The implementation of the International Maritime Organisation (IMO) 2020 regulation from 1 January 2020 is likely to lead to higher operating costs and/or capex for shipping companies. We do not expect the companies to be able to fully pass all the associated costs on to customers due to their limited bargaining power in a market plagued by overcapacity. Tanker shipping companies may benefit from higher demand for low-sulphur fuels, which should help them offset higher compliance costs with the regulation. IMO 2020 provides for limiting sulphur content in marine fuels to 0.5% from 3.5%.

There is an even stricter limit of 0.1% already in effect in the so-called emission control areas, for example, the Baltic Sea and the North Sea area. The compliance can be achieved through the use of low-sulphur fuels, installation of abatement technology (scrubbers) or use of alternative fuels, such as LNG, methanol and others. We anticipate that most companies will comply with the sulphur cap by using low-sulphur fuels, which are more expensive than high-sulphur fuels. AP Moeller-Maersk estimates its bunker cost could increase by more than USD2 billion. Scrubber technology and the use of alternative fuels are part of IMO 2020 compliance strategy but to a limited extent as they require upfront capex either for scrubber installation or purchase of new LNG-fuelled vessels and developed LNG bunkering infrastructure. CMA CGM plans to use LNG to power 20 vessels by 2022.

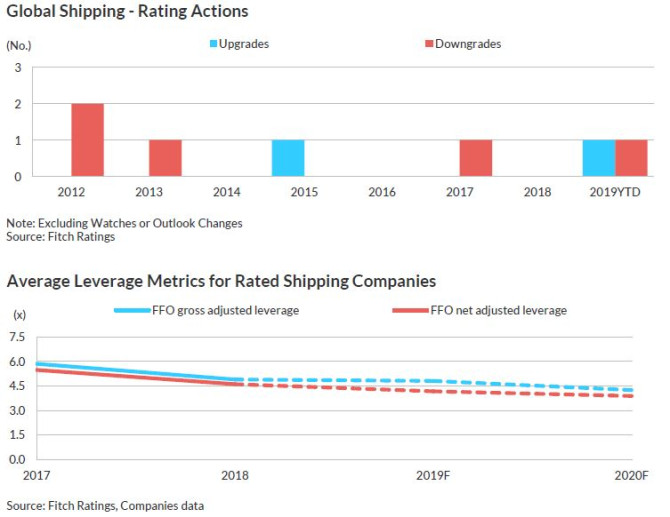

Global container shipping is focusing more on vertical integration, moving into logistics and away from consolidation amid slowing growth in container trade as well as digital disruption. The credit implications are not yet clear as shipping companies’ ability to generate stable cash flows through vertical integration could be offset by the competitive and fragmented nature of logistics markets. Fitch believes that the consolidation wave in container shipping is approaching its end. We think any large-scale acquisitions are unlikely although we do not discount the possibility of further consolidation through the defaults of smaller, financially weaker companies or their acquisition by stronger rivals. This is because only limited additional cost efficiencies are achievable through further increases in scale. Moreover, obtaining regulatory approvals may become challenging due to competition issues, while funding large acquisitions requires an ability to demonstrate a clear deleveraging path, which could be difficult in the prevailing market conditions.

Free global trade is vital for shipping development. About 80% of world trade in goods is carried by the international shipping industry. The main risk to shipping is if protectionist measures escalate into a protracted trade war, damaging the prospects for global trade and GDP growth. Global trade growth is an important stimulator of demand for container shipping, while China remains the key driver for dry-bulk commodity imports and trade.

Container Shipping

Economy and Trade Weigh on Demand

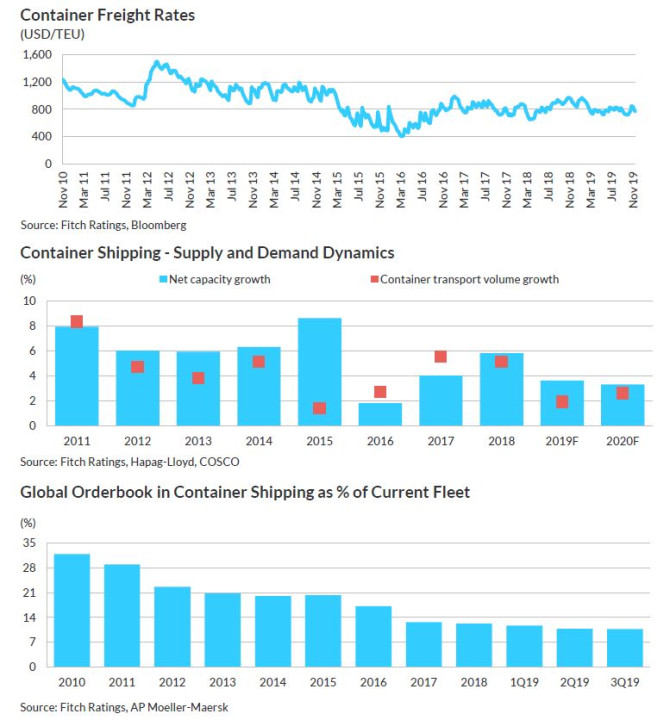

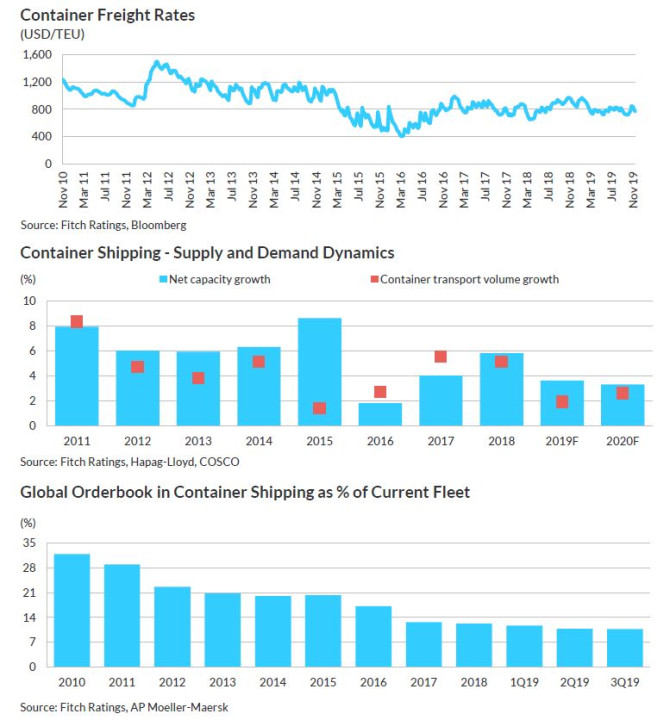

Fitch forecasts global container trade volumes to grow at about 2.5% in 2020 due to slowing global economy and US-China trade tensions. While this represents a small increase from 2019, the growth is well below the average growth rate of about 4.5% in the past eight years. Trade restrictions if remain unresolved are likely to have a negative impact on global container volumes of around 1% in 2020, according to AP Moeller-Maersk. There is an upside from a potential trade deal between the US and China. However, similar to last year, we believe the balance of risks to our forecast is skewed to the downside. We lowered our projections for container volumes growth for 2019 to about 2% from 4.3% on the back of a sharp slowdown in the world trade volume growth projected by the IMF at 1.1%.

Improving Capacity Management

We expect the moderation in growth of the global container fleet capacity to persist in 2020 and forecast it to expand by about 3.3% following growth of 3.6% in 2019. In 9M19, orders were placed for 45 new container vessels. Although the companies continue to order mega vessels to gain advantage from scale and defend their market position, the trend in the order book seems to indicate more modest future capacity expansion. As of October 2019, the order book is equivalent to about 10% of the global container fleet capacity, well below 32% in 2010 and 61% in 2007.

Rates Underpinned by Better Market Balance

Since 2016 container shipping sector has achieved a better match between supply and demand growth, which provides support to freight rates contributing to their lower volatility. We anticipate the average freight rates in 2020 will remain comparable to 2019’s level. A modest increase in average annual rates is possible in 2020 if risks on the demand side do not materialise. However, the positive impact on the companies’ financials is likely to be offset by rising costs following the introduction of IMO 2020. Longer-term sustainability of the supply/demand balance depends on the companies’ consistent adherence to capacity management. Supply dynamics generally remain volatile, with marketrelated opportunistic behaviour affecting the level of scrapping, idle capacity and new orders, while there is still oversupply.

Watch to Watch –Market Impact from Consolidation

With three alliances dominating container shipping and the top five companies accounting for 65% of the market in 2018 (31% in 2000), there have been signs of more coordinated action among alliance members regarding capacity deployment on certain trades. This in our view establishes the necessary foundation for the industry’s medium-term profitability. However, to maintain more sustainable freight rates, a record of wider and consistent capacity management is needed.

Dry Bulk Trade

Volume Growth to Improve

Fitch expects dry-bulk trading volumes to grow by 3% in 2020, up by more than 1.5pp from 2019. This should be driven by higher iron ore volumes together with other commodities, such as coal, grains and steel. Iron ore volumes, which constitute over a quarter of global dry-bulk trade, suffered in 2019 due to lower exports from Brazil and Australia following an accident at Vale’s site in January and weather effects at Australian ports. However, shipments are picking up with capacity gradually coming back online. Higher iron ore supply should be matched by better demand due to higher global steel output. India’s iron ore imports could also rise in 2020 due to potential delay in renewal of several domestic mining leases that are due to expire. Volumes for coal, which constitute almost 25% of global trade, should be supported by higher coal-fired power generation in emerging Asia. Any de-escalation of global trade disputes will present an upside to our dry-bulk volume growth expectations. Volumes for such items as steel, iron ore, bauxite, cement and scrap should rise further due to improved business sentiment following such trade-related developments.

Slight Pick-up in Supply Growth

We also forecast net fleet growth of 3% in 2020, slightly higher than 2.7% in 2019. The pick-up in capacity growth should be driven by delivery of new-build orders. Supply should also be boosted by the return to service of fleet after increased dry-docking activity in 2019. These factors should be partly offset by lower optimal operating speeds for ships due to higher costs associated with low-sulphur fuel usage following the implementation of IMO 2020. Vessels with a combined capacity of more than 45 million DWT are scheduled to be delivered in 2020, up from about 30 million DWT in 2019, according to data from Clarksons Research. The uptrend in rate of vessels being out-of-service for scrubber fittings in 2019 should also reverse next year.

Higher Rates Likely

We expect freight rates to rise in 2020, driven by improved supply/demand balance and an increase in fuel cost. We think the Baltic Dry Index (BDI), based on time-charter rate average for various vessel sizes, could jump by 15%-20% in 2020, after remaining fairly flat in 2019 when supply growth has outpaced demand. While there has been a significant recovery in the BDI in 2H19, we expect rates in 2020 to be less volatile for the year as a whole. The increase in annual average and relative stability in 2020 should be similar to the trend seen in 2018, when both trade volume and fleet capacity grew by 3%. An 18% increase in the annual BDI average in 2018 had followed a 70% jump in 2017 and a recovery from historic lows in 1Q16.

Tanker Shipping

Flat Tanker Rates Expected

We expect that tanker rates in 2020 will have recovered from their troughs in the middle of 2018 and broadly flat from their annual average in 2019. Distressed tanker rates bottomed out and started to recover in 4Q18. The average Time Charter Equivalent rates for Very Large Crude Carriers (VLCC), Suezmax and Aframax tankers improved by 17%, 27%, and 49%, respectively, in 9M19 from the 2018 annual average, although high volatility remains.

Better Supply/Demand Dynamics

Fitch forecasts that global tankers supply and demand will grow by 2.5% and 3.5%, respectively, in 2020 supporting a better supply/demand balance. Order books as a percentage of existing fleet are declining and were below 10% and 8% for crude oil and oil product tankers, respectively, as of October 2019 (20% and 14% in 2015). We expect demand for tankers to be supported by steady but sluggish growth in global oil consumption, fast-growing US oil exports and changes in route dynamics caused by OPEC+ production cuts that are positive for tankers’ tonne-mile demand.

Credit Profiles to Improve

We expect financial performance of tanker shipping companies to improve in 2019 and be flat in 2020, with healthier operating cash flow generation than 2017 and 2018. We also expect the companies’ liquidity positions, although tightened, to be manageable given stronger expected earnings in 2H19 due to event-driven tonnage shortages and the unusual number of ships idled for retrofitting scrubbers in the run-up to the implementation of IMO 2020.

Mixed Signals from Regulation and Geopolitics

Fitch believes lingering trade and geopolitical tensions and political risk may depress long -term tanker demand due to the negative impact on global economic growth. Geopolitical factors add a further layer of complexity for the market dynamics, as they pose opportunities as well as threats and exacerbate already weak visibility. Companies that run under long-term time charter contracts will be better hedged during periods of uncertainty, but will be less able to exploit shortterm opportunities. The impact from IMO 2020 on tanker shipping companies is likely to be mixed. This is due to the fact that rising compliance costs are likely to be mitigated by opportunities arising from increased tanker demand (especially for oil product tankers) and the formation of additional route structure in the course of producing and delivering low-sulphur fuels.

Source:Fitch Ratings

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

admin@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar