US West Texas Intermediate crude futures were at 64.04 US dollars per barrel. That was up 65 cents, or 1 percent, from their last settlement.

The higher oil futures came after stock markets recovered some of their steep losses of previous days.

The market was supported by a report by the American Petroleum Institute saying that US crude inventories fell by 1.1 million barrels in the week to February 2 to 418.4 million barrels, traders said.

A group of oil producers around OPEC and Russia have been withholding supplies since last year in order to tighten supplies and prop up prices. The cuts are set to last through 2018.

“Evidence points to a global inventory market that has arguably already balanced – with days of forward cover in the low single digits or possibly even lower - which should support the spot price going forward,” said Richard Robinson, manager of the Ashburton Global Energy fund.

Other analysts, however, warned of the risk of lower oil prices, both from financial markets and because of weaker seasonal demand.

In the short-term, demand is expected to slow due to refinery maintenances at the end of the northern hemisphere winter season.

“The combination of rising risk-aversion and fading short-term fundamental support continues to put downward pressure on oil,” said Ole Hansen, head of a commodity strategy at Saxo Bank.

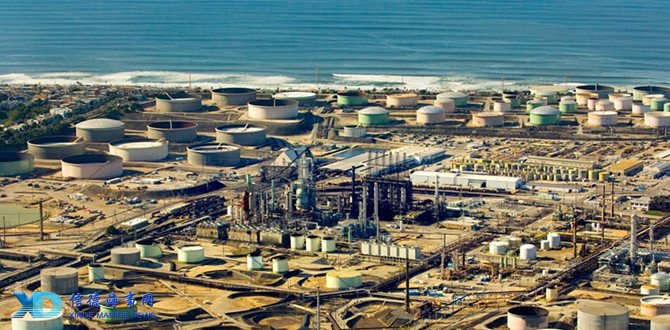

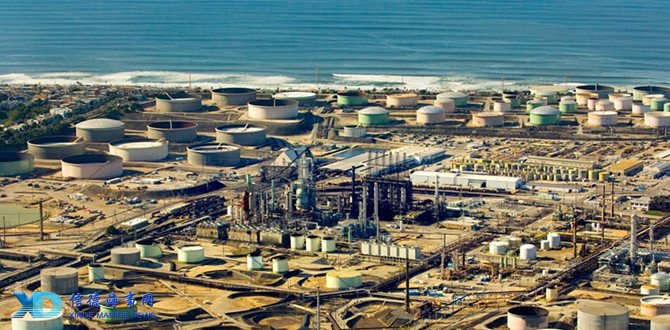

Looming over oil markets is rising US crude production, which has already soared by 18 percent to almost 10 million barrels per day (bpd).

The US Energy Information Administration expects US output to rise to an average of 10.59 million bpd in 2018, and then 11.18 million bpd by 2019.

That would be more than top producer Russia, which pumped on average 10.98 million bpd out of the ground in 2017.

“With all the chatter about US production ramping up, there could be a growing propensity to move lower near-term,” said Stephen Innes, head of trading for Asia/Pacific at futures brokerage Oanda in Singapore.

Sources:CGTN

Please Contact Us at:

admin@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar