In recent years, China's shipbuilding capacity has been continuously reducing due to the bankruptcy and conversion. The reduction of shipbuilding capacity (supply) does not result in a price going up but going down, which only indicates that the shipbuilding demand has been shrinking ever more than that of the supply. The situation also implicates that shipowners are bearish on the market prospects in the next few years. According to statistics from CNPI, new orders for the first half of the year fell sharply (see The Survival of The Fittest).

One of the CNPI panel broker Forocean wrote in its comment to CNPI that “The new shipbuilding market in the first half of 2019 can be described as a decrease in quantity and price. On the one hand, the volume of new ships in the global market shrank to 24.93 million dead weight tons (DWT), down 53.6% year on year. On the other hand, the price of new ships was basically stable. For the recent dry bulk market, although the recent BDI has been rising, the whole dry bulk shipping market is still in a low orbit. BDI's surge is tied to short-term factors such as Vale's resumption of production and the concentration of iron ore shipments, not enough to support demand for newbuildings. The new shipbuilding market is still not optimistic.”

Another CNPI panel broker HIT pointed out that “Suffered from unprecedented heat wave all over the Western Europe - the traditional buyers of newbuilding bulk segment are kept quiet although freight market and BDI index are kept going upwards. Some owners hold the sentiments that it does not pay off to invest in newbuildings since second-hand vessels are still available and can cash in at once.”

Another CNPI panel broker, who does not want to be named, said that “The freight market suddenly jumped to a new high since last peak in 2013, nearly surpassing the break-even point, for a variety of reasons. But the problem is that whether it is a real market recovery long expected by shipping society……. The orderbook level has been reducing and may probably reach a record low. It seems that it is far from recovery.”

It is obvious that most CNPI panel brokers are not optimistic about the prospect of the market in the long run. This point of view is not consistent with the current Chinese shipping media opinion. The main tone in the media is "really good despite of short bad times" and the opinion of brokers is "really bad despite of short good times".

Dry Bulkers | Orders disclosed in July

There are still certain amount of orders going to Chinese, Korean and Japanese yards in July. Nissen Kaiun has placed 5 42,000dwt handymax dry bulkers in Tsuneishi Zhoushan and Cebu respectively. Kukje Maritime Investment Corp (Kmarin) has entered into letters of intent with two Chinese yards for the construction of eight VLOCs. According to CNPI panel brokers, the company will place orders for 4 X 325,000 dwt dry bulker at Yangzijiang and Beihai respectively on the back of long-term charter with Vale. JMU made big gains in Newcastlemax in July (see Newbuilding Orders Disclosed in July).

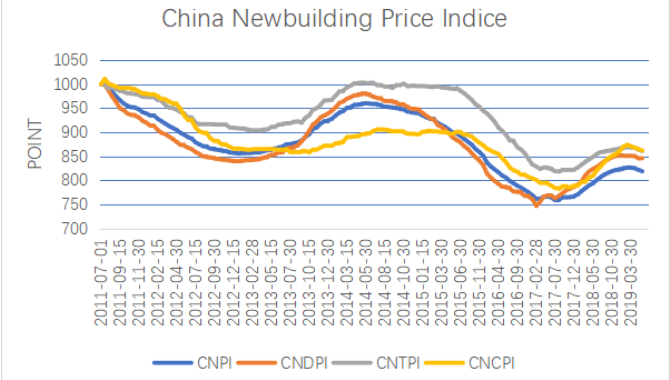

CNPI base ship indexes for dry bulkers were off slightly, with Ultramax and Kamsarmax down 0.3%, Capesize and Newcastlemax down 0.2%, and Handysize stabilizing at its June level without further declines.

Tankers | Overflow demand from Korean yards

I wrote in my report “The Survival of the Fittest” that “Due to the limited capacity of Korean yards, especially large ships like VLCC, Chinese yards may continue to receive overflowed orders from Korean yards in the second half of the year, but the quantity will not be too large.”

Wah Kwong placed two VLCC at DSIC, Union Maritime inked 2+2 Aframax with Cosco Shipping HI (Zhoushan), New Times bagged 2+2 MR & 2+2 LR2 from Bihar International, Nisshin and Nantong Xiangyu inked four 33,000dwt and four 19,900 dwt stainless chemical tankers, and AVIC Dingheng also got an order of one 11,960 dwt stainless chemical tanker. Korean shipyards also enjoy plenty of orders in July.

Boxship | No order in July for Chinese yards

The biggest drop in base ship types was 10K teu class, and the second one is 1900 teu class feeder type. No new order disclosed for domestic yards. The market at abroad was also very sluggish. Only one new order report for a small 1000 teu feeder.

Gas Carrier | CMIC Raffles wins a big order

Australia’s Global Energy Ventures (GEV), a developer of global integrated marine compressed natural gas (CNG) projects, signed a letter of intent (LOI) with CIMC Raffles for construction of 4+4 CNG carriers. The price for each ship was reported at 135 to 140 million US Dollars.

In Korea, SK and Hyundai has signed an LOI for a 180,000cbm LNG carrier, the price has not been disclosed.

Source:Xunliang Liu,

CNPI

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

admin@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar