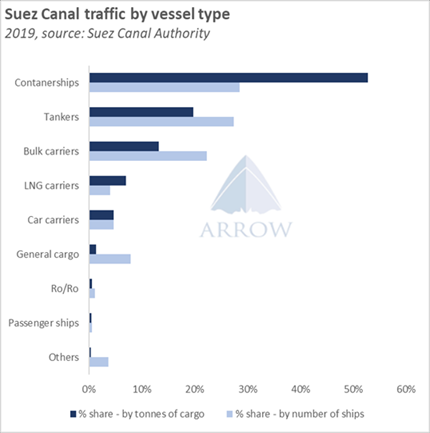

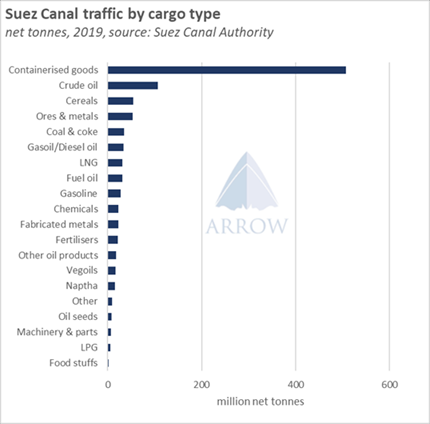

The biggest impact will surely be on the containership sector. Container traffic accounted for 53% of the Suez Canal traffic by tonnes of cargo and 29% by the number of ships transited the canal in 2019.

Container sector is already very tight and the closure of the Suez Canal will make things worse for shippers as well as the global supply chains that rely on goods that transit the canal. We are hearing that liners are already considering re-routing around Africa and

ShippingWatch reported that Maersk is considering air freight for particularly time-sensitive cargoes.

Tankers represent the second largest segment in terms of Suez Canal traffic, accounting for about 22% of the total crossings in 2019. The split between crude and products is 10% (crude) and 12% (products).

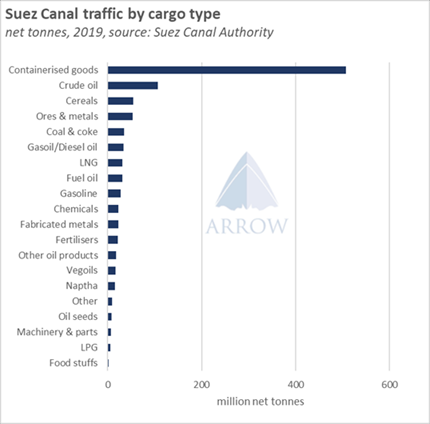

While oil prices jumped following the news yesterday, they are down sharply again today on the back of rising concerns over global demand. Crude oil accounts for about 10% of the total canal traffic (basis 2019 figures), but SUMED pipeline provides an alternative route for the Middle Eastern crude to be delivered to the Mediterranean.

The pipeline has 2.5mbpd capacity and we understand flows have been slashed since last year due to OPEC+ production cuts. In theory, flows can be increased to offset the drop in supplies through the Suez Canal. However, this will depend largely on the ability of vessels to deliver crude at the Ain Sukhna Terminal in the Red Sea

SUMED Pipeline

Mostly suezmax and aframax tankers transit the canal to carry Middle East crude to the Med/Europe. If the canal remains closed for a prolonged period, we may see shippers upsizing to VLCC stems and take the longer route around the Cape of Good Hope. Longer haul sailings around Africa would support VLCC earnings, whereas a possible decline in the number of westbound Aframax ballasters could support rates in the west.

Dry bulk carriers accounted for about 13% of the total traffic in terms of volume of cargo but 22% in terms of the number of ships transited the canal.

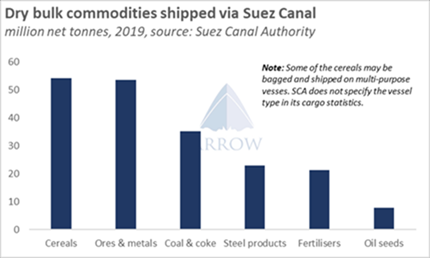

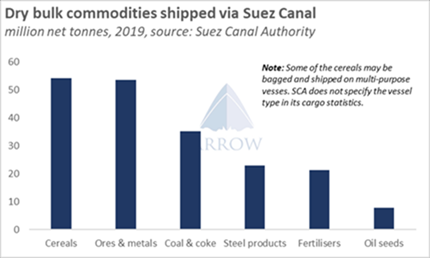

The largest dry bulk commodity shipped via the Suez Canal is cereals. However, we do not know with certainty if all of this is shipped on bulk carriers. We suspect some may be bagged and carried by multi-purpose vessels. Other major dry bulk cargoes that transit the canal are ores, coal, steel products and fertilisers.

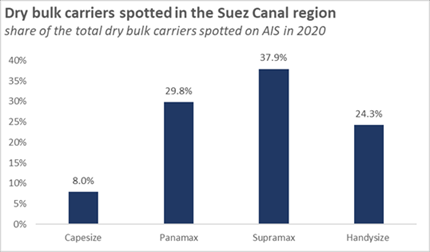

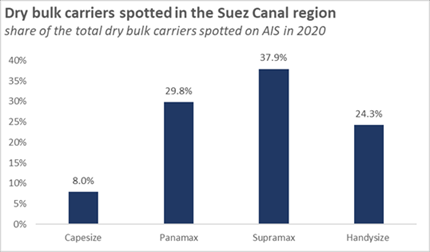

Suez Canal Authority does not provide a breakdown of dry bulk carriers that transit the canal by size segments. However, based on the number of vessels spotted within the canal region* in 2020, we estimate that Supramax is the most exposed segment to a prolonged closure as it accounted for 38% of the total dry bulk trade within the region in 2020, followed by Panamax with 30% and Handysize with 24% share. Capesize segment accounted for 8% of the vessels spotted in the region last year.

* Canal Region: a polygon we created to capture the canal as well as the entry points just north and south of it. We then counted the number of vessels that transited the polygon in 2020 using the AIS vessel tracking system in order to estimate dry bulk traffic with more granularity (by vessel size segment). Official transit figures may differ from our estimates.

* Canal Region: a polygon we created to capture the canal as well as the entry points just north and south of it. We then counted the number of vessels that transited the polygon in 2020 using the AIS vessel tracking system in order to estimate dry bulk traffic with more granularity (by vessel size segment). Official transit figures may differ from our estimates.

We do not know how long the canal will remain closed at this stage. Therefore it is difficult to estimate its impact on the freight market accurately. However, the longer the closure the deeper the impact will be. A prolonged closure would not only restrict tonnage supply due to vessels being stuck at or near the canal but also due to rerouting of thousands of vessels around Africa every month – more than 1,500 vessels transit the canal on average every month.

Under such a scenario, container rates would hit new record highs and dry bulk and tanker earnings would get a boost.

The situation is very fluid and the next few days will be critical in understanding what the impact on the freight markets will be. We will continue to follow the developments and update our readers accordingly.

Source: Arrow

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar