Rates for containers heading towards Europe from the Far East have continued to surge in recent days, as a spike in demand for containerized good continues within the region.

The S&P Global Platts-assessed PCR11 (North Asia-to-UK) trade route reached record highs of $8,000/FEU on Dec. 15. This assessment is more than a three-and-a-half-fold increase on the rate a month previous.

Across the Mediterranean and North Continent, rates from North Asia have also jumped, increasing to $7,000/FEU and $6,800/FEU respectively, both rates are the highest level since Platts started assessing these routes.

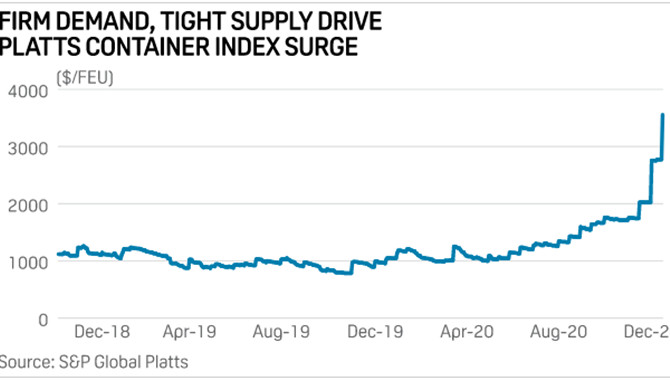

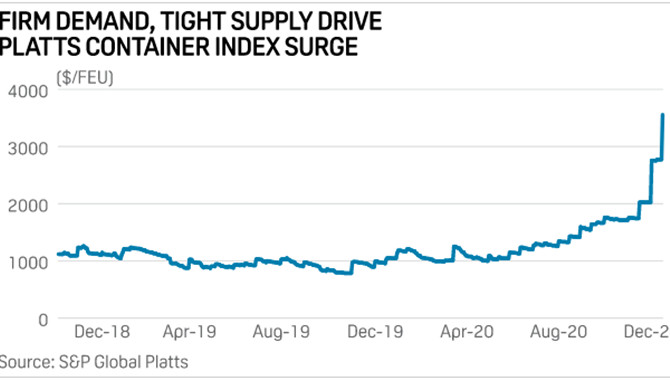

These three increases have led to the Platts container index to also reach new highs of $3,557.45/FEU, increasing by two-fold on the month previous.

With rates increasing so rapidly, freight forwarders have told Platts that containers booked at lower rates are not being loaded onto vessels.

“I’ve just had 60 containers canceled; they were meant to be heading to Europe,” said one freight forwarder.

Rates to the UK have seen the largest increase, as businesses seek to stockpile before the UK leaves the EU customs union. Uncertainty over the future trading relationship and fears of delays at the boarder due to customs checking has led to increased demand for goods. This compounded with a change in consumer spending habits away from services towards consumer goods, seasonal pre-Christmas demand and businesses restocking after shutting due to national lockdowns, has left ports struggling to cope with the increased volumes.

Felixstowe – the largest container port in the UK – has born the brunt of the increase in traffic and has faced subsequent delays. As well as an increase in demand, storage capacity at the port has been reduced in recent months as government supplies of Personal Protective Equipment have been held at the port. However, according a statement released by the Port of Felixstowe on Dec. 13, the volume of PPE containers has “reduced significantly since their peak.”

Delays at Felixstowe has led to some carriers amending their schedules away from the port. Maersk and MSC now call at Liverpool on their transatlantic services TA2 and NEUATL2 respectively. Those carriers who do still stop at Felixstowe have now introduced a congestion surcharge; Hapag-Lloyd are currently charging $175/TEU for all cargo from Asia passing through the port.

According to one freight forwarder, this is only the beginning of the UK’s woes, “The UK may cease to be served by the large carriers, instead only feeder vessels will service UK ports.”

CARRIER TO INCREASE VOLUMES ON KEY ROUTES

As rates hit record highs, CMA-CGM have announced additional capacity along the Asia-to-Europe routes. Three new 23,000 TEU, LNG powered ships have been added to the route and, according to a statement released Dec. 14, “Capacity will be 10% higher than in the current quarter.”

Even with increased capacity along these routes, rates are expected to rise even further on Jan. 1. According to a source at a carrier, negotiations for the next rate change are set to begin at the end of this week and continue into next week. Indications from Freight forwarders and carriers show that the rise isn’t expected to be as great as previous increases.

“I think rates will stay elevated until at least Chinese New Year, and then they may decrease back down to around December levels,” said a source at a carrier.

EQUIPMENT SHORTAGE CONTINUES

Another factor affecting global container markets is the equipment shortage in Asian ports. As containers take longer to process at warehouses and factories around major importing hubs — due to government-imposed restrictions on the number of people able to work in an enclosed space – an imbalance of equipment has arisen.

Carries are now taking preference of empty boxes over full boxes on backhaul routes Asia. This is in order to decrease the turnaround time for a container in the Far East, to allow a container to spend more time heading westwards on the lucrative head-haul routes.

“I am offering 100 40-FEUs for January and no one is offering me a rate at the moment; they are saying they’re fully booked,” said a freight forwarder.

Frustration over equipment shortages has meant that some large shippers have started to investigate leasing their own containers, according to a separate freight forwarder.

Rates along the backhaul route have also increased to record highs, however not to the same magnitude as the head haul. The PCR12 (UK-to-North Asia) trade route has experienced an almost two-fold increase in a month from $1000/FEU to $1,900/FEU.

Source:Platts

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar