With waves of iron ore imports arriving in a record number of shipments throughout the third quarter in China, and no signs of any letup to this explosive demand for the raw ferrous commodity, the Capesive market is expected to remain firm in the last quarter of this year.

Defying the anemic industrial activity seen elsewhere globally due to the current pandemic, China imported extraordinary volumes of iron ore during June, July as well as August at 101.7 million mt, 112.6 million mt and 100.3 million mt, respectively, according to the General Administration of Customs data.

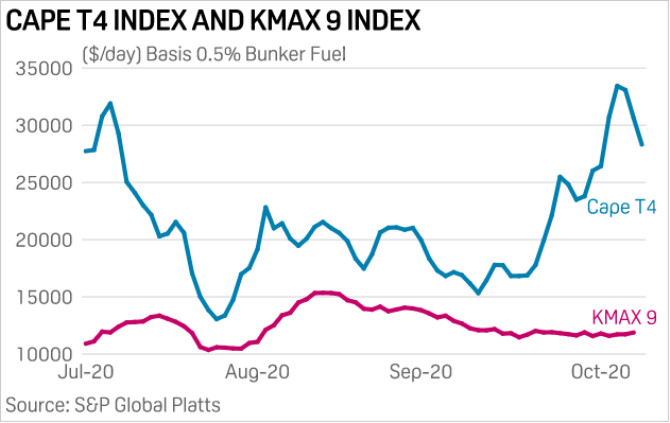

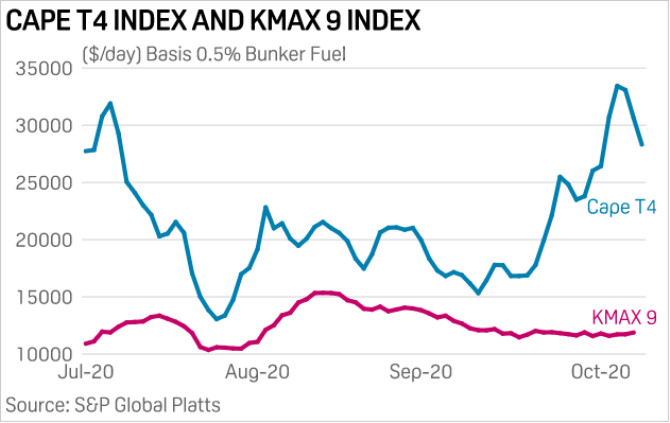

Catering to China’s iron ore demand, the Capesize segment boomed in Q3 with the Platts Cape T4 index basis 0.5% sulfur marine fuel averaging $20,823/d after registering a high of $31,901/d on July 6.

Ores galore for Capesize

“China's strong iron ore demand and the robust price of it are the biggest support for the Capesize market,” a ship-owning source said, adding that miners will try to push out as many cargoes as they can, leading to a rush for tonnage.

“So far the market is still promising and the Q4 performance for Capesize is mainly relying on the Brazil shipping demand,” added a chartering source with a Chinese steel mill.

The Q4 Capesize market has been riding on positive sentiment on the back of Brazilian mining major Vale sticking to its 2020 iron ore production guidance of 310 million-330 million mt range, despite halting operations at its Viga concentration plant on Sept. 24, which would reduce output by 11,000 mt/d.

According to cFlow, Platts trade-flow software, Vale’s exports from Brazilian ports totaled around 79 million mt for the third-quarter and 193 million mt over Q1-Q3.

Vale would need to export at least 107 million mt in Q4 to meet its 2020 target. As such, market participants expect the current Brazil market to be busier in the last quarter than it was in the third.

Boost for bauxite, blow for coal

“While the rainy season has temporarily restricted [bauxite] output from West Africa in Q3, we expect to see shipments from Guinea play a big role in the employment of Capesize ships in Q4,” a shipbroker said.

A dampener for the Capesize market is the poor demand for shipping coal as the pandemic slashes trading activities. The sliding Chinese seaborne coal demand, further exacerbated by the port quota restrictions on imports, has reduced the availability of “swing cargoes” for the Capesize ships, which predominantly moves iron ore.

China’s coal imports in August fell to 20.66 million mt from July’s 26.1 million mt, according to customs data.

Many Capesize market watchers expect the inclement weather, which is quite usual during winter in the Far East, to help this segment by causing delays with ships getting held up at Chinese and other North Asian ports.

Grains feed Panamaxes

In the smaller Panamax segment, as the east coast South American grain supplies get sold out, the US grains are expected to provide the much needed support to the Pacific Panamax market.

A staggering 22.4 million mt of soybeans was sold during the US grains season, which is due for export during the 2020-2021 marketing year with close to half of it sold to Chinese buyers. Only 5.6 million mt was shipped to China the previous year.

Support has also emerged from the US corn market, where sales nearly double at 13.7 million mt this year compared with 7.9 million mt in 2019.

After an outstanding run in August, the Asia Pacific Panamax market is witnessing a slight bearishness at the start of Q4. The Platts KMAX 9 Index after averaging $14,010/d in August fell to $12,413/d in September mainly on the back of sluggish demand for seaborne coal from China.

Indian coal demand may help

India's coal imports in Q3 are showing signs of recovery from the COVID-19 pressure. It received 11.46 million mt of seaborne coal in August, which is up 6.84% from July. Coal-fired power generation from India during September compared with the same period in 2019

The burgeoning thermal coal demand into India has seen the time charter equivalent rate for Supramax vessels, opening in Singapore, for a trip via South Kalimantan to west coast India average at $9,084/d for September, the highest since the launch of the assessment in November 2019.

Source:Platts

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar