Global coal shipments grew by 3.8% or by 30.6 million tonnes during the first eight months of the year according to the vessel tracking data. Growth was once again driven by strong demand from the Asia-Pacific countries led by China and India. Other developing countries in the region such as Pakistan and Vietnam also saw strong growth as their energy consumption continue to grow rapidly, and they depend heavily on the coal-fired capacity for power generation. Imports into Pakistan was up by 45% or about 3 million tonnes whereas Vietnam’s imports grew by 65% or by approximately 1 million tonnes.

Although domestic coal production in India grew by 8% imports (thermal and coking) continued to rise rapidly. According to the official data, volumes were up by 14.8% or by 14.2 million tonnes during the first half of the year. Demand was driven by a robust 5.3% rise in power generation1 and 5.1% growth in steel output.

Indian Imports are likely to remain elevated as we are entering into a seasonally strong period during when power plants and traders start building stocks. Although power plants are in no immediate need to increase purchases as they are currently well-stocked, there are signs that this could change soon as the number of plants with super-critical stocks (less than four days of consumption) rose from 6 at the beginning of the month to 13 earlier this week.

Chinese coal imports were also up sharply so far this year as demand from the power generation and steel industries remained strong but domestic coal production dwindled. During the first eight months, imports including lignite were up by 14.2% or about 25 million tonnes whereas raw coal production was down by 2.3% or about 35 million tonnes.

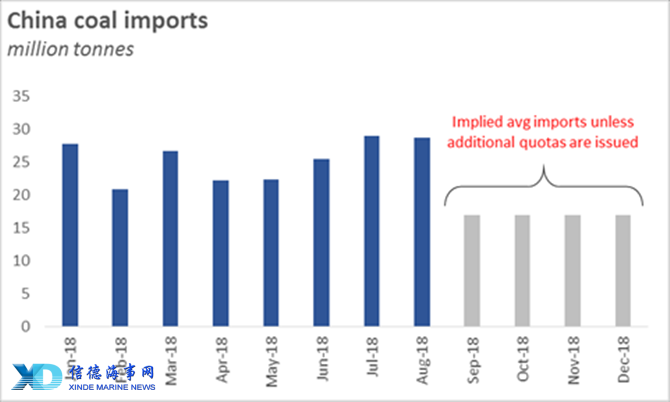

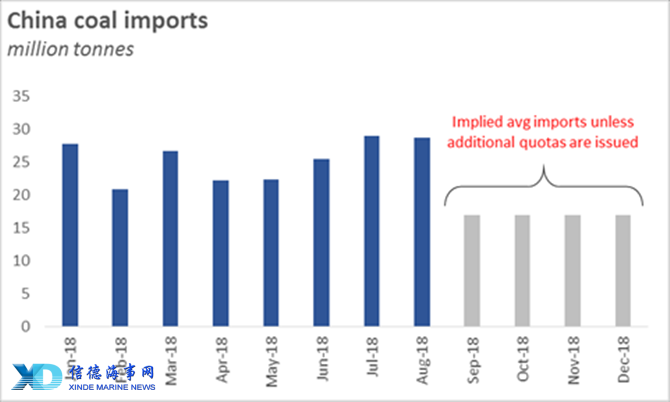

However, Chinese coal import activity is under increasing pressure as power plants have almost exhausted their allowances for the year. Quotas for utility companies were kept unchanged and set at 271 million tonnes earlier this year. With imports during the first eight months already breaching 203 million tonnes, average monthly imports could drop sharply unless the government issues more quotas in coming weeks.

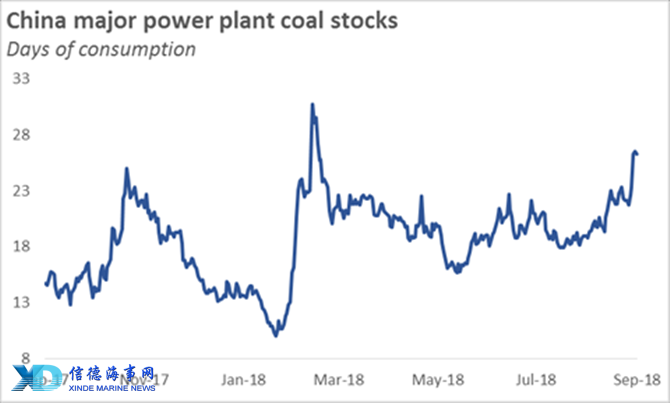

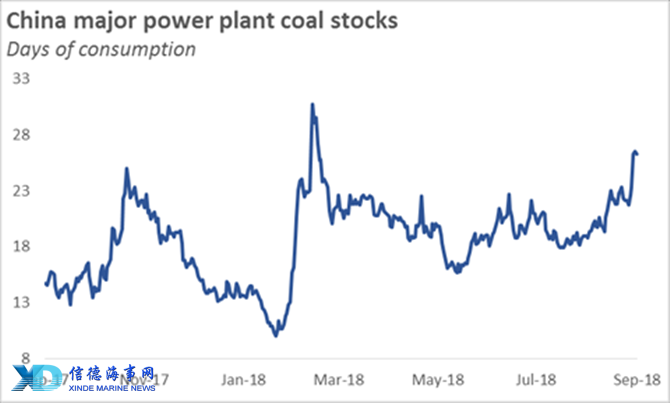

So far there is no indication that the government will soften its stance and we understand traders are becoming increasingly cautious in taking positions on cargoes. Power plants are also well stocked as the weather has been getting cooler and daily consumption at major power stations has been falling in recent weeks. Coal inventories at the major power plants went up from 19.8 days of use on average in August to 25.6 days this week.

We are not sure how the situation will develop as it is more politically driven than by market fundamentals at the moment. We understand that the official document on winter pollution controls will not be released until the beginning of October and until then we expect little change in the circumstances.

Sources:Arrow

Please Contact Us at:

admin@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar