ncludes: BULKER, LPG, LNG, CONTAINER, TANKER, PASSENGER, FLOATER GAS, OSV, SMALL DRY, VEHICLE CARRIER, OCV, OTHER OCV, SPECIALISED CARGO, REEFER, MODU, MULTIGAS, FLOATER WET.

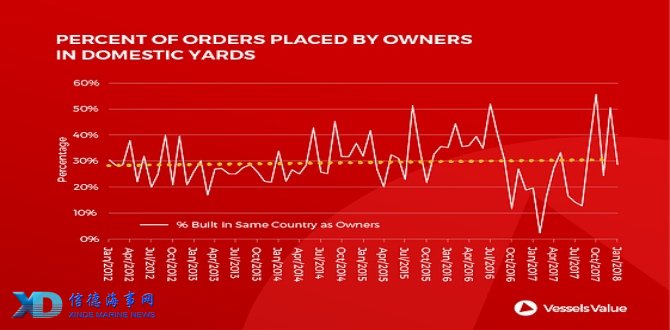

One of the big shifts reported is the increasing number of ships ordered by Chinese owners at their home based yards. Orders placed jumped from 18pc in 2012 to 28pc in 2017, and the trend looks like it will continue. Financing made available by national banks and leasing companies will ensure that work continues to be steered towards businesses in mainland China.

South Korea has seen a modest boost as well, but interest from their countrymen remains a much smaller piece of their business than the other two Asian shipbuilding powerhouses.

Some of the domestic orders are driven by protectionism, such as orders placed in US yards. Cabotage laws such as the Jones Act tend to drive this activity. The impact of the dramatic fall in oil prices in 2014-15 can be seen in the sharp drop in orders at Norwegian yards which had specialised in supporting the offshore industry.

Trends in economic nationalism come and go over the decades, and the current favouritism for domestic work will not continue indefinitely. However, it does look like we will see a higher percentage of owners ordering from the yards in their home countries in the near term. This will be most noticeable in low specification ships. Specialised units and complex projects should continue to go to the most capable builders though. Independent owners with access to financing will seek the best yards at the fairest price. Meritocracy still reigns supreme in the highly competitive, and global, business of shipping.

Sources: VesselsValue

Please Contact Us at:

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar