Huge stimulus packages have so far been enough to prop up some parts of the economy. However, these are not magic pills, and, with the virus still spreading, a global recovery is some way off.

Overview

Many nations across the world recorded their largest recorded drops in economic activity in the second quarter of the year. Many had double-digit drops and some saw more than a fifth of their economy disappear. For many of these countries, the large Q2 gross domestic product (GDP) drops came after smaller contractions in Q1 – which, combined, has left large parts of the world in a recession.

Even as the pandemic continues to spread at an elevated rate, and a trusted vaccine appears months – if not years – away, most governments have eased their containment measures and are using a more local approach to target flare-ups over the summer. Because of this, even if the outbreak continues to spread, Q2 is likely to have been the quarter in which economies were most affected by the pandemic, as many workers have since returned to factories and consumers to shops and restaurants. The recovery will not be spectacular, however, given the public health restrictions still in place, greater uncertainty and higher unemployment.

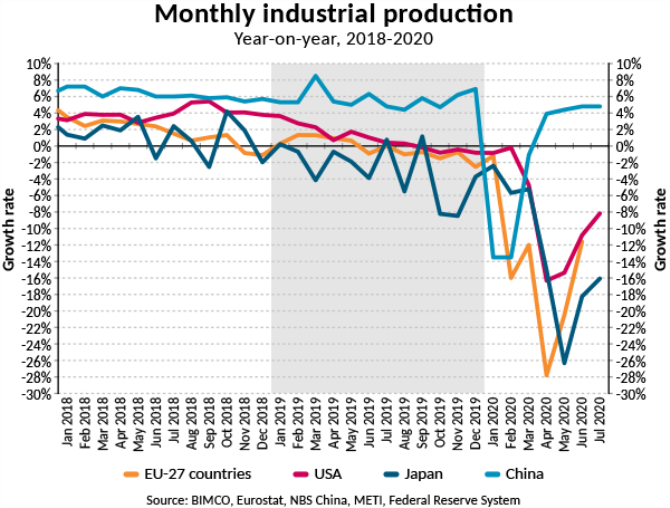

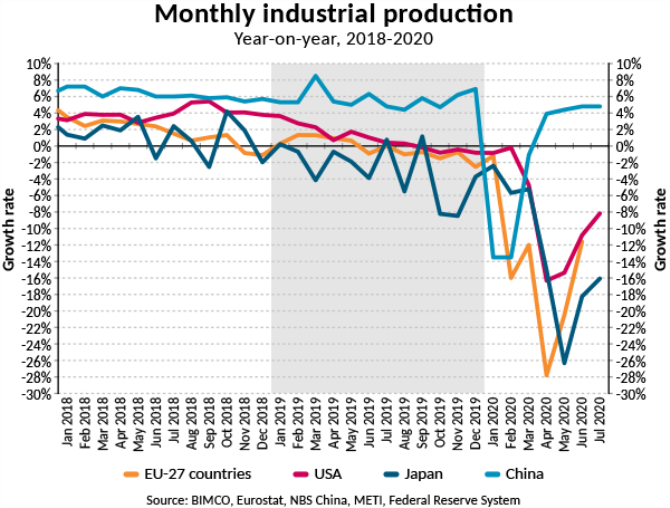

China bucks the global trend; having locked down earlier than other countries, it saw a faster return to growth. It is the only major economy seeing growth in its industrial production compared to last year. Others – such as the EU, the US and Japan – are, to July, still experiencing double-digit drops in industrial production compared to last year.

A continued recovery in production and a return to the pre-pandemic trend is probably not on the cards until consumption returns to its previous levels, which is still a long way off given the higher uncertainty and many government support schemes for workers ending. In the US, the extra payments of USD 600 a week for the unemployed ended at the end of July and many European governments are easing their furlough schemes.

Europe

Overall, the EU economy fell by 14.1% in the second quarter of the year compared with the same quarter last year. Spain was the worst-affected European economy, with a 22.1% drop in GDP. France and Italy take the runners-up spots, with declines of 19% and 17.3%. These economies also experienced the worst outbreaks of coronavirus in the EU, as well as some of the strictest lockdowns.

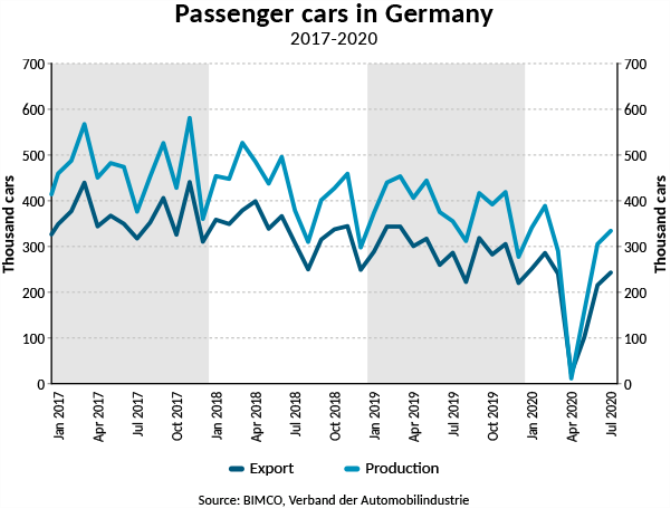

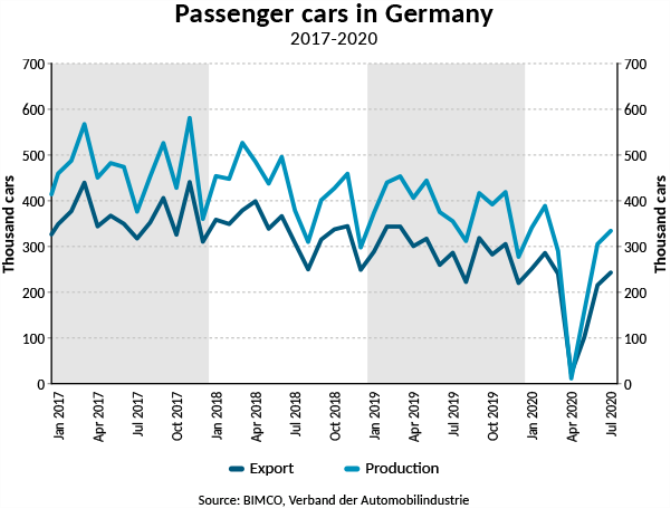

Across the EU, many industries that provide demand for shipping have been hard hit. One of the largest of these is the German car industry, which was brought to its knees in April, when only 11,287 cars were produced, a 97.2% drop from April 2019. The easing of restrictions since then has resulted in car production rising to 334,000 cars in July, though this still leaves accumulated production down by 35.8% in July (source: VDA). This comes after three consecutive years of declining car production in Germany because of new environmental regulations, a slowing economy, and the US-China trade war. In 2019, the lowest number of cars was produced since 1997. The German car industry’s importance to EU manufacturing is illustrated by the European manufacturing PMI falling month on month since December 2017.

Now out of the EU, the UK experienced a 21.7% drop in its economy in Q2. Services fell by 21.2% from a year ago, but, more importantly for shipping, total production is down 18.8%, with manufacturing suffering a 22% drop. The construction sector has also been hard hit and is down 36.4% from Q2 2019. Though the data showed a slight recovery in June, as restrictions eased, the economic activity generated remained one-sixth smaller than it had been in February.

Better news for shipping could be found in July, when the eurozone manufacturing PMI posted its first reading above 50 (51.8) in a year and a half. Month on month growth was registered in output as well as new orders. However, employment continued its decline, with cost cutting still in focus as manufacturing remains stuck far below pre-pandemic levels, and the outlook is bleak.

US

The world’s largest economy is also suffering the largest COVID-19 outbreak. Its GDP fell by 9.5% in the second quarter of the year compared with last year. As in other countries, despite a 10.1% increase in personal income (driven upwards by an 80% rise in income payments by the government, in particular the Economic Impact Payment), personal consumption expenditure fell by 10.7%. Exports were down 23.7% from last year and imports fell by 22.1%. The latter development was especially felt by container lines trans-Pacific, as well as trans-Atlantic.

The worsening COVID-19 outbreak in the US has stalled the number of passengers flying, which had previously been increasing from its low point at the height of the crisis. Having bottomed out at just 87,534 passengers per day in mid-April, numbers have since stabilised at a higher level and stood at 721,060 on 27 August. This is still far below the 2.6 million passengers (-71.8%) on the equivalent day last year and, with the virus still spreading fast – and travel restrictions in place between states, as well as internationally – a further increase will have to wait until the coronavirus is under control.

The collapse in flight passenger numbers shows the impact the crisis has had on the demand for jet fuel, an important commodity for the product tanker shipping industry.

Asia

As many economies faced record-breaking contractions in Q2, China – which was affected by the pandemic much earlier than the rest of the world – showed more positive signs. After a 6.8% drop in the first quarter compared with Q1 2019, the Chinese economy grew by 3.2% compared with Q2 2019, indicating a return to growth, though below the 6% China had been used to.

Part of this growth is because of the broad range of stimulus measures that the Chinese government has launched with the aim of keeping the economy going and ensuring continued employment. These include an RMB 1tn rise in government spending and a RMB 2.6tn increase in bonds being issued to local governments.

The recovery has, however, been uneven, as infrastructure investments and industrial production have proven easier for the government to boost than consumer spending. Industrial production has been posting monthly increases since April, though growth in July of 4.8% was not quite enough to bring accumulated year on year growth rate into positive, it is still down by 0.4%.

On the consumption side, though, total retail sales of consumer goods have fallen every month compared with last year, with July down 1.1% from July 2019 and accumulated sales down 9.9% in the first seven months of the year.

All Asian export nations will see a ‘double dip’ as lower export orders bring down their earlier recovery. The delay from the pandemic means that, while some of Asia is reopening, they are economically limping, as many of their trading partners are still in economic crisis.

Japan, already in a recession before the pandemic really hit, has also seen its economy badly hurt, despite an effective response to the virus. Stimulus measures have been considerable and wide-ranging, and yet, even as the unemployment rate remained low through the crises (<3% in May) and workers’ disposable income rose (+13.4% from May 2019) – both held up by government stimulus measures – consumer spending fell. Consumers are well aware that the government transfers are temporary, so they were more likely to hold on to the extra money than go on a spending spree.

As well as lower domestic spending, Japan is heavily dependent on foreign demand. A recovery in China boosts demand from Japan’s biggest export market, but a true pick-up can only occur once there is a sustained recovery in the US and other major consuming nations.

The major trading hubs of Singapore and Hong Kong saw their economies shrink by 13.2% and 9% respectively in Q2. Both are heavily reliant on the global economy and trade performing strongly, which is not currently the case.

India is facing a rapid increase in coronavirus cases and, with the severity of lockdown measures varying by state, a recovery in the whole economy still appears a way off. In June, the International Monetary Fund forecast a 4.5% fall in Indian GDP in 2020 – though, with the pandemic still raging, this is now a best-case scenario.

Outlook

In many of the world’s major economies, spending power has remained stable or even increased over the course of the pandemic, primarily as a result of the massive stimulus measures put in place by many governments. This increase in spending power did not result in higher consumption, however, because of uncertainty and the fear of unemployment among consumers.

Now, with lockdown measures eased and many countries reopening (locally, not internationally), governments are looking to end these very expensive measures, which means more people facing job losses and/or lower unemployment benefits. This is likely to lower consumption even further and cause more pain to a container industry already struggling with low volumes, though still making money.

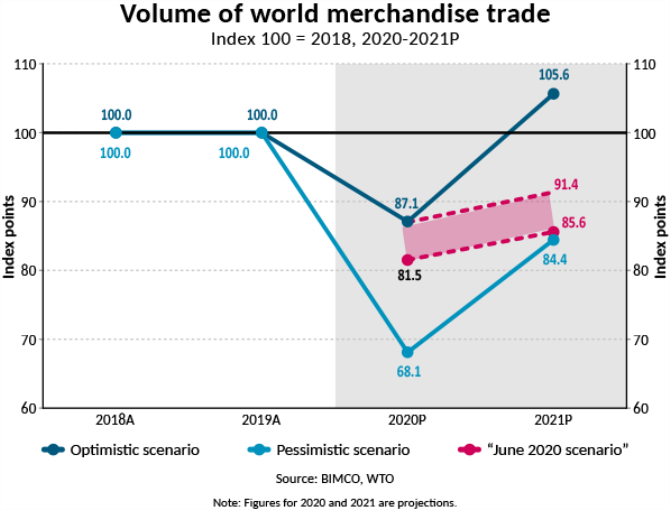

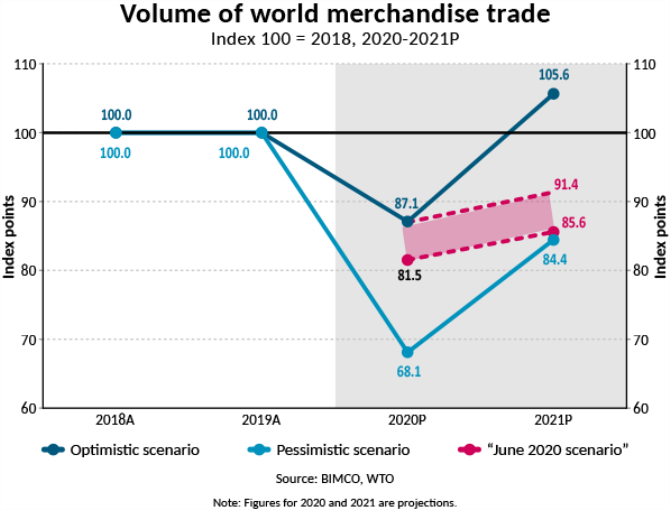

The World Trade Organization (WTO) estimates that world merchandise trade fell by 18.5% in the second quarter of the year and it expects a full-year drop of 13%, much less than the 32% drop under its original, pessimistic, scenario.

For growth to return to its pre-pandemic level, however, growth of around 20% is needed in 2021. Continued and coordinated stimulus and trade policies would have to be put in place for this to happen, which is not currently the case. The slower recovery means the WTO forecasts trade growth as low as 5% in 2021, leaving 2021 GDP between 9% and 14% lower than in 2019.

The pandemic has made many countries and governments look inwards, and turn their backs on their dependencies, both for imports of key goods and exports to support their own economies. China is a prime example of the latter. Here, while production is increasing – as shown by the latest PMI readings all posting above the threshold of 50 (which signals a month-on-month expansion) – its new export orders index continues to contract, holding back its recovery.

In recent years, China has already been trying to rebalance its economy so that it can rely more on domestic demand. Between 2006 and 2019, the share of GDP attributable to imports and exports fell from 64% to 32%. This trend is likely to continue in the wake of the pandemic as the Chinese government focuses on getting its own economy growing strongly again, rather than having to wait for the rest of the world to catch up.

Changing trade patterns – as a result of increased awareness of the vulnerability of supply chains, as well as economies’ interdependence – is something shipping will most probably have to adapt to in the coming years. The scale of this could be huge. The McKinsey Global Institute estimates that 16-26% of global trade could be relocated in the medium term. This would involve some combination of a return to domestic production, near-shoring and shifting to other offshore locations, with a new balance having to be found between just in time and just in case.

Source:BIMCO

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar