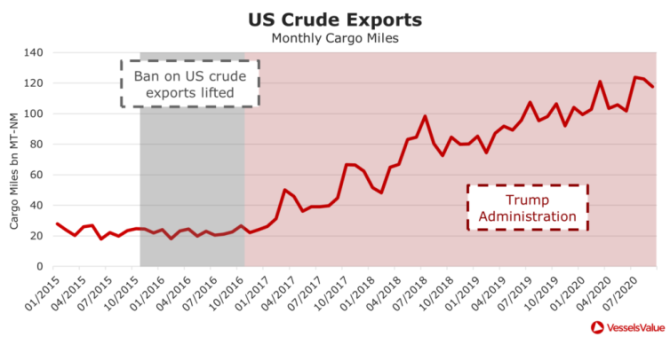

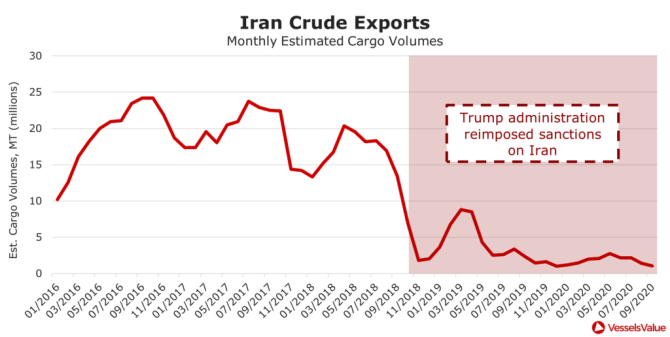

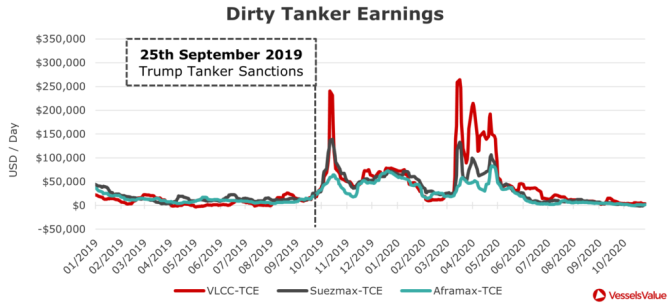

Even though this effect was short lived, the Tanker market benefitted from restricted supply and related upwards volatility which led to some great earnings for Tanker owners. Political volatility tends to be good for Tankers, Trump is volatile, so Tanker owners would likely prefer Trump.

Headline:Trump's trade war had harmed US Bulker exports. The January 2020 trade deal has somewhat reversed this recently, but the likelihood is that Trump will continue with the trade war, which could be bad for Bulkers.

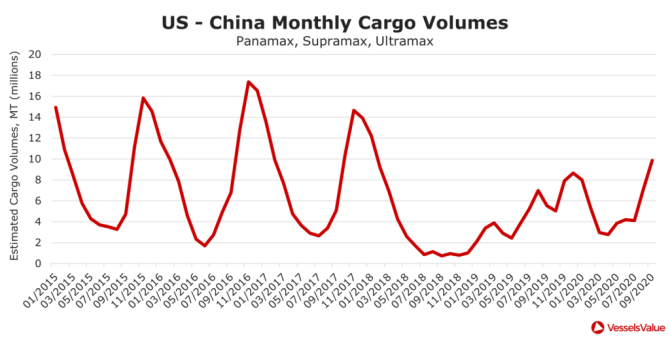

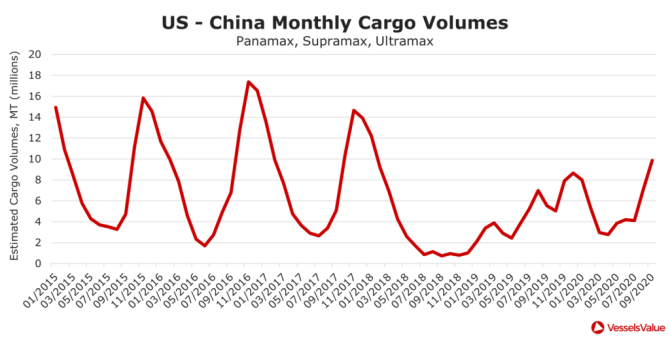

The US to China Dry Bulk trade, including key grain exports such as soya beans and corn, shows clear seasonal trends over the last 5 years, with peaks in cargo volumes between August and November correlating with the start of the marketing year in September. However, since trade differences on the route escalated in 2018, there has been a clear decline and volatility in volumes being imported to China. The below chart shows US to China Bulker trades, focussing on Panamax, Supramax and Ultramax Bulkers.

Since 2018, Dry Bulk trades from the US to China have been much less consistent than in previous years, correlating with when Trump began setting tariffs on China, and vice versa. Seasonal peaks have not reached highs of previous years, although pre-Covid-19 this year, imports to China were beginning to rise again incrementally.

Imports fell in February and March as a result of the pandemic, but since July, as demand began to recover, imports have followed an upwards trajectory, increasing by 140% from 4,109,657 MT in July to 9,872,754 MT in September this year. This suggests that the phase one trade deal that was signed by both countries in January 2020, whereby China agreed to increase their US imports over the next two years, could be showing results as imports begin to rise in line with pre-trade war periods. However, there is a real risk of more trade war type actions if Trump is re-elected, so we expect Bulker owners to be more optimistic with a Biden presidency (despite his attitudes towards trade with China not yet being clear).

Boxships for Biden

Headline: Trump’s protectionist policies have had a negative impact on China to US Container trades. Additionally, Biden’s promise of higher stimulus levels should increase consumer spending and related Container trading volumes.

Trump’s protectionist policies, especially against China, could be bad for the Container market as Chinese Container exports to the US are a major driver of Container demand. This can be seen in the chart below which shows cargo miles on the China to US route falling since 2018 when trade hostilities between Trump and China intensified, until the recent sharp recovery in the summer, related to the post lockdown economic recovery.

At this stage it is unclear if Biden will be any more lenient on China, but his statements suggest he is more accepting of the benefits of international trade.

Additionally, Containership demand is driven by economic activity and related consumer spending. Recent history has shown that Trump was very loose with stimulus which has led to record breaking stock markets and increased consumer spending. However, currently the Democrats are proposing a far higher stimulus bill than the Republicans. More stimulus, especially in the wake of the Covid-19 pandemic, should lead to more consumer spending which should benefit the Container markets (as long as owners refrain from over ordering new vessels and causing a vessel oversupply).

Summary

Tankers for Trump. Bulkers and Boxships for Biden.

The result of the US election will undoubtedly have a meaningful impact on global shipping markets with the industry being at the crux of geopolitical trade wars and the movement of goods, however, different sectors will feel different impacts.

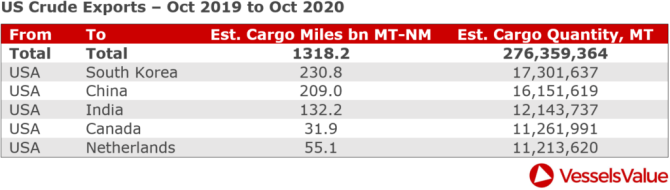

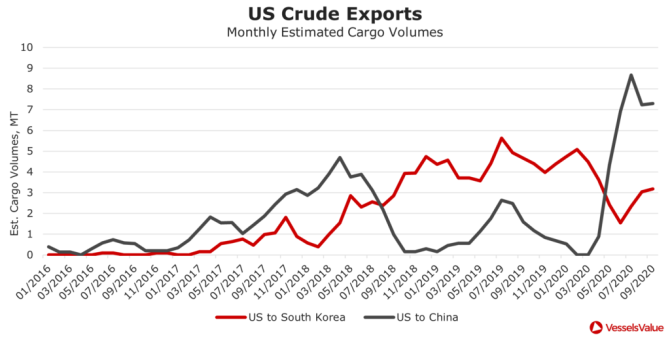

The Tanker market is expected to benefit from a Trump presidency as evidence suggests it has already over the last four years. His favouring of US crude production and his blacklisting of certain Tanker fleets has resulted in higher Tanker rates both in the long and short term. Biden is expected to focus on investment into clean energies, thus reducing US crude supply, which could change Tanker trading patterns globally and push down rates.

Biden is likely to be favoured by the Bulker and Container markets, which have suffered as a result of Trump’s protectionist policies and the ongoing trade war between the US and China. However, this is less clear cut as there is still some uncertainty about what a relationship between Biden and China would look like.

Source: vesselsvalue

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar