The Board presented the interim report of Jinhui Holdings Company Limited (the “Company”) and its subsidiaries (the “Group”) for the six months ended 30 June 2020.

INTERIM RESULTS

The Group’s revenue for the first half of 2020 was HK$138,250,000 whereas HK$208,913,000 was reported in the same period of 2019. The net loss attributable to shareholders of the Company for the first half of 2020 was HK$110,946,000 as compared to a net loss of HK$3,574,000 was reported in the first half of 2019. The increase in the net loss is mainly attributable to (1) poor business sentiment as affected by the outbreak of the Coronavirus Disease 2019 (“COVID-19”) pandemic leading to a reduction in chartering freight and hire revenue and decrease in fleet utilization rate; (2) the significant unrealized fair value loss on financial assets at fair value through profit or loss amid the COVID-19 pandemic that triggered an adverse global financial markets sell off in early 2020; and (3) an increase in shipping related expenses, in particular the bunker related expenses as a result of both price loss on bunker fuel on-board of the Group’s owned vessels and an increase in bunker consumption due to positioning of owned vessels in between time charter contracts of vessels. Basic loss per share for the six months ended 30 June 2020 was HK$0.209 as compared to basic loss per share of HK$0.007 for the corresponding period in 2019.

INTERIM DIVIDEND

The Board has resolved not to recommend the payment of any interim dividend for the six months ended 30 June 2020 (30/6/2019: nil).

BUSINESS REVIEW

Chartering freight and hire. The Group operates its worldwide shipping activities through Jinhui Shipping and Transportation Limited (“Jinhui Shipping”), an approximately 55.69% owned subsidiary of the Company, whose shares are listed on the Oslo Stock Exchange, Norway.

In the first half of 2020, the very unexpected and unfortunate outbreak of the COVID-19 was regarded as posing moderate public health risk to start off with, but as the velocity at which the virus spread exceeded experts’ expectations, the World Health Organization (“WHO”) declared COVID-19 outbreak as pandemic in March 2020 as it has affected initially China, then rapidly affected regionally and globally across different countries. This negative backdrop translated to much reduced demand for dry bulk commodities including iron ore, coal and certain minor bulk cargoes and impacted sentiment in the dry bulk shipping market given the sudden erosion in business confidence. The dry bulk freight market has gained some positive momentums since late May with increasing demand and limited supply of vessels due to increasing scrapping of vessels under the new IMO 2020 regulations. Baltic Dry Index (“BDI”) opened at 1,090 points at the beginning of January and closed at 1,799 points by the end of June. The average of BDI for the first half of 2020 was 685 points, which compares to 895 points in the same period in 2019.

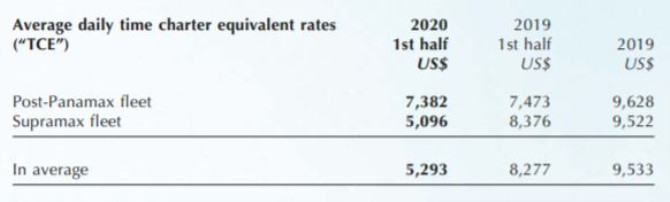

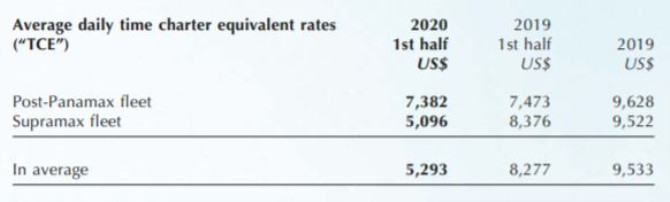

In average 5,293 8,277 9,533 Revenue from chartering freight and hire for the first half of 2020 was HK$138,250,000 representing a decrease of 34% as compared to HK$208,913,000 for the first half of 2019. The decrease was mainly due to the average daily TCE earned by the Group’s owned vessels dropped 36% to US$5,293 (approximately HK$41,000) for the first half of 2020 as compared to US$8,277 (approximately HK$65,000) for the first half of 2019.

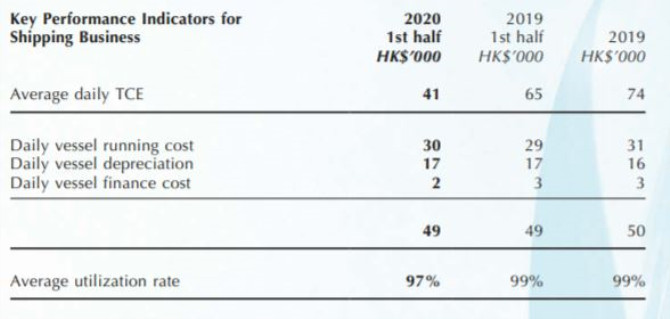

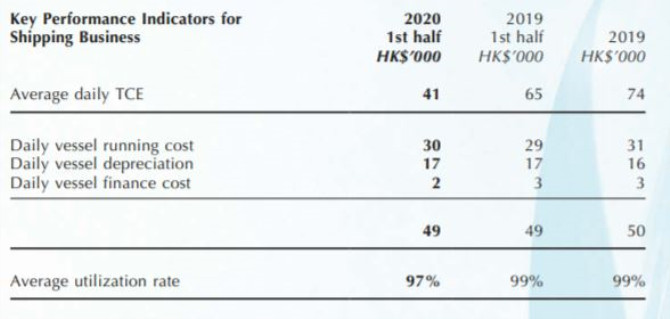

Average utilization rate 97% 99% 99% Daily vessel running cost increased 3% from US$3,709 (approximately HK$29,000) for the first half of 2019 to US$3,823 (approximately HK$30,000) for the first half of 2020. Daily vessel finance cost decreased 33% from US$445 (approximately HK$3,000) for the first half of 2019 to US$300 (approximately HK$2,000) for the first half of 2020. We will continue with our cost reduction effort, striving to maintain a highly competitive cost structure when stacked against other market participants. Fleet utilization rate decreased from 99% for the first half of 2019 to 97% for the first half of 2020.

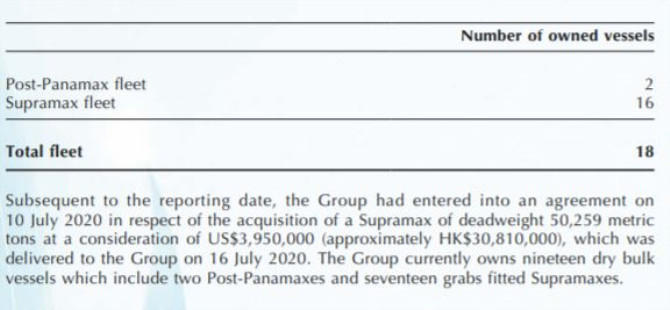

As at 30 June 2020, the Group had eighteen owned vessels as follows:

Subsequent to the reporting date, the Group had entered into an agreement on 10 July 2020 in respect of the acquisition of a Supramax of deadweight 50,259 metric tons at a consideration of US$3,950,000 (approximately HK$30,810,000), which was delivered to the Group on 16 July 2020. The Group currently owns nineteen dry bulk vessels which include two Post-Panamaxes and seventeen grabs fitted Supramaxes.

FINANCIAL REVIEW

Revenue and operating loss. Revenue from chartering freight and hire for the first half of 2020 was HK$138,250,000 representing a decrease of 34% as compared to HK$208,913,000 for the first half of 2019. The decrease was mainly due to the average daily TCE earned by the Group’s owned vessels decreased 36% to US$5,293 (approximately HK$41,000) for the first half of 2020 as compared to US$8,277 (approximately HK$65,000) for the corresponding period in 2019.

The operating loss for the first half of 2020 is mainly attributable to (1) poor business sentiment as affected by the outbreak of the COVID-19 pandemic leading to a reduction in chartering freight and hire revenue and decrease in fleet utilization rate; (2) the significant unrealized fair value loss on financial assets at fair value through profit or loss amid the COVID-19 pandemic that triggered an adverse global financial markets sell off in early 2020; and (3) an increase in shipping related expenses, in particular the bunker related expenses as a result of both price loss on bunker fuel on-board of the Group’s owned vessels and an increase in bunker consumption due to positioning of owned vessels in between time charter contracts of vessels.

The net loss attributable to shareholders of the Company for the first half of 2020 was HK$110,946,000 and HK$3,574,000 was reported for the corresponding period in 2019. Basic loss per share for the period was HK$0.209 as compared to basic loss per share of HK$0.007 for the first half of 2019.

Other operating income. Other operating income decreased from HK$47,429,000 for the first half of 2019 to HK$21,514,000 for the first half of 2020 due to no settlement income and net gain on financial assets at fair value through profit or loss were recognized in the current period. Other operating income for the first half of 2019 included net gain of HK$19,239,000 on financial assets at fair value through profit or Management Discussion and Analysis loss, settlement income of HK$4,789,000 from a charterer in relation to repudiation claims and net gain of HK$4,746,000 on disposal of assets held for sale (disposed vessel). We remain cautious with the increased volatility due to the negative effect of the US-China trade war, as well as the fluid outlook of interest rates.

Interest income for the first half of 2020 increased to HK$20,465,000, comparing to HK$12,297,000 for the first half of 2019. The increase was attributable to the interest income arising from the stable interest income generated from loan receivables which were asset-based financing that help mitigate cyclicality from core shipping business.

Shipping related expenses. Shipping related expenses for the period increased from HK$120,750,000 for the first half of 2019 to HK$167,516,000 for the first half of 2020. The increase was mainly included the bunker related expenses of HK$53 million as a result of both price loss on bunker fuel on-board of the Group’s owned vessels and an increase in bunker consumption due to positioning of owned vessels in between time charter contracts of vessels. Daily vessel running cost increased from US$3,709 (approximately HK$29,000) for the first half of 2019 to US$3,823 (approximately HK$30,000) for the first half of 2020. We will continue with our cost reduction effort, striving to maintain a highly competitive cost structure when stacked against other market participants.

Other operating expenses. Other operating expenses for the first half of 2020 increased to HK$80,398,000, comparing to HK$20,734,000 for the first half of 2019. The increase was mainly due to the net loss of HK$60,209,000 on financial assets at fair value through profit or loss (30/6/2019: net gain of HK$19,239,000 on financial assets at fair value through profit or loss included in other operating income). Other operating expenses for the period also comprised of professional fee of approximately HK$3.9 million, directors’ fee of approximately HK$3.3 million, auditor’s remuneration related to audit services of approximately HK$0.8 million and remaining are various office administrative expenses.

Finance costs dropped from HK$18,565,000 for the first half of 2019 to HK$17,530,000 for the first half of 2020. The decrease was mainly attributable to the decrease in interest rate as compared with that of the corresponding period in 2019.

Financial assets at fair value through profit or loss. As at 30 June 2020, the Group’s portfolio of investment in financial assets at fair value through profit or loss was HK$308,809,000 (31/12/2019: HK$510,605,000), in which HK$236,559,000 (31/12/2019: HK$334,833,000) was investment in listed equity securities, HK$70,449,000 (31/12/2019: HK$175,772,000) was investment in listed debt securities and HK$1,801,000 was investment in investment funds (31/12/2019: nil).

During the first half of 2020, the Group’s net loss on financial assets at fair value through profit or loss was HK$60,209,000 (30/6/2019: net gain of HK$19,239,000 on financial assets at fair value through profit or loss) and the aggregate interest income and dividend income from financial assets was HK$26,088,000 (30/6/2019: Management Discussion and Analysis HK$18,590,000). We remain cautious with the increased volatility in global financial markets due to the negative effect of the geopolitical tensions, the recent outbreak of COVID-19 across different regions, as well as the fluid outlook of interest rates.

Loan receivables. As at 30 June 2020, the Group’s loan receivables was HK$331,713,000 (31/12/2019: HK$350,500,000). The Group’s loan receivables, which arise from asset-based financing are denominated in United States Dollars and are secured by collaterals provided by the borrowers, bear interest ranged from 8% to 10% per annum and are repayable with fixed terms agreed with the borrowers. At the reporting date, these receivables have been reviewed by management to assess impairment allowances which are based on the evaluation of current creditworthiness and the collection statistics, and are not considered as impaired.However, due to the slight decrease in market values of collateral vessels, we requested top-up repayment of loans in June 2020 in accordance with the facility agreements and such top-up repayments would lead to an increase in current portion of loan receivables.The carrying amount of these loan receivables are considered to be a reasonable approximation of their fair values.

Trade and other payables. As at 30 June 2020, the Group’s trade and other payables was HK$147,073,000 (31/12/2019: HK$153,891,000), including trade payables of HK$2,584,000 (31/12/2019: HK$2,844,000), accrued charges of HK$10,121,000 (31/12/2019: HK$7,223,000) and other payables of HK$134,368,000 (31/12/2019: HK$143,824,000). Other payables mainly included payables related to vessel running cost and ship operating expenses of HK$123,635,000 (31/12/2019: HK$131,122,000) for owned vessels, hire receipt in advance of HK$3,926,000 (31/12/2019: HK$3,369,000) from charterers, loan interest payables of HK$2,065,000 (31/12/2019: HK$2,775,000) and accrued employee benefits payables of HK$1,581,000 (31/12/2019: HK$4,343,000).

Liquidity, financial resources and capital structure. As at 30 June 2020, the Group maintained positive working capital position of HK$43,428,000 (31/12/2019: HK$211,986,000) and the total of the Group’s equity and debt securities, bank balances and cash decreased to HK$593,893,000 (31/12/2019: HK$808,308,000). During the first half of 2020, cash used in operations before changes in working capital was HK$140,800,000 (30/6/2019: cash generated from operations before changes in working capital was HK$56,914,000) and the net cash generated from operating activities after working capital changes was HK$70,843,000 (30/6/2019: net cash used in operating activities after working capital changes was HK$262,523,000).The changes in working capital are mainly attributable to the decrease in equity and debt securities, and loan receivables in respect of the six facility agreements.

The Group's total secured bank loans decreased from HK$1,188,193,000 as of 31 December 2019 to HK$1,090,961,000 as at 30 June 2020, of which 56%, 11% and 33% are repayable respectively within one year, one to two years and two to five years. During the period, the Group had drawn new revolving loans and term loans of HK$149,079,000 (30/6/2019: HK$402,268,000) and repaid HK$246,311,000 Management Discussion and Analysis

(30/6/2019: HK$164,778,000). The bank borrowings represented vessel mortgage loans that were denominated in United States Dollars, revolving loans, term loans and property mortgage loans that were denominated in Hong Kong Dollars and United States Dollars. All bank borrowings were committed on floating rate basis.

The gearing ratio, as calculated on the basis of net debts (total interest-bearing debts net of equity and debt securities, bank balances and cash) over total equity, increased to 26% (31/12/2019: 18%) as at 30 June 2020. With cash, marketable equity and debt securities in hand as well as available credit facilities, the Group has sufficient financial resources to satisfy its commitments and working capital requirements. As at 30 June 2020, the Group is able to service its debt obligations, including principal and interest payments.

Pledge of assets. As at 30 June 2020, the Group’s property, plant and equipment with an aggregate net book value of HK$1,587,499,000 (31/12/2019: HK$1,619,289,000), investment properties with an aggregate carrying amount of HK$371,500,000 (31/12/2019: HK$371,500,000), financial assets at fair value through profit or loss of HK$219,644,000 (31/12/2019: HK$432,340,000) and deposits of HK$40,378,000 (31/12/2019: HK$65,810,000) placed with banks were pledged together with the assignment of twenty (31/12/2019: twenty) subsidiaries’ income and assignment of two (31/12/2019: two) subsidiaries’ loan receivables of HK$300,513,000 (31/12/2019:HK$319,300,000) to secure credit facilities utilized by the Group. In addition, shares of ten (31/12/2019: ten) ship owning subsidiaries were pledged to banks for vessel mortgage loans.

Capital expenditures and commitments. During the six months ended 30 June 2020, capital expenditure on additions of motor vessels and capitalized drydocking costs was HK$27,454,000 (30/6/2019: HK$55,869,000) and on other property, plant and equipment was HK$18,000 (30/6/2019: HK$1,326,000). During the six months ended 30 June 2019, capital expenditure on additions of investment properties was HK$33,773,000.

On 20 April 2018, an approximately 55.69% indirectly owned subsidiary of the Company (the “Co-Investor”) entered into the co-investment documents to co-invest in a property project in Tower A of One Financial Street Center, Jing’an Central Business District, Shanghai, the PRC (the “Tower A” or previously named as “T3 Property”), pursuant to which the Co-Investor committed to acquire non-voting participating class A shares of Dual Bliss Limited (“Dual Bliss”), the holding company of the co-investment vehicle, of US$10,000,000 (approximately HK$78,000,000). During the first half of 2020, the Co-Investor paid US$1,420,000, approximately HK$11,071,000 (30/6/2019: US$2,678,000, approximately HK$20,884,000) in accordance with the terms and conditions of the co-investment documents and as at the reporting date, the capital expenditure commitments contracted by the Group but not provided for was US$1,075,000, approximately HK$8,393,000 (31/12/2019: US$2,495,000, approximately HK$19,464,000). The Co-Investor further provided additional US$4,276,915, approximately HK$33,360,000 (30/6/2019: nil) as co-investment supplemental capital call in early February 2020 pursuant to a supplemental memorandum signed on 31 January 2020 for acquiring 4,276,915 issued non-voting participating class A shares of Dual Bliss (the “Co-Investment Supplemental Capital Call”). In March 2020, the Co-Investor received a total of US$4,276,915 (approximatelyHK$33,360,000) under the share repurchase scheme, and those 4,276,915 issued non-voting participating class A shares of Dual Bliss under the Co-Investment Supplemental Capital Call had been repurchased and cancelled.

The Co-Investor received updates from Phoenix Property Investors Limited (the “Investment Manager”) in May 2020 in relation to the status of the co-investment as announced by the Company on 28 May 2020. Due to unexpected COVID-19pandemic that has broadly affected different economic sectors, the Investment Manager advised the Co-Investor on 21 August 2020 that the vendor of Tower A has agreed on the extension of the closing of the acquisition to November 2020. We will update all shareholders of the Company on the significant investment update timely and accordingly.

SIGNIFICANT INVESTMENT

The Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (“Listing Rules”) have now been extended to also require companies to disclose the details of each significant securities investment that represents 5% or more of their total assets.

As at 30 June 2020, the Group had investments in listed equity and debt securities with fair value of HK$236,559,000 and HK$70,449,000 respectively. The principal activities of these companies include mainly banking groups that provide money lending and financial services; securities trading and investment; property development and investment; shipping and transportation, provision of value-added services and online advertising services to users in the PRC. As at 30 June 2020, the fair value of each of these equity securities and debt securities represented less than 5% of the total assets and net assets of the Group.

As at 30 June 2020, the Group’s investment properties were stated at fair value of HK$418 million and comprised of premises and car parks held under operating leases to earn rentals or held for capital appreciation, or both. These premises and car parks are held under long term leases and located in Hong Kong. As at 30 June 2020, the fair value of each of these investment properties represented less than 5% of the total assets and net assets of the Group.

As at 30 June 2020, the Group did not hold any significant investment or investment properties that accounted for more than 5% of the Group’s total assets and net assets as at 30 June 2020, nor did the Group carry out any material acquisition and disposal during the first half of 2020.

EMPLOYEES AND REMUNERATION POLICY

As at 30 June 2020, the Group had 67 (31/12/2019: 67) full-time employees. The Group remunerates its employees in accordance with their performances, experiences and prevailing market practices and provides them with usual fringe benefits including medical insurance and contributions to provident funds. Share options and bonuses are also available to employees of the Group at the discretion of the Directors and depending upon the financial performance of the Group.

RISK FACTORS

This report may contain forward looking statements. These statements are based upon various assumptions, many of which are based, in turn, upon further assumptions, including the Company’s management’s examination of historical operating trends.

Although the Company believes that these assumptions were reasonable when made, because assumptions are inherently subject to significant uncertainties which are difficult or impossible to predict and are beyond its control, the Company cannot give assurance that it will achieve or accomplish these expectations, beliefs or targets.

Key risk factors that could cause actual results to differ materially from those discussed in this report will include but not limited to the way world economies, currencies and interest rate environment may evolve going forward, general market conditions including fluctuations in charter rates and vessel values, financial market conditions including fluctuations in marketable securities value, counterparty risk, changes in demand in the dry bulk market, changes in operating expenses including bunker prices, crewing costs, drydocking and insurance costs, availability of financing and refinancing, inability to obtain restructuring or rescheduling of indebtedness from lenders in liquidity trough, changes in governmental rules and regulations or actions taken by regulatory authorities, potential liability from pending or future litigation, general domestic and international political conditions, potential disruption of shipping routes due to accidents, piracy or political events, and other important factors described from time to time in the reports filed by the Company.

OUTLOOK

The freight market in the first half of 2020 has been challenging due to a slowdown in global economic activity, which was further amplified by the COVID-19 global pandemic.

The global public health concern worldwide means market participants of all industries have been very nervous. This negative backdrop translated to much reduced activity in the dry bulk shipping market given the sudden erosion in business confidence.

The relaxation of national lockdowns and other measures to contain the spread of the virus has begun in some countries, the route to a full reversion to normality will be rocky, but we remain confident that we will overcome this challenge collectively with economic activity to slowly recover going forward.

On a positive note, we have been vigilant on this front as a company in making sure our operations, as well as our colleagues at shore or at sea are in no way negatively affected by the COVID-19. We have adopted policies to ensure all our colleagues are healthy and remain positive in order to take action as soon as the market conditions pick up. In particular crew changing has been a challenge during these times and we would like to express special thanks to all crew on board of our ships for their patience and understanding. We are cautiously optimistic that business activity will resume sooner than later, as governments and public health authorities around the world gain increased control over the spread of the COVID-19 in the coming days.

China is the biggest importer of raw materials by far given its important role in the global manufacturing supply chain. We remain cautiously optimistic that business and industrial activity will continue to pick up in China. We continue to see people heading back to work in orderly batches, with exceptionally high alert in public hygiene and the necessary protocols in place at work places. We hope this resumption to work in an orderly fashion will continue without too much new negative surprises, and hence global trade will begin to revert to normal albeit we wish at a higher speed.

While we have full confidence in mankind’s capacity to respond to events and shape their futures for the better, we have to be mindful that increasingly frequent economic, political, or other unforeseen surprises can introduce volatility to our business performance, as well as the carrying value of our shipping assets and financial assets.

We currently have no capital expenditure commitment in relation to newbuilding contracts, as well as no charter-in contracts at this juncture, and will continue to focus on taking sensible and decisive actions to maintain a strong financial position.

On behalf of the Board of Directors of the Company, I would like to express our heartfelt appreciation to all customers and stakeholders for their ongoing support.

Source:Jinhui Holdings Company Limited

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar