Furthermore, Covid-19 restrictions has hampered imports from neighbouring Mongolia.

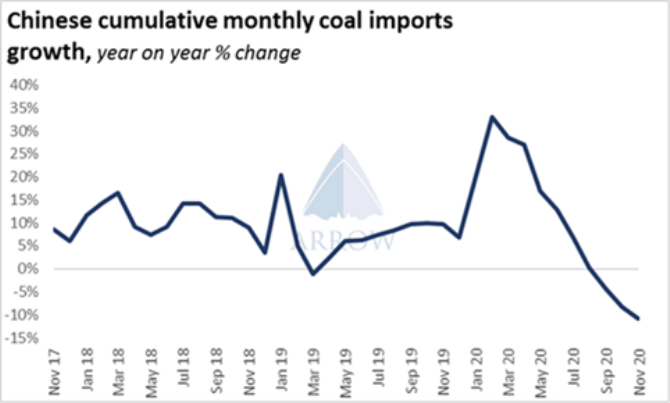

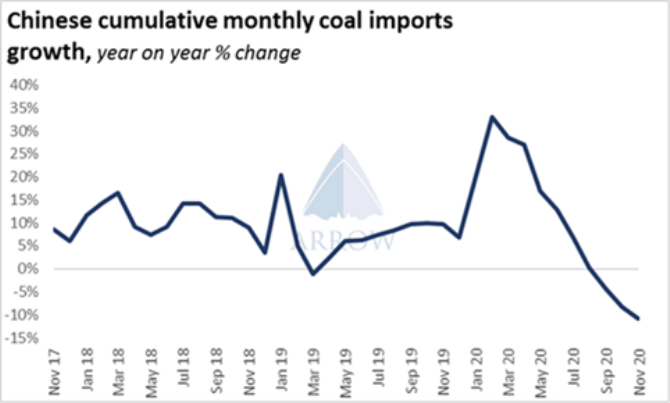

Coal imports have been drastically curtailed in the past few months as quotas were exhausted, with cumulative 2020 imports down 10.8% year over year in November. However, China has recently allocated another 20mt of import quotas for 2020, which is a sign that domestic tightness is starting to bite.

With quotas being refreshed in the New Year and Australian coal off the menu, Chinese buyers are looking elsewhere to pick up whatever prompt cargoes they can. And it appears like the market is sniffing out strong Chinese demand returning as international coal prices have been rallying recently with the whole forward curve moving up – reduced global supply also contributing to the rally. Prices for prompt Indonesian thermal coal are up from $24 in September to $36 now – with similar percentage returns for other origins/qualities.

Another interesting dimension to the current situation is China’s apparent attempt to hide the situation on the ground. Both daily coal burn data and some price indices have been discontinued during 2020, and one can speculate that the intention behind this is to try to hide the true situation occurring – things are tighter than officials would like to let on. Furthermore, the Zhengzhou Commodity Exchange on which domestic thermal coal futures are traded even issued a statement yesterday reminding “investors to operate cautiously and invest rationally” amid the current rally, which can be interpreted as “if this rally continues we will intervene”. Which has been often witnessed on domestic iron ore futures when prices rally to uncomfortable levels – just yesterday they hiked margin requirements on iron ore after implementing an open position cap last week.

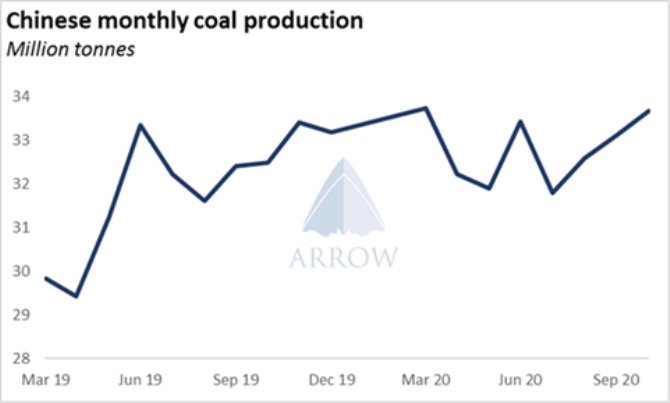

With unimpressive domestic supply, reduced imports and a potentially cold winter approaching we can expect the Chinese coal market to be tight over the next few months. The rally in coal prices suggests the market agrees with this view. And China’s apparent attempts at eliminating key data sources plus pressuring futures trading confirms it.

However the key question is whether China will be forced to take Australian coal or not. Further escalations in the Australia-China trade war in recent weeks gives Beijing further cause to maintain the ban. However, thinning vessel queues at ports along Australia’s Eastern Coast implies traders are not anticipating large volumes of Australian coal flowing to China for the New Year quota renewal.

This latest rally in coal prices and the extra quota allocation combined with China’s apparent data suppression indicates that the situation is escalating sharply, perhaps soon reaching an inflection point.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar