Bloomberg reported on Thursday that China is set to allow a shipment of Australian coal into the country despite the ban remaining in place, citing a person familiar with the matter. According to the article, a vessel carrying a cargo of 135,000 tonnes of Australian thermal coal is expected to clear customs and discharge at the southern port of Fangchenggang.

It is unclear whether if China has lifted its ban on coal imports from Australia or not. Neither the Tangshan Port Group, which operates the Fangchenggang port nor the customs officials released any statements. However, AIS data shows that more ships have been allowed to discharge in China recently.

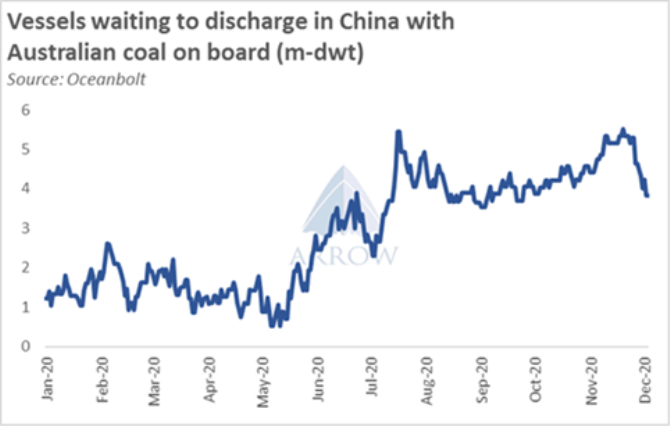

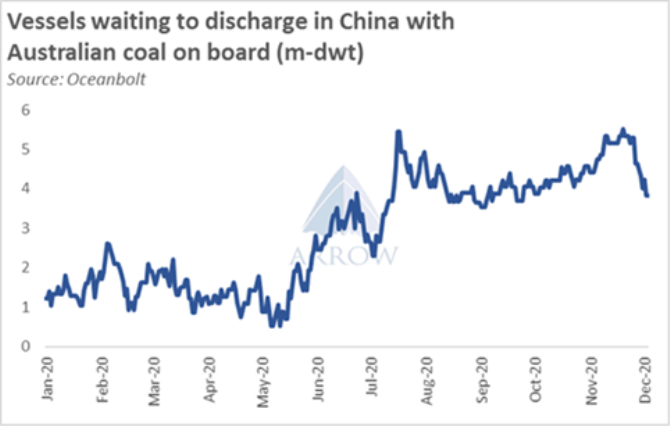

Data provided by Oceanbolt shows a sharp drop in the number of vessels waiting to discharge in China with Australian coal on board over the past few days. At least eight ships carrying about 0.9mt of Australian coal are reported to have unloaded since last Friday. Out of those eight, four completed their discharge during the previous two days.

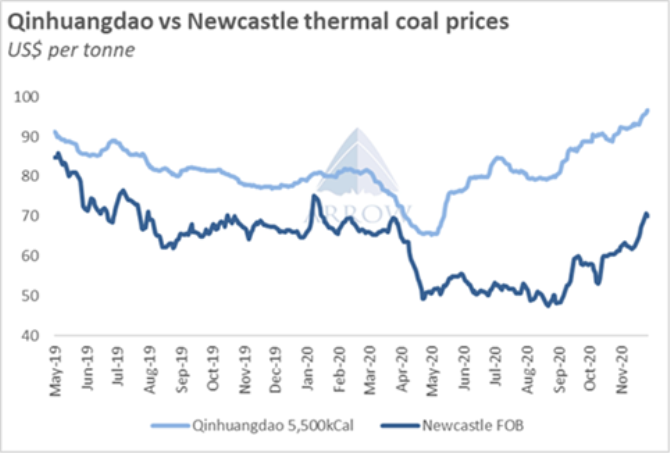

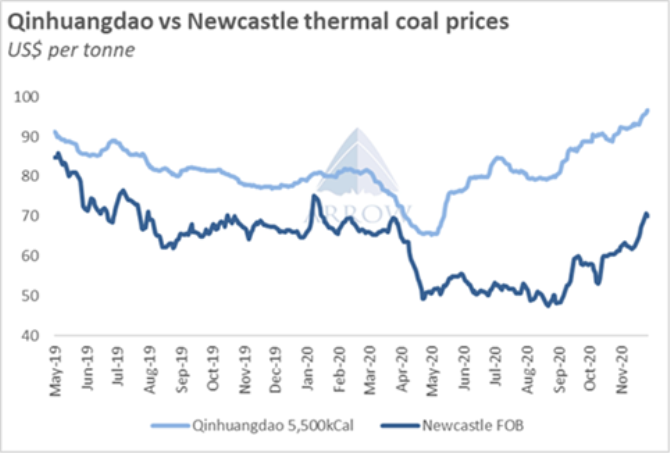

China domestic coal market remains tight. Despite the 20mt of additional import quotas issued last week prices continue to increase. Benchmark 5,500kCal thermal coal at Qinhuangdao port has risen to RMB634 per tonne this week, which is well above the level that authorities are comfortable with and suggests that China may relax its import policy further to allow Australian coal in the coming weeks.

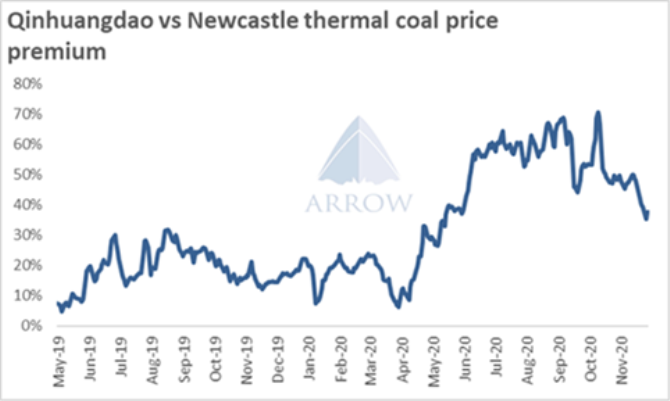

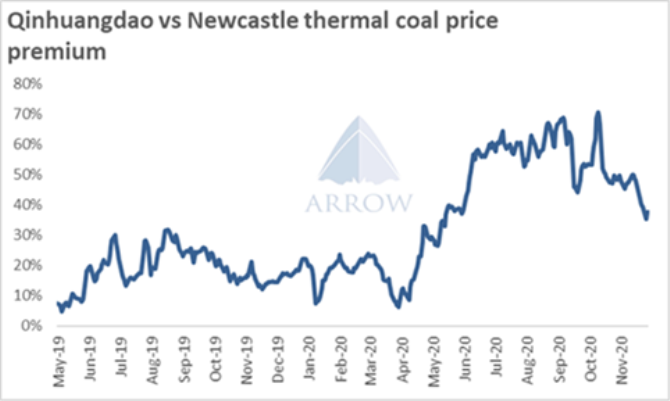

Latest price moves also point in that direction. China domestic thermal coal price premium dropped sharply since the news of additional coal import quotas last week. But it was mainly due to a sharp rise in Newcastle prices rather than a drop in domestic prices in China, suggesting that traders may be pricing in a possible return of Chinese buyers to the market.

The coking coal market is even tighter with severe supply shortages pushing Chinese coking coal prices to multi-year highs. Despite central government trying to encourage domestic production, output growth remains slow due to safety and capacity constraints. Imports from Mongolia, China’s second-largest supplier after Australia has also slowed with a brief border shutdown in late November due to a surge in new Covid cases. We understand that border crossings at Ganqimaodou have recovered to about 400-500 daily cargoes, but it is still about half the average level of about 800-900 trucks a day. Trucking costs have also doubled to RMB200 per tonne.

Chinese end-users are now paying a massive premium (~$65 per tonne) for non-Australian coking coal as a result.

We argued in our recent reports* that the politics between the largest consumer and the largest supplier of dry bulk commodities in the world is yet to play out. However, the cost of sustaining the import restrictions is becoming excessive with the price of the critical commodity to Chinese consumers nearing record highs. Given the political nature of the issue, it is difficult to predict how it will play out. But we suspect we may be nearing the end of the import ban on Australian coal.

Source:Arrow

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar