Today we bring you our bi-weekly Brazil iron ore shipments and VLOC/Valemax arrivals monitor.

Charts below show following three things:

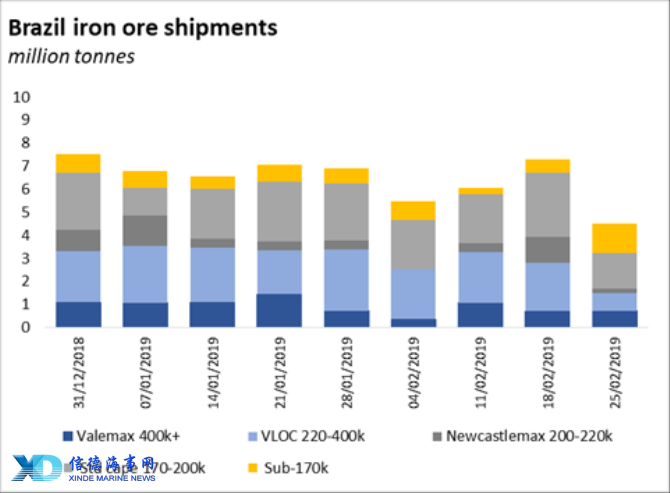

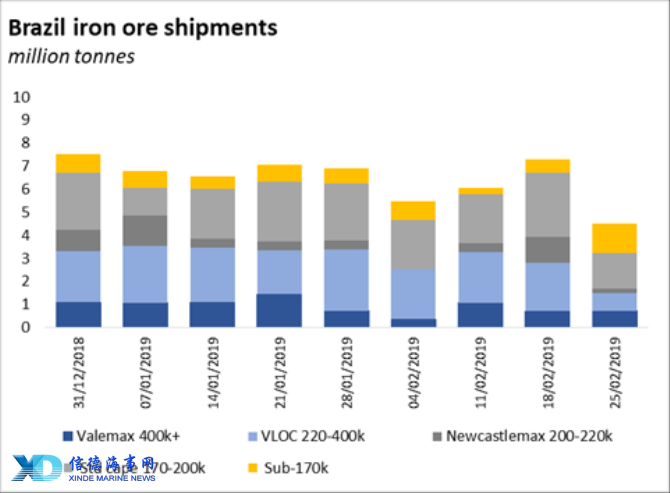

1. Brazil’s weekly iron ore shipments by vessel class beginning 2019 (left chart)

2. VLOCs and Valemax with actual ETAs Brazil (right chart)

3. Theoretical forward VLOC and Valemax arrivals in Brazil giving an idea of forward spot Cape demand (theoretical ETA Brazil derived from ETA elsewhere – eg if ETA Teluk Rubiah 14th May, model adds 32 days for estimated theoretical arrival back in Brazil). The model also excludes those VLOCs doing Aussie-China repeat business (right chart)

Based on the current schedule, VLOC/Valemax arrivals in Brazil are expected to hover around high 4m-dwt over the next two weeks. However, they are projected to surge to north of 5m-dwt during the week starting 11 March. This could be part of the reason why the spot cape market has slid to such low levels recently.

Arrivals of VLOC/Valemax vessels at Brazilian ports are estimated to drop to less 3m-dwt in mid-late March. This could actually boost the cape market in coming days.

However, supply of VLOCs/Valemaxes might spike to potentially over 6.5m-fwt during the first week of April. Although it is all theoretical at this point, this is likely to put further pressure on the spot cape market in mid-March.

Source:XINDE MARINE NEWS

Please Contact Us at:

admin@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar