The index developed by Shanghai Shipping Exchange has been there since 2009 and has been recognized by the related industries, and many would hedge the freight risks by buying or selling this particular freight index. Also freight traders would like to speculate the freight derivatives like doing WTI or Brent futures.

But that index was assessed on the quoted freight rates offered to shippers at the time of cargo booking by different shipping lines, freight forwarders on the panel. There could be some variations and cancellations or sudden changes afterwards due to circumstances, though the Exchange has been trying hard to keep the index as correct as possible.

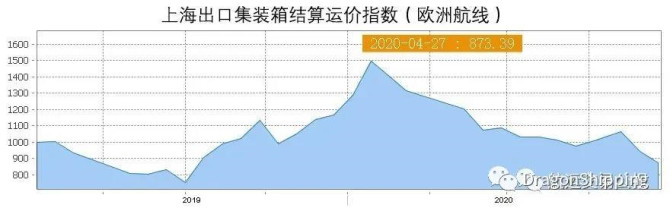

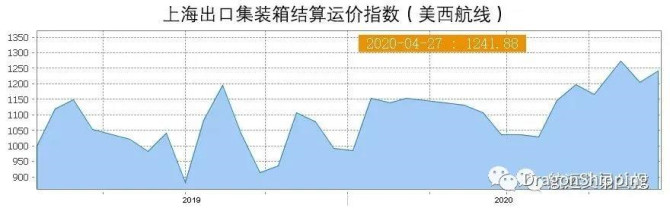

Now the index are being calculated based on settlement freight rates which were used to settle the outstanding freights and related surcharges with shippers, after the ships sailed.

The freights reported to the Exchange are all truly 'settled' prices and sent over automatically via the integrated computer system by the panel members.

April 27th 2020 was the first day of the switch of this settlement index, should be called SCFI- Settlement.

27 th April, Index 873.39 Shanghai-Europe

Shanghai- West Coast America 1,241.88

Note Base 1000 6 Sept 2019

The Index has been accepted by FMC in 2013 to register the freight liners’ index-link freight and also been quoted by many as leading economic indicator.

China handled 261 million TEU last year as China has become the most important section of the world supply chain. Shanghai is definitely the leading port which did 43.3 million TEU in 2019.

Source:DragonShipping

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar