Chairman's Statement

I am pleased to report that, amid some of the most challenging economic and operating circumstances in living memory, Orient Overseas (International) Limited (“OOIL”) and its subsidiaries (the “Group”) achieved a profit attributable to shareholders of US$102.1 million for the six-month period ended 30th June 2020 (2019: US$139.0 million). The profit per ordinary share for the first half of 2020 was US16.3 cents, compared to US22.2 cents in the first half of 2019. The Board of Directors is pleased to announce an interim dividend of US4.89 cents per ordinary share.

To have achieved such a positive outcome is a remarkable feat, considering the global recession caused by the sudden outbreak of the COVID-19 pandemic in the first half of the year. The Group’s financial strengths, as well as our adept handling of unforeseen and demanding situations, have enabled us to navigate these uncharted waters relatively smoothly.

We saw extremely radical changes to many growth forecasts for 2020 cargo volume, after the impact of the pandemic on container shipping started to materialise. Faced with dire predictions of dramatically falling demand from our customer base, OOCL reacted by paying careful attention to customer demand and reviewing and calibrating our services accordingly on a timely basis. The container shipping sector has recent experience of significant falls in demand that hurt the industry badly, both in 2009 and 2016, and so OOCL has prioritised cost management during the anticipated tough conditions of 2020. This adaptability is one of the factors that has allowed OOCL to resist the headwinds of the pandemic, and to produce these solid results. Since May, demand on some trade appears to have improved somewhat, with OOCL providing additional capacity to support our customers’ requirements. However, this tentative demand recovery is far from secure, and we will continue to monitor the situation closely.

The financial outcome has also been helped by a fall in fuel prices, although it is not known how long this will last, as well as by a low interest rate environment and a reduction in the Group’s debt.

OOIL continues to benefit from its co-operation with the wider COSCO SHIPPING group. The ability to keep costs under control, through for example our effective joint management of our container boxes, has been a key attribute of our success. In addition, our close co-operation has also allowed us to plan multiple adjustments to our network offering, in line with the huge changes seen in expected customer demand. The many synergies achieved through our joint efforts are one of the underpinning drivers of our highly successful Dual Brand strategy.

I would like to thank all OOCL staff for their contribution both to OOCL itself and to the wider COSCO SHIPPING group. OOCL’s “We Take it Personally” spirit is truly showing its value as we traverse the challenges of this extraordinary time. Through office closures, national and regional lockdowns, changes in scheduling and disruptions to various parts of the supply chain, our colleagues have clearly demonstrated the strengths that make OOCL such a valued partner in this business.

Looking forward, the pandemic will have long-lasting effects, and the epidemic prevention and control measures adopted in many countries have become part of daily life. Thanks to the tremendous efforts of all parts of society, as well as economic stimulus packages, many economies have re-emerged from lockdowns and have restarted activity. Against the difficult backdrop, China has managed to expand its GDP 3.2% year on year in the second quarter of 2020, a sign that production activity is steadily improving, which gives us some degree of hope for a more widespread recovery. While the pandemic could continue to bring uncertainties in the rest of the year, tensions in global trade relationships or other factors such as oil prices could also have an impact on our business in the coming months. In this situation, the only rational response is to remain cautious.

Despite the challenges, we remain confident in our long-term future. The order we placed in March this year to build five 23K TEU vessels is a tremendous display of our enduring confidence in container shipping. We are playing a leading role in the digitalisation of our industry and building on very solid foundations in providing integrated container logistics services, which will help us to respond better to the evolution of our customers’ requirements in the post-epidemic era. OOIL is among the best-placed groups to handle whatever difficulties may be faced by our industry.

GROUP RESULTS

For the first six months of 2020 Orient Overseas (International) Limited and its subsidiaries (the “Group”) recorded a profit attributable to equity holders of US$102.1 million compared to US$139.0 million for the corresponding period of 2019.

Results of the Group's continuing operations arise from its business of container transportation and logistics conducted through the “OOCL” brand, augmented by earnings from the Group’s liquidity management and investment activities at holding company level.

CONTAINER TRANSPORT

The operating conditions of the first half of 2020 were challenging, with COVID-19 affecting all trades. Following the initial spread of the virus across the world, market and customer forecasts suggested massive reductions in expected levels of demand, which resulted in multiple adjustments to services on our network. While conditions so far have not been as severely impacted as feared, our outlook remains cautious.

Compared to the first half of 2019, OOCL total liner liftings decreased by 2.6%, but revenue per TEU increased by 6.0%, allowing total revenue to increase by 3.2%. Negative market growth occurred on several trades, but in some cases this drop in liftings was outpaced by an improvement in the freight rates.

In terms of overall liftings, for the first half of 2020, we observed only a small reduction in liftings on the Trans-Pacific trade as a whole. Liftings declined on the Asia-Europe trade, as well as on the Intra-Asia and Australasian trades, but increased on our Trans-Atlantic trade. Revenue increased on our Trans-Pacific, Asia-Europe, and Australasian trades, and was slightly down for our Trans-Atlantic business. Revenue per TEU increased for majority of the tradelanes as compared to 2019.

Despite IMO2020 rules requiring vessels to use the more expensive and higher quality VLSFO as from 1 January 2020, global economic conditions and excess oil supply drove bunker prices to markedly lower levels for much of the period. Notwithstanding this reduction in a key component of our operating costs, considerable uncertainty still exists over the future levels of fuel prices, especially during these extraordinary times.

Trans-Pacific Trade

This trade overall has performed well, clearly better than expectations given the exceptional circumstances during the first half of 2020.

Despite the extended shutdown in China during Chinese New Year, and the lockdowns in many parts of North America forcing the temporary closure of retail stores that use our services, volume growth for OOCL has only been slightly negative. This is due in part to the economic slowdown not being as bad as predicted, and to government support provided to individuals and corporates. The specifics of our customer portfolio, and our reputation as a creditworthy counterparty with reliable and efficient customer service also helped us to maintain business activity.

Trans-Pacific liftings decreased by only 0.3% compared to the same period last year, with revenue increasing by 0.1%.

Contract rates for 2020-2021 are above the levels agreed for 2019-2020. The spot market on many Trans-Pacific routes have been relatively strong in recent weeks, especially for the Pacific Southwest routes. Current conditions remain good, but visibility over future months is low, given the inherent uncertainty caused by COVID-19 and its economic impact.

Asia-Europe Trade

The Asia-Europe trade has also performed better than expected. However, the relatively less robust European economies (as compared to the US) provided a less resilient backdrop than we saw on the Trans-Pacific trades.

Furthermore, lockdowns in several European countries were very severe, which had immediate impact in terms of onward transportation of containers and in terms of economic sentiment. It is unclear how quickly economic activity will recover in the second half, even if there have been some encouraging data points, for example UK retail sales improved significantly in June 2020.

In the first half of 2020, liftings decreased by 2.3%, but revenue increased by 8.1%, compared to the same period in 2019.

At this stage, the impact of Brexit and of potential changes in the EU-US trading relationship appear minor as compared to the impact of COVID-19.

Intra-Asia and Australasia Trade

There was a drop in liftings of over 5% on the Intra-Asian (including Australasian) trades, but an increase of over 5% in terms of total revenue in these areas. Volumes and revenues were much strong in Australian and New Zealand business as compared to Intra-Asian activity. While Australian volumes to some extent mirrored the patterns seen in the US and Europe of not being as badly impacted as expected (although impacted nonetheless), volumes on certain Intra-Asian tradelanes such as China-Middle East and China-Indian- Pakistan suffered more from specific circumstances (e.g. strict lockdowns in India, effect of automotive industry slowdown in Japan etc.).

Trans-Atlantic Trade

The European and American economies were deeply affected by COVID-19, and while OOCL added to its service offering on this trade, resulting in improved volumes, revenues declined slightly.

Bunker Cost

Bunker prices had experienced significant volatility during the first half of 2020. Not long after the International Maritime Organization’s (IMO) Low Sulphur Cap regulation went into effect on 1st January 2020, bunker prices rose to more than US$600. However, with the rapid spread of COVID-19 outbreak that began in late January and eventually becoming a global pandemic, the price dropped sharply where crude oil futures plunged below zero for the first time in history on 20th April 2020. Both the Fuel oil and Diesel oil prices had also dropped to historical lows in May but began to steadily increase in June.

The average price of bunker recorded by OOCL in the first half of 2020 was US$424 per ton compared with US$441 per ton for the corresponding period in 2019. The price drop in fuel oil and diesel oil led to the decrease in bunker costs by 11.3% in the first half of 2020 when compared to the corresponding period in 2019.

LOGISTICS

For the first half of 2020, OOCL Logistics revenue increased by 5.3% while contribution dropped by 12.2% compared with the same period last year.

The contribution from International Supply Chain Management Service (ISCMS) decreased by 23.9% because many retail shops and outlets were forced to close due to the COVID-19 outbreak and city lockdowns which significantly reduced the volume in the first half of the year. Although the volume of Import/Export Services increased but the overall contribution decreased slightly by 4.9% due to the increased procurement costs. There was a 28.5% improvement on Domestic Logistics contribution after effective cost control initiatives, improved utilisation of warehousing resources and new customers being secured.

Looking forward, we are cautiously optimistic that the ISCMS volume for the second half of the year will recover as countries gradually relax lockdown measures and restore the health of the economy. In fact, the volume has already been picking up since June. The focus for Import/Export Services is to further increase volume and improve profitability. For Domestic Logistics, strict cost control and expansion of customer base will continue in order to further improve our performance.

Furthermore, our depot footprint will continue to grow in South East Asia in the second half of the year. In terms of region development, logistics capabilities will be further strengthened in Europe, Latin America and the USA.

VESSELS

During the first half of 2020, OOCL placed orders for two 23,000 TEU vessels from Dalian COSCO KHI Ship Engineering Co., Ltd. and three 23,000 TEU vessels from Nantong COSCO KHI Ship Engineering Co., Ltd. in China. The expected delivery for these five vessels will be in the year 2023.

OTHER ACTIVITIES

The other activities of the Group consist of property investments and other investing activities. The latter includes centralised treasury and investments department to manage the Group’s liquidity and investments. The Group’s property investments include its long- standing ownership of Wall Street Plaza, and 0.5% direct holding in Hui Xian REIT, the first RMB – denominated REIT listed in Hong Kong.

Net profit for investment was dropped in first half of 2020 as compared to first half of 2019. The decrease in net profit was mainly due to the fair value loss on portfolio investments due to the impact of COVID-19 and the reduction in interest income from bonds due to the disposal and redemption of bonds.

The performance of Wall Street Plaza was adversely affected by COVID-19 in the first half of 2020. Based on an independent valuation, it has been re-valued downwards by US$10 million as at 30th June 2020 to reflect an assessed market value of US$300 million.

In the first half of 2020, Hui Xian Holdings Limited, the original developer company of Hui Xian REIT, declared a cash dividend to its shareholders, of which the Group’s shares amounted to US$7.9 million. In addition, the Group also received a distribution of US$0.4 million from its direct holding of Hui Xian REIT. As at 30th June 2020, the Group’s total investment in Hui Xian was valued at US$16.8 million.

The investments in Wall Street Plaza and Hui Xian are both historical in nature and the Group currently has no intention of further investment in property other than as may arise in relation to the operation of our container transportation and logistics business.

LIQUIDITY AND FINANCIAL RESOURCES

As at 30th June 2020, the Group had total liquid assets amounting to US$2.4 billion and total indebtedness of US$3.4 billion. Net debt as at 30th June 2020 was therefore US$1.0 billion, which remains at the same level as in 2019 year-end.

The Group continues to have sufficient borrowing capacity and remains comfortably within its target of keeping its net debt to equity ratio below 1:1.

The indebtedness of the Group mainly comprises bank loans and lease liabilities which are mainly denominated in US dollar. The Group’s borrowings are closely monitored to ensure a smooth repayment of the borrowings to reach maturity. The profile of the Group’s long-term liabilities is set out in Notes 17 and 18 to the Financial Information.

The liquid assets of the Group are predominantly cash deposits placed with a variety of banks and with tenors ranging from overnight to up to 1 year. We review the list of approved banks and the exposure limits of each bank on a regular basis.

Given the inherently volatile nature of shipping industry earnings and the fluctuations of its asset values, the Group maintains a portion of its liquidity reserves in a portfolio of longer tenor investments. The Group’s investment portfolio of US$310.5 million as at 30th June 2020 is predominantly comprised of investment grade bonds.

CURRENCY EXPOSURE AND RELATED HEDGES

The Group operates internationally and is exposed to foreign exchange risk arising from various currency exposures, primarily with respect to fluctuation in the exchange rates of foreign currencies to the US dollar. Foreign currency exposures are covered by forward contracts and options whenever appropriate. Income and expenses from container transport and logistics activities are mainly denominated in US dollar and in various currencies, mainly including Euro, Canadian dollar, Japanese yen and Renminbi.

The Group’s borrowings are all denominated in US dollar, which effectively eliminates the risk of currency fluctuations on the Group’s debt profile.

EMPLOYEE INFORMATION

As at 30th June 2020, the Group had 10,436 full-time employees. Salary and benefit levels are maintained at competitive levels and employees are rewarded on a performance-related basis within the general policy and framework of the Group’s salary and discretionary bonus schemes. These schemes, based on the performance of the Company and individual employees, are regularly reviewed. Other benefits are also provided including medical insurance and retirement funds. In support of the continuous development of individual employees, training and development programmes are offered for different levels of employee. Social and recreational activities are arranged for our employees around the world.

SAFETY, SECURITY AND ENVIRONMENTAL PROTECTION

Our Group consistently maintains the highest safety and security standards as they remain a top priority in our business operations for our people, cargo, ships and facilities, both onshore and at sea.

The Group’s Corporate Security Policy guides our company in the prevention and suppression of security threats against international supply chain operations. We are not only committed to complying with rules and regulations such as the International Ship and Port Facility Security (ISPS) Code, but also doing much more by embracing many other industry best practices and voluntary initiatives. We actively collaborate with various governments and relevant authorities around the world as part of our efforts against activities that might impinge upon maritime or cargo security. For example, we participate in various national security programmes including the Customs-Trade Partnership Against Terrorism (C-TPAT) and the Authorized Economic Operator (AEO) initiatives.

In addition, our Global Data Centre maintains ISO 27001 certification in order to provide our customers and partners with quality and secure information that are in accordance with international standards on information security management.

To ensure everyone takes part in protecting our assets and become more resilient against cyber attacks, we have developed new programmes and initiatives such as monthly knowledge and trend updates, annual cyber security training and mandatory tests for all employees, sophisticated monitoring and protective systems, as well as conducting awareness exercises focusing on various aspects of this subject.

The Group also recognises that businesses must take responsibility for their industry’s effects on the environment. In our commitment to further build on our Environmental, Social and Governance (ESG) profile, we continue to engage in the United Nations’ Sustainable Development Goals (SDG) across our business strategies, operation, and corporate culture. We are committed to supporting the Ten Principles of the United Nations Global Compact (UNGC) that sets out fundamental responsibilities in areas such as human rights, labour, environment and anticorruption to tackle global environmental and social challenges. OOCL is also a member of the Maritime Anti-Corruption Network (MACN), which aims to work within the industry to eliminate all forms of maritime corruption and foster fair trade practices through collective initiatives.

OOCL is dedicated to environmental protection and committed to data integrity standards. Each year, OOCL ensures that such standards are consistent and upheld by certifying our environmental data through independent business assurance service providers. Accredited by Lloyd’s Register (LR), OOCL has achieved excellent reporting standards through the use of the Clean Cargo Working Group (CCWG) verification tool. Our Group Sustainability Report is published on an annual basis and it covers the significant environmental, economic and social aspects of the business arising from the principal activities of OOIL and its subsidiaries. This year, the scope of our report has been adjusted to prepare for the commencement of the Environmental, Social and Governance (ESG) Reporting Guide set out in Appendix 27 of the Main Board Listing Rules from The Stock Exchange of Hong Kong Limited.

We are very pleased to have been recognised for our consistent and sustained efforts in environmental protection initiatives, safety management and community engagement. In recognition of our achievements, we have been the honoured recipients of the:

• “Fuel Efficiency Award” from Seatrade Maritime Awards Asia for our efforts in fuel savings and efficiency improvements with the input of our workforce; and

• “2019 Hong Kong Awards for Environmental Excellence (HKAEE) Gold Award” in the transport and logistics sector which recognises our excellent performance in embracing green management and innovation towards environmental sustainability.

OOCL continues to achieve one of the best records for the Green Flag Program organised by the Port of Long Beach and Port of Los Angeles in the United States, achieving full voluntary compliance in vessel speed reduction for our vessels. Through our memberships with environment-focused organisations such as the Clean Cargo Working Group and the Business Environment Council, we are committed to doing our part in addressing climate change and environmental protection issues in countries and regions in which we operate.

In view of the latest COVID-19 situation, the Company had rolled out various measures to protect the health and safety of our employees at workplace and made necessary adjustments from time to time. A centralised platform has been set up to keep our employees updated on the latest development, as well as the respective Business Continuity Plans.

Other Information

INTERIM DIVIDEND

The Board of Directors of the Company (the “Board”) is pleased to announce an interim dividend of US4.89 cents (HK$0.381 at the exchange rate of US$1: HK$7.8) per ordinary share for the six months ended 30th June 2020 to be paid on 23rd October 2020 to the shareholders of the Company whose names appear on the register of members of the Company on 22nd September 2020. Shareholders should complete the dividend election form (if applicable) and return it to the Company’s Hong Kong branch share registrar, Computershare Hong Kong Investor Services Limited (the “Branch Share Registrar”) at 17M Floor, Hopewell Centre, 183 Queen’s Road East, Wanchai, Hong Kong, not later than 4:30 p.m. on 14th October 2020.

CLOSURE OF REGISTER OF MEMBERS

The register of members of the Company will be closed from 18th September 2020 to 22nd September 2020, both days inclusive, during which period no transfer of shares will be registered. In order to qualify for the interim dividend, all share transfer documents must be accompanied with the relevant share certificates and lodged with the Branch Share Registrar at Shops 1712-1716, 17th Floor, Hopewell Centre, 183 Queen’s Road East, Wanchai, Hong Kong for registration not later than 4:30 p.m. on 17th September 2020.

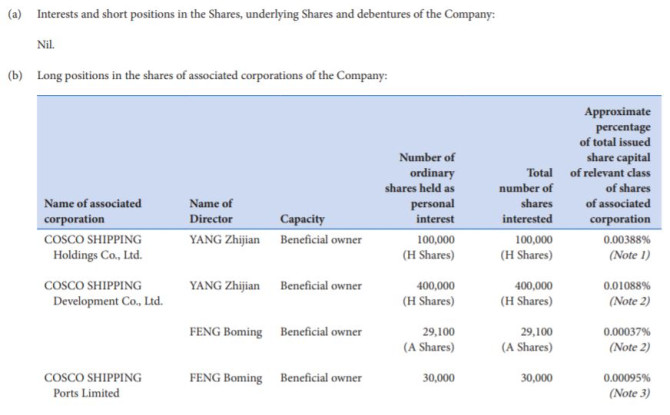

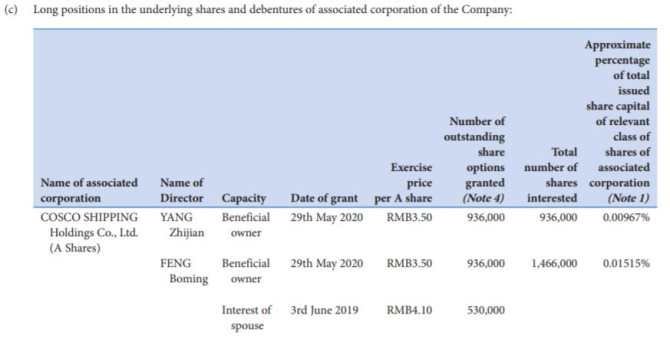

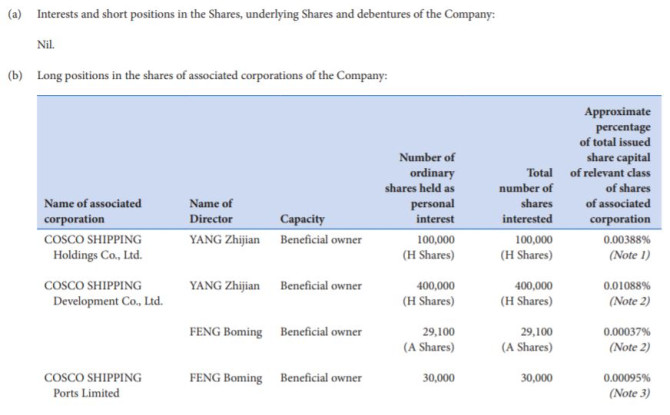

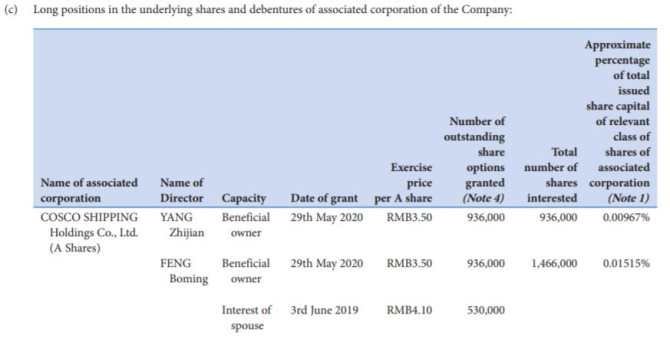

DIRECTORS’ AND CHIEF EXECUTIVE’S INTERESTS

As at 30th June 2020, the issued share capital of the Company consisted of 625,793,297 ordinary shares (the “Shares”). The interests and short positions of the Directors and the Chief Executive of the Company in the Shares, the underlying Shares and the debentures of the Company or any of its associated corporations (within the meaning of Part XV of the Securities and Futures Ordinance (“SFO”)) as recorded in the register kept by the Company pursuant to Section 352 of the SFO or otherwise notified to the Company and The Stock Exchange of Hong Kong Limited (the “Stock Exchange”) pursuant to the Model Code for Securities Transactions by Directors of Listed Issuers (the “Model Code”) contained in the Rules Governing the Listing of Securities on the Stock Exchange (the “Listing Rules”), were as follows as at 30th June 2020:–

Source: Orient Overseas International

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar