The US is set to consider tightening sanctions on Venezuela at the end of October. This would aim to put a stop to the limited activity that is still happening, primarily with European and Asian buyers. Tensions have also been on the rise in the Middle East Gulf after US seizures of Iranian oil that was headed to Venezuela – which has also brought an increased focused on ships turning off their AIS locators when loading fuel in Iran, as well as ship-to-ship transfers.

In contrast to the other major shipping sectors, the crude oil tanker sector has seen very little demolition in the first six months of the year. In fact, only seven crude oil tankers were demolished in the first eight months of 2020, totalling 681,832 dead weight tonnes (DWT).

Year to date, no VLCCs have been demolished, while 26 were delivered, resulting in the VLCC fleet growing by 7.9m DWT. This is on top of the 68 VLCCs delivered in 2019, which led to the VLCC fleet growing by 8.6%. The last VLCC to be demolished was in June 2019, with only four having been demolished since October 2018.

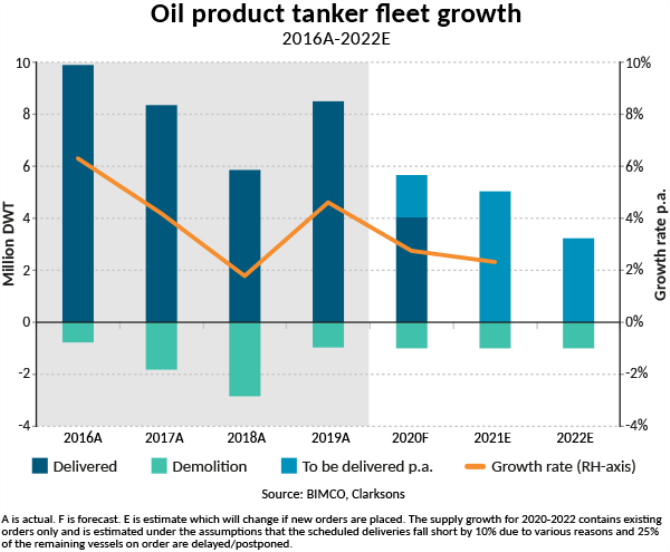

BIMCO expects demolition activity to rise as freight rates and actual demand for tanker shipping falls, with total crude oil demolition coming to 7.5m DWT in the full year and 1m DWT of product tankers being demolished. So far this year, 547,334 DWT of oil-product tankers have been removed.

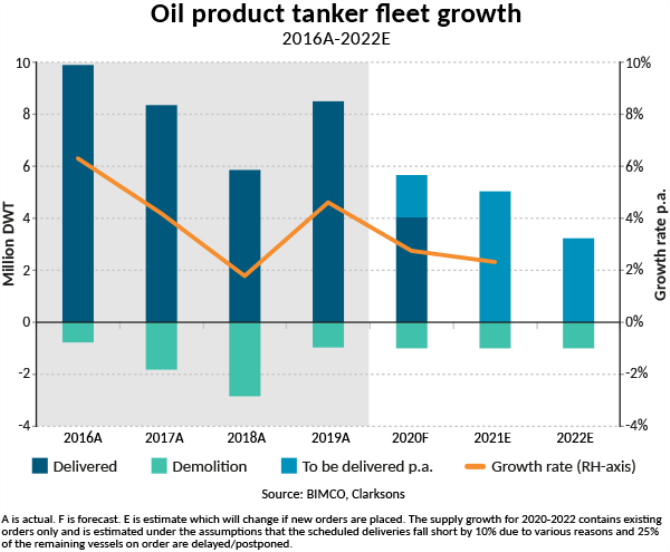

Over the full year, BIMCO expects that the oil product tanker fleet will grow by 2.7% and the crude oil tanker fleet by 2.4%. This represents a marked slowdown from last year, when they grew by 4.6% and 6.2% respectively. Total tanker deliveries have totalled 16.2m DWT so far this year, a 43.9% drop from last year.

This slowdown in fleet growth will continue in the coming years, as the pandemic has lowered contracting activity. Contracting for crude oil tankers has fallen by 37.9% so far this year compared with last. At 4.1m DWT, product tankers is the only segment in which there have been more new orders in the first eight months of this year than the same period of last year (+31.9%). Ten of these orders are for a series of 50,000 MR tankers placed by Bahri.

The lower contracting activity fits with the poorer outlook, which is also reflected in the value of second-hand tankers. Prices for 10-year-old VLCCs and LR2s both fell by 19.2% and 18.4% respectively from the start of the year to late-August. A new VLCC is worth 7.5% less now than at the start of the year, and the value of an LR2 has fallen by 1.7% – drops of USD 7.35m and USD 0.86m respectively.

Outlook

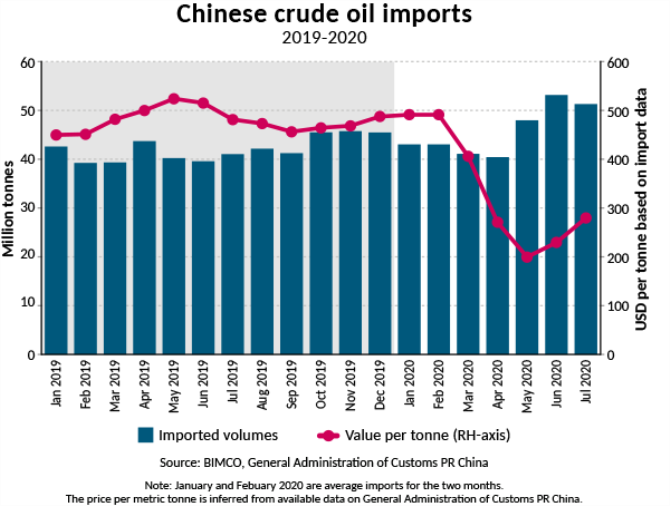

Despite tensions between the US and China ratcheting up in previous months, there was progress made on the Phase One trade agreement, with record-high US crude oil exports to China in May, when 5.1m tonnes was exported. China remained the largest destination for US seaborne crude oil exports in June, even as exports halved. Whether or not China continues to make these higher purchases of US crude oil remains to be seen, with any that are made providing a good boost to the crude oil tanker shipping market, given the long sailing distance between the loading and discharging ports.

Despite the strong purchases in May and June, however, China remains far behind on its commitments under the Phase One agreement. Because the agreement is made in value rather than volume, the recent drop in oil price has made it even harder to achieve than previously, although it would provide an even bigger increase in demand for shipping were China to meet its commitments. A six-month review of the deal, originally scheduled for mid-August, has been postponed, with no new date set, highlighting the tensions between the two countries.

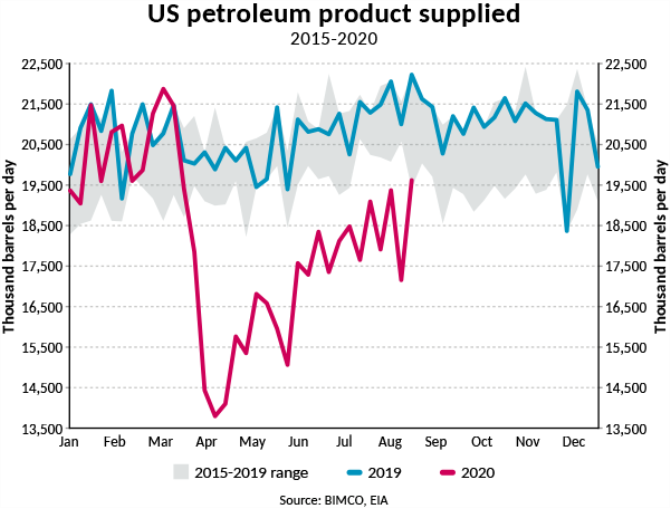

The question of when demand will return to pre-pandemic levels remains clouded in uncertainty as the virus continues to spread. Travel restrictions remain complicated and demand for global travel is still abated. Land-based transportation has had a stronger recovery than air transport, but it remains lower than this time last year.

The EIA doesn’t expect global oil demand to return to pre-pandemic levels in 2021; instead, it sees demand rising to 100.17m bpd in 2021 (in 2019 it was 101.25m bpd). As it looks now, 2022 seems to be the year in which volumes will have recovered.

The loss of several years’ growth in global demand for oil – and, therefore, for tanker shipping – will lead to a worsening of the fundamental balance in the market. Though fleet growth will be lower, as a result of the drop in contracting during the pandemic and the poorer outlook in the coming years, the fleet will continue to grow year on year.

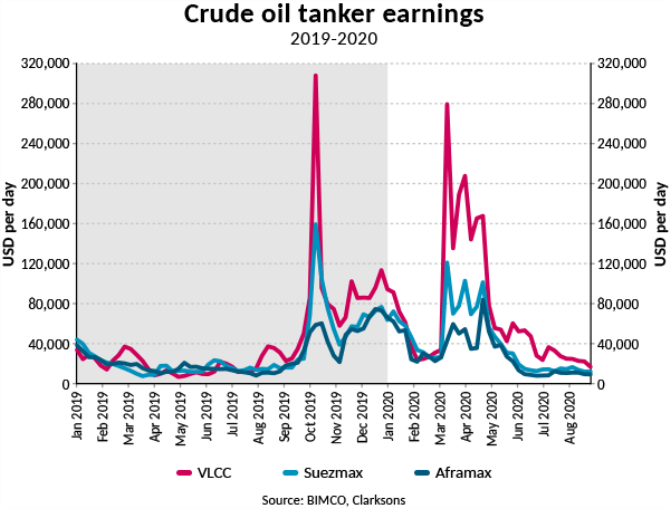

For the remainder of this year, the tanker shipping industry will find itself paying for the highs it reached in the second quarter. The higher demand for shipping at the time was not because of higher immediate consumption, but because of future demand being brought forward as importing refiners sought to benefit from the lower price.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar