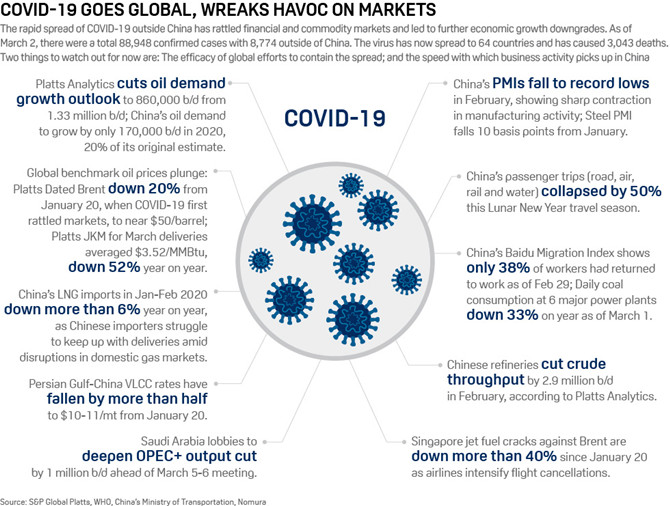

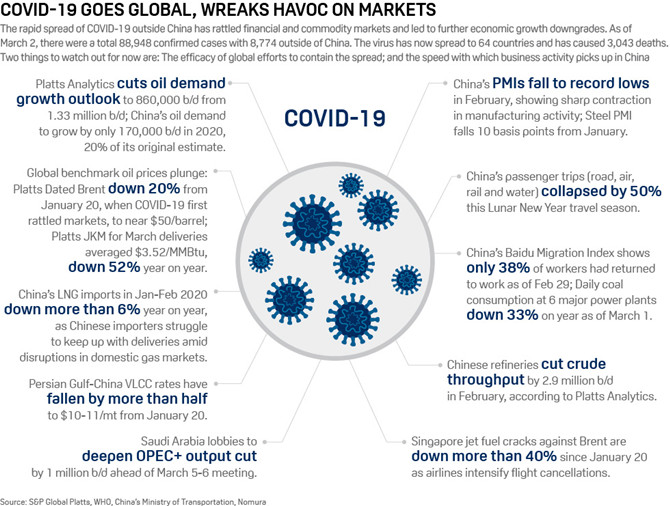

Oil demand is set to contract in 2020 as the coronavirus outbreak widened to 72 countries outside China as of Wednesday, threatening to put more pressure on the global economy and fuel demand, according to analyst projections this week.

This is notable because oil demand has consistently increased every year for several decades, with the exception of a few occasions like the early 1990s recession. A contraction in oil demand in 2020 will be the first decline since the financial crisis of 2008-2009.

“Over the last week, the situation has worsened with outbreaks now in a number of additional countries,” Goldman Sachs analyst Damien Courvalin said in a report dated March 3.

“We therefore reduce further our global oil demand growth forecasts to minus 0.15 million b/d in 2020 from 0.55 million b/d previously (and 1.1 million b/d before the coronavirus), its lowest annual growth rate since the financial crisis of 08/09,” Courvalin added.

He said the revisions were entirely outside China given the bank’s aggressive cuts made initially to China’s oil demand growth, the sharp slowdown in new coronavirus cases in China and steady but slow signs of recovery in domestic activity.

Goldman Sachs expects a global oil demand loss of 2.1 million b/d in the first half of the year alone, and cut its oil price forecasts, expecting Brent to trough in April at $45/b before gradually recovering to $60/b by the end of the year. It earlier expected a $53/b trough and a recovery to $65/b.

Separately, energy consulting firm Facts Global Energy said it expects global oil demand to contract by 220,000 b/d on average in 2020, “with strong risks still on the downside we believe, despite a major initiative now for a global economic stimulus.”

“Global oil demand is now expected to contract by 2.3 million b/d year on year in the first quarter of 2020, before only returning to year-on-year growth in the third quarter of 2020,” FGE said. It had slashed its oil demand growth forecast to zero for 2020 last month.

“The source of oil demand in its essence is very simple: producing things and moving things/people. If, as is happening now, production lines slow down or even stand still and global trade and travel stops, oil demand stops growing as well,” FGE said.

Global economy slows

S&P Global Ratings said on Tuesday that the global macro impact of COVID-19 had doubled since mid-February and cut its 3.3% GDP growth baseline by 0.5 percentage points, assuming the epidemic subsides in the second quarter.

“We now estimate that China’s 2020 GDP growth could be lower by 0.9 percentage points to 4.8% this year; and the euro-area by 0.5 percentage points, and Italy by about 0.7 percentage points. Growth in the more-insulated US economy is expected to be lower by 0.3 percentage points,” it said in a report.

“The virus has now gone global. It is no longer just an issue for China and its closest economic partners, and no longer mainly a supply chain issue. Both supply and demand effects are in play, and both are being amplified by tightening financial conditions,” Ratings added.

“Even though the virus’s spread appears to have peaked in China, what we have seen recently is an acceleration outside China,” said Kang Wu, head of S&P Global Platts Asia Analytics.

“Under these circumstances, Platts Analytics expects global oil demand growth to move away from the best-case scenario and come a step closer to our worst-case scenario of 320,000 b/d, though we are not there yet,” Wu said.

FGE said the COVID-19 crisis can develop as either a short-term crisis with less damage to the global economy and a rebound in oil demand from the third quarter, or a long-term crisis that severely impacts global GDP with a prolonged oil demand recovery.

“Our current outlook is more similar to the short-lived price shock in 1990 rather than the global economic crisis a decade ago. In order to become a longer demand shock, the impact on GDP would need to be more severe,” it added.

Source:Platts

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

admin@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar