Vessel design and technology advances have seen the typical new order LNG ship become larger and more efficient, making ships ordered even three or four years ago outdated. Ship orders now are typically sized at 170-180,000m³, compared to 155,000m³, dues to design advances and to maximise carrying capacity through the newly expanded Panama Canal. In addition, the introduction of gas-injection slow-speed engines has offered fuel savings of over 20 tonnes per day even against modern DFDE/TFDE engines and 75 tonnes per day against older steam ships.

Huge orderbook to be delivered

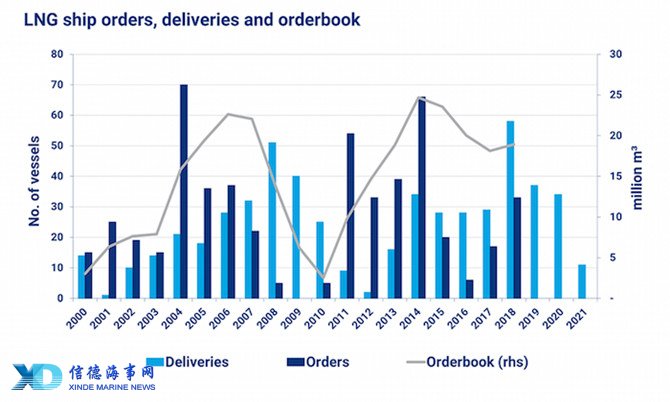

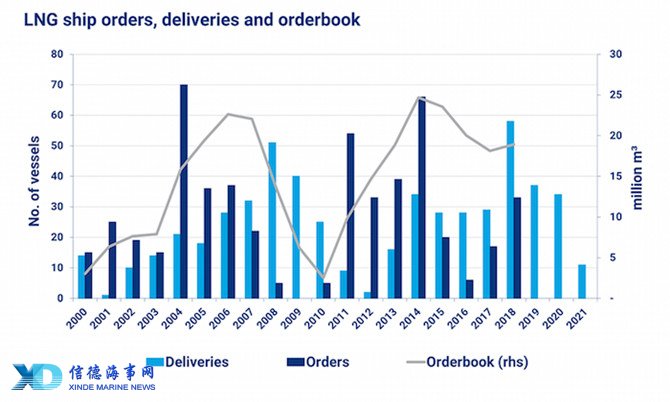

So far this year 36 new vessels have been added to the fleet and three have been scrapped. A further 22 are scheduled for delivery before the end of the year – if these vessels are delivered on time and no further vessels are removed from the fleet, capacity will grow by 13.0% in 2018 (up from 6.8% in 2017). The 37 vessels currently scheduled for delivery in 2019 will grow the fleet another 7.6%.

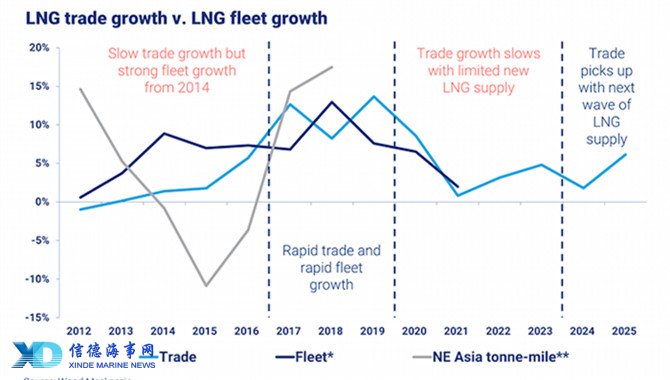

LNG trade is growing strongly but our forecast of an 8.2% expansion in 2018 lags behind fleet capacity growth. More long-haul imports from the USA to Asia should see tonne-mile demand grow at a faster rate, leaving a delicate balance between supply and demand for LNG ships. But forecast trade growth of 13.7% in 2019 should tip the balance in favour of ship owners.

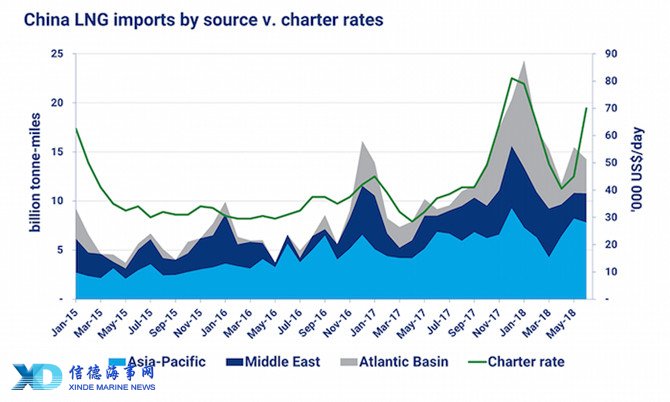

Swings in where US exports go are creating more volatility in spot/short-term LNG charter rates. Peak demand periods in Asia see more US exports attracted to long-haul destinations, taking ships out of the Atlantic basin. This drives up charter rates globally, but drives up rates even higher in the Atlantic basin. In June charter rates in the Atlantic basin peaked at around US$90,000/day, whilst rates in the Pacific Basin at the same time were closer to US$70,000/day.

Industry outlook – too little too late or too much too soon?

LNG is one of the fastest growing sectors in shipping and design advances have made new ships more attractive compared to much of the existing LNG fleet. The market clearly wants more of these new ships and it could be said orders have been too little too late.

But looking at the wider picture there is a lot of new capacity still to be delivered from the current orderbook. There is under-used and laid-up older shipping capacity that could be more fully employed. The next pre-FID wave of LNG supply won’t come on stream until mid next decade. If ordering activity continues at recent levels there is a high danger that it will be too much too soon!

Sources: Wood Mackenzie

Please Contact Us at:

admin@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar