Halfway through 2019, the bustling market is still full of noise. The mood of shipowners and shipyards fluctuates with various statistics and indexes. Due to the sharp decline of the BDI index at the end of 2018 and the beginning of 2019, the once confident market tone shifted to the bearish dry bulk market. In my paper dated March 2019 “On the Dry Bulk Shipping Market (II)”, the conclusion of short run market is that “The decline of freight market for this round can be seen as a short run market correction, a correction of the overly optimistic market psychology at the beginning of 2018. Then the fall in freight rates should not be too deep and will not last too long.”

Coincidentally, the BDI rebounded within a few months. With the rise of BDI, the market tone began to turn to optimism, the media began to secrete the hormone of optimism, and all kinds of positive articles began to appear frequently. In fact, the shock trend of BDI reflects the game process between supply and demand under the traction force of the equilibrium. Although the theoretical equilibrium price is difficult to appear or fleeting, so the actual market price is always adjusted and oscillated around the equilibrium point over time.

Short-run demand can be delayed or brought forward by shippers, and it may also be delayed or brought forward due to the influence of natural and political factors. However, short-run supply of transport capacity is less elastic, and it can only increase or decrease by adjusting the speed, so short-run demand fluctuation often brings market turbulence. The current sharp rise in BDI should be one of these shocks, the long-run basic pattern of supply and demand has not changed fundamentally.

In the long run, because the life of a cargo ship for 20 to 25 years, so the supply side of the shipping market is more inelastic than that of the demand side. Once the rice is cooked, especially when a big pot of rice is cooked, it is difficult to change the structure of the supply side, so the pattern of long run shipping market depends more on the supply side.

Newbuilding prices show bearish trend

Ship prices are the best indicator of owners' expectations for the future. A report titled "The dry bulk market roaring in July with surging freight rates and active trading," pointed out that "capesizes are hot in second-hand market, modern handysizes are replacing old types", which gives the impression that the energy of the freight market has been transferred to the second-hand and new shipbuilding markets.

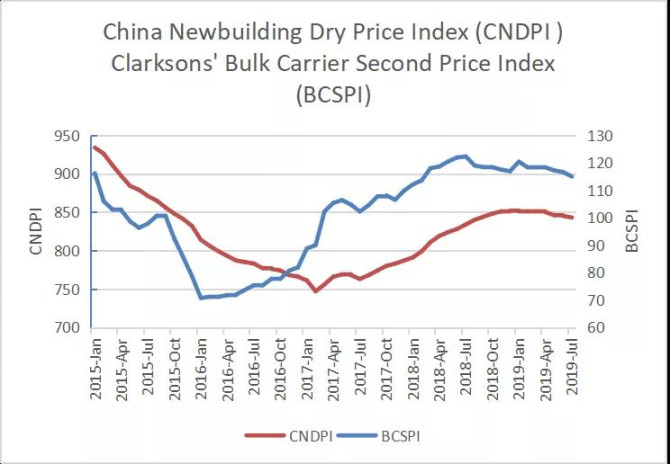

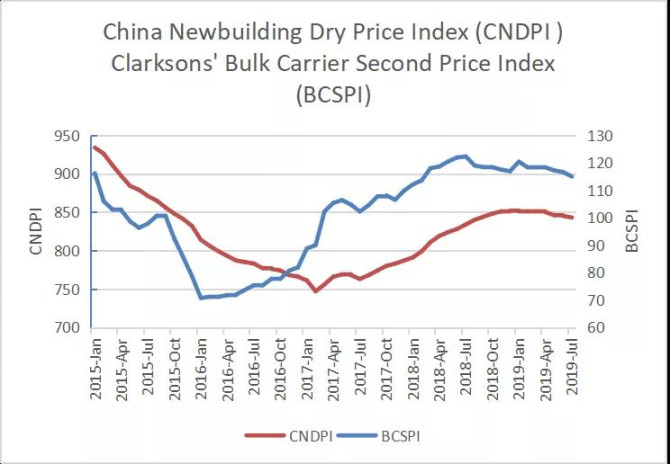

However, looking at the prices of 5 years old and 10 years old second-hand cape prices, one cannot see such a hot market. Nor do the movements of the second-hand and new shipbuilding price indices prove bullish (see Figure 1).

Since it takes about two years for newbuildings to go from order to delivery, the price trend of newbuildings more effectively reflects owners' expectations for the future.

China Newbuilding Price Index (CNPI), which consists of drybulkers, tankers and boxships, has begun to climb since August 2017 until March 2019 when it recorded its first decline. The decline has been continuing up to July (see Table 1). Looking longer, we can see a more pronounced downward trend(see Figure 2). The total composite index CNPI, the composite index for dry bulker CNDPI, the composite index for oil tanker CNTPI and the composite index for containership CNCPI all have gone lower and lower.

Orders are generally down, but Chinese yards are bucking the trend in some ship types

In recent years, China's shipbuilding capacity has been continuously reducing due to shipyard bankruptcy and production conversion. In this case, CNPI and the three major ship type indexes still show such a downward trend, which shows that the demand for shipbuilding has been reducing so steadily that the reduction of capacity supply cannot keep the price from going down. The situation is a portraiture of shipowners' expectations for the future. In order to further verify the negative information from the price signal, let's have a look at the new orders received in the first half of this year (as per data collected by CNPI).

1. Drybulkers | general decrease globally

In the first half of 2019, new orders for dry bulkers placed to Chinese yards fell sharply compared to the same period last year, totaling 6.47 million dwt only. In the first half of 2019, new orders for dry bulkers around the world dropped by about 60% compared with the same period last year.

2. Tankers | Globally decrease while larger tankers’ order increased in China

In the first half of 2019, Chinese shipyards received orders of 4.35 million deadweight tons, with a significant increase in orders for larger ships. Since Chinese yards do not dominate the global tanker shipbuilding market, new orders are still down by 12% (DWT) and 10% (number of ships) compared with the same period in 2018 from a global perspective.

3. Boxship | Globally decrease while larger ships’ order increased in China

In the first half of 2019, the new orders inked in Chinese shipyards in terms of TEU increased significantly compared with the same period last year, but the new orders in terms of the number of ships decreased compared with the same period last year implicating the proportion of larger ships increased. Global container orders, like those of other ships, have fallen sharply, by 66 per cent year-on-year in terms of number and 75 per cent year-on-year in terms of teu.

4. Gas carriers | China Increases, global decreases

In the first half of 2019, new orders inked in Chinese shipyards increased significantly compared with the same period last year, but Chinese share in global market was less than 13%, so the global situation was still reduced by 6% (by number of ships) and 21% (by cubic meters).

5. Offshore rig related facilities/ships | China keeps balance, Global decreases sharply

Chinese yards received just three orders in the first half, unchanged from the same period last year. But the volume of global orders for offshore rig related facilities/ships was 74 per cent lower than the same period last year.

Shipowners' shipbuilding intentions depend on their expectations for the future, and new orders in the first half of the year further confirm the fact that demand for shipbuilding has decreased. But why are Chinese orders for certain ship types increasing instead of decreasing?

The role of leasing companies in China

Chinese leasing companies are playing an increasingly important role in the shipping market. What are their projects in the first half of 2019? The biggest news just after New Year's Day was the financing of 10 85,000 dwt dry bulkers leased to SDTRA Marine by AVOC Leasing. The order was placed at DSIC Group. Later, CSSC Leasing became the focus of the market and frequently appeared in market reports for new orders. However, many large projects were eventually taken by IBC Leasing and CMB Leasing.

In general, domestic leasing companies provide relatively large financing support to dry bulker, boxship and gas carrier. Domestic leasing companies provide financing to dry bulker, accounting for at least 23% of all new domestic orders, 14% of tanker, 52% of gas carrier, and 90% of boxship. They almost never participate in financing projects of offshore rigs and auxiliary facilities/ships.

Generally, big shipowners will not be in a hurry to arrange financing in the first year of placing the order, but they usually negotiate financing according to the situation of financing market at that time about one year before delivery. As a result, China's leasing companies may end up financing at a higher proportion.

The 14.3 billion Yuan of big order promoted by CSIC Group in June have not been included in the statistics, and there are several new orders promoted by CSSC Leasing which have not been materialized yet (for example, at the beginning of this year, CCCS Leasing placed 8 1100teu ships in Wenchong and Chengxi respectively, but the big order with 16 ships has not been materialized up to now). The degree of participation of yard leasing companies is deeper than the statistics show.

Financing from yard-backed leasing companies may benefit their own yards, but there is still risks of artificial demand. If large capital is led to wrong direction, it will have certain negative impacts on the supply-demand relationship of the entire shipping market although it may bring short term benefit to their own shipyards. The massive excess caused by the offshore rig boom has yet to be digested. Lessons of history should be learned and caution should be taken.

Financial institutions have a profound impact on shipping industry, and ship assets are inseparable from financing. Financial institutions should not blindly believe the word of shipowners, nor should they jump to the front to become operating shipowners themselves, both of which will cause or aggravate the excess capacity in the shipping market. If financial institutions can find the right position in the shipping market, they can play a benign role in promoting and harmonizing the supply-demand relationship of the market.

Market Prospect

Market Prospect

1. Dry bulker is still dominated by Chinese yards, but the market is still not out of the downside or bottom channel

According to the statistics of CNPI, in the first half of this year, Chinese shipyards accounted for 65% of the market share by number of ships, and 86% by deadweight tons, occupying a significant comparative advantage in the segment market of dry bulk carriers.

Although the recent BDI index has been climbing, the whole dry bulk shipping market is still in a long run downward trajectory. Most CNPI panel shipbrokers took a bearish view of the second half of the year. The CNPI sub-indexes, like the composite indexes, have been trending lower and lower. Take Kamsarmax as an example, the ship type was once very hot in newbuilding market, and now the trend has been notably downward, at least in the short run

Although the world existing dry bulker fleet is aging compared with several years ago, it is still a young fleet. The bankruptcy of individual shipowners does not reduce capacity. Instead, after their ships are sold or auctioned at a fire-sale price, new shipowners with cheap tonnage will have stronger competitiveness compared to existing shipowners. Dead losers create more competitive rivals for existing winners, and these new rivals can be their terminators……I still hold my point of view on market prospect in my paper in On the Dry Bulk Shipping Market II in March 2019, i.e. “fluctuations in the down corridor or consolidates in the bottom”. In other words, the makers of dry bulkers will have hard days ahead.

Even if the sulphur cap comes into force in 2020, it will not remove enough old capacity from the market. As for the expectation of short-term capacity reduction caused by the installation of the scrubber, it is hard to say which side is better than the other, the competition between low sulphur fuel oil and scrubber has not been finished. This topic is not the main tone of this thesis and shall be discussed later in other occasion.

2. Tanker may enjoy unexpected gains

While Korean yards are still the biggest tanker builder in the market, with most of orders go to Korean yards, Chinese yards also received about 30 percent of new orders in terms of dwt in the first half of this year. There has been an obvious improvement in acquiring tanker orders for Chinese yards, and new orders increased by more than 70% compared with the same period last year in terms of dwt.

The tanker market has gone through many years of ups and downs, and the psychology has become more cautious. The existing fleet is older than bulk carriers. Figure 4 is a graph often used by the author to observe the status quo of the supply side. The blue bar represents the tonnage delivered in each year (deadweight tons), and the orange "cumulative age distribution" refers to the percentage of tonnage delivered in a certain year and before in the total fleet, so it must be 100% in the end.

The interpretation of figure 4 is different from person to person. I would like to mention a few words for your reference. The existing tonnage built before 2001 account for nearly 9% of the total fleet. It is expected that some ships will be scrapped before the f4th SS. Even if the other ships choose not to be demolished after the 4th SS, it is estimated that most of them will be used for storage tanker, which will not have a significant impact on the market supply and demand pattern. Tanker new orders, on the other hand, account for 9% of the fleet's capacity only. In this case, it is believed that the replacement demand of tankers will also maintain a certain amount of newbuilding orders, but the temperature varies between different ship types. Due to the limited capacity of Korean yards, especially large ships like VLCC, Chinese yards may continue to receive overflowed orders from Korean yards in the second half of the year, but the quantity will not be too large.

3. Boxship | Mega ship orders still pending

Chinese yards accounted for 56% of new orders in terms of number of ships in the first half of the year, while the weight is 61% in terms of teu. While the volume of new orders for container ships around the world fell sharply from a year earlier, the volume of new orders for Chinese shipyards increased significantly from a year earlier. It is believed that the major causes are the 10 15,000 container ships placed by CMA CGM and financed by ICBE Leasing and CMB Financial Leasing respectively.

No 20,000teu meg boxship newbuilding order has been seen since last June when HMM placed 12 23, 000 TEU ships in its compatriot yards. Just like thunder without rain, some exciting market rumors has been circulating on the market for nearly half a year but no real deal has been fixed up to now......10 X 23,000 teu from Evergreen, 10 X 23,000 teu from Hapag Lloyd CSAV, 5 X 22,000 teu from OOCL, 10 X 13,000 teu from MSC, and 10 X 15,000 teu from ZIM... Whether it is to build or not build, how many to be built, where to be built is uncertain, so big yards, big lease firms, big shipowners still have a lot of work to do, volume of new order for the whole year may be very different from the first half.

However, these large orders will only be distributed among several large yards, and they are meaningless to the small and medium-sized shipyards. In addition, there is no followings news about 2+2 X 5400 container ships from Delphis. Will it be materialized in the second half of the year? Will 5,000 teu class boxship become a rising star?

Law of survival

From the post-war shipping market history of more than 70 years, as long as there is profit, it will lead to the increase of shipping capacity until the industry profit returns to zero or even losses. Therefore, the survival and development of both shipowners and shipyards is innovation. Innovation is nothing more than reducing cost, improving efficiency and adapting the ship and transport mode to the changing pattern of global maritime logistics.

As a carrier of goods, ship's function is to provide space displacement and temporary storage for goods. The direction, category, batch, quantity, origin and the destination of global cargo transport (space displacement) are constantly changing, the port throughput capacity and related transport system are also changing, so the size of the ship, tonnage, draught, speed, loading and unloading process/efficiency, fuel consumption, type of fuel and a series of parameters will change with the changing demand. The shipowner who ADAPTS to this change in time will survive, that is, he or she can always get ahead of the long run industry profits becoming zero, through innovation to make excess profits.

Source:Xunliang Liu,众盟航运智库

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

admin@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar