The Brazilian weather has had a significant impact on dry commodity exports so far this year. Seasonally dry weather in key iron ore mining & exporting regions supported export levels in January and early February. However, rainfall since early February, especially in the Northern State of Para, has trimmed export levels more recently.

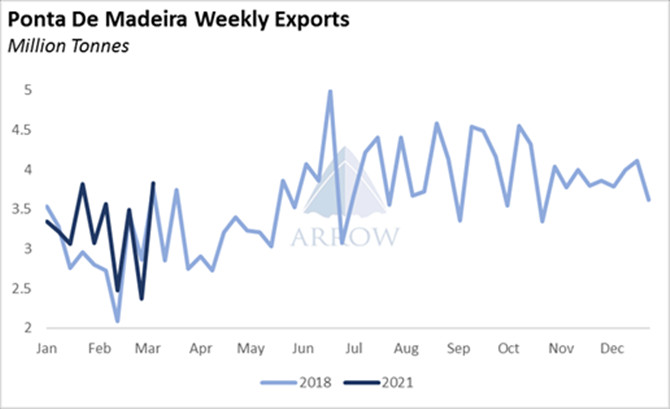

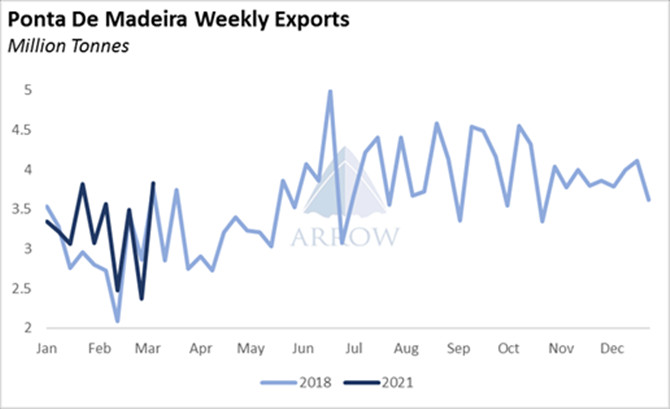

The Brucutu dam disaster in 2019 and Covid-19 in 2020 means Q1 comparisons with these years are not so useful; therefore, we can look at 2018 for comparison. Vale's 2018 full-year guidance was 20% higher than its 2021 target, but this year's dry weather supported shipments in the first few weeks of the year, and 2021 exports outpaced 2018. However, since this initial burst, the pace of shipments has fallen back to levels close to 2018 but still posting year over year gains.

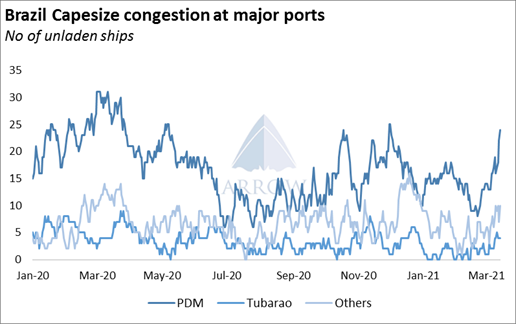

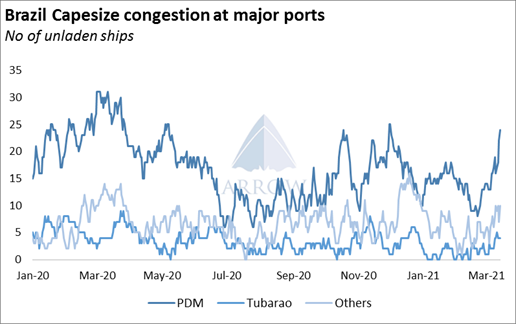

This slowdown in exports is now causing a pick-up in congestion to around the highest level in 10 months for PDM.

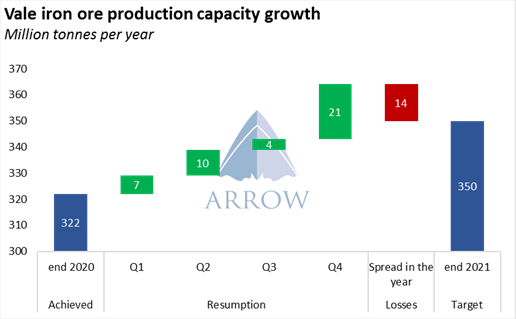

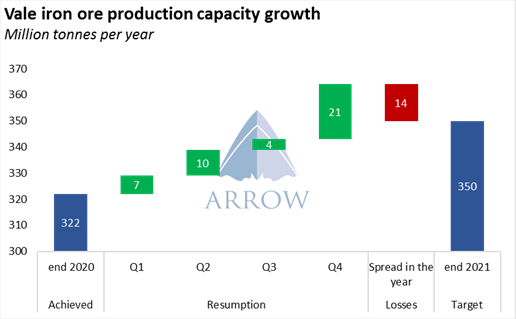

Throughout 2021 Vale will be ramping up operations that have been idled/curtailed since the 2019 dam disaster. Last week Vale started commissioning operations at the Timbopeba wet processing site, and this week the filtration plant at the Vargem Grande complex has cautiously started production.

Vale foresees a 28 million tonnes increase in annual production capacity in 2021, with most of the restarts expected in the second half of the year. Should it go to plan, Vale's run rate will sit at a strong 350 million tonnes per year going into 2022.

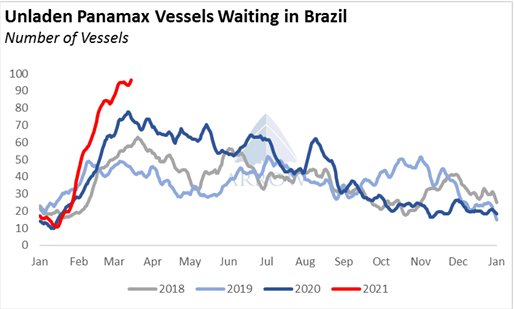

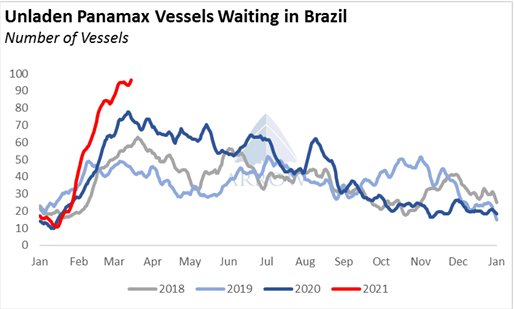

A delayed soybean planting due to dry weather earlier in the year caused a delayed harvest which consequently led to a slow start to Brazil’s export program. Additionally, very wet weather across key soybean producing regions more recently has slowed down operations. However, the pace is picking up fast with year to date exports now higher than 2020. These rains have also boosted yields, so potentially more soybeans will be available to export, provided the rest of the harvest goes smoothly.

Panamax congestion in Brazil has soared over the past 2 months as a flood of vessels arrived at Brazil a bit early, but now congestion is likely around a peak as the fast export pace clears though the line-up.

Moving forward, the 2-week rainfall forecasts are around average levels for the key dry cargo regions of Brazil. Notably, the northern state of Para, which feeds PDM continues to have plenty of rain in the forecast as the wet season will continue until around mid-April. That will likely act as a headwind for exports and may disrupt shipments over the next few weeks. However, strong demand and improving supply should boost volumes further down the line.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar