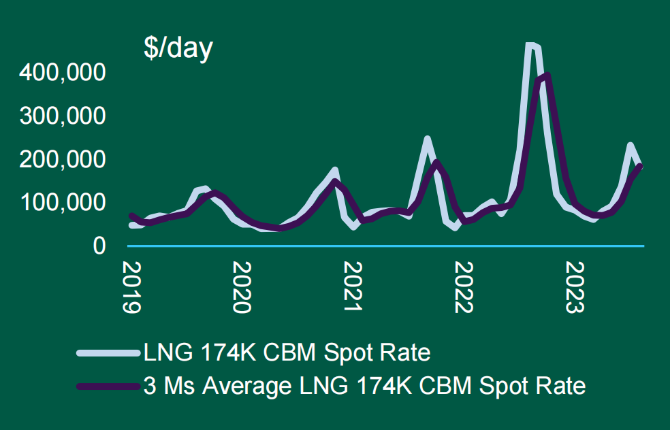

The LNG market remains high as winter heating demand is driving the high market. French energy major TotalEnergies has sealed a gas supply deal with QatarEnergy for up to 3.5m tons a year for 27 years. LNG New building stays high and pushed MOL returned to Samsung Heavy Industries with more LNG carrier orders. Malaysian Bumi Armada has received approval in principle from the ABS for a new FLNG infrastructure solution.

Offshore:

Disclaimer

The above product summary provides a general overview of the terms and conditions of the insurance policy. It does not necessarily address every aspect of the policy terms. It is not the intended to be, and should not be, used to replace specific advice related to individual situation and this should not been seen as legal, accounting or tax advice. The coverage is subject to full terms, conditions and exclusions of the policy.

The views and opinions expressed are those of the author and do not reflect the official position of Oneglobal. The company and its employees hold no responsibility for errors of fact, market changes and/or any losses incurred as a result of the content obtained in this document. Any forecasts and/or trends reported are based on the author’s assumption which may vary from actual situation due to volatile changes. It does not warrant its completeness or accuracy and should not be relied upon. Users are recommended to exercise judgement and discretion while using this information.

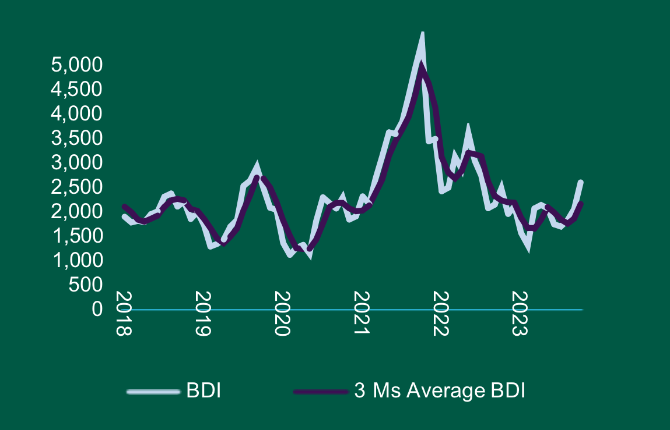

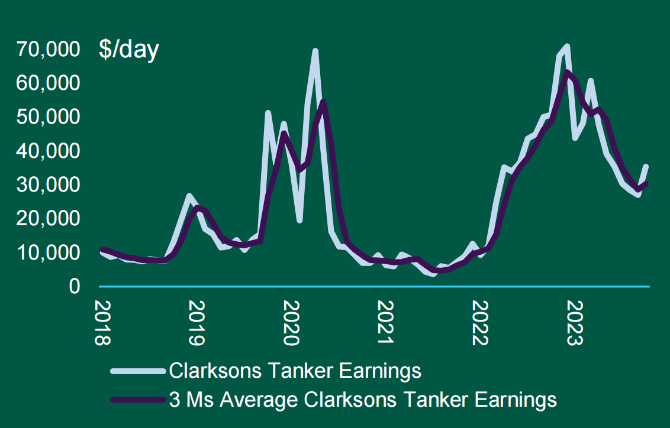

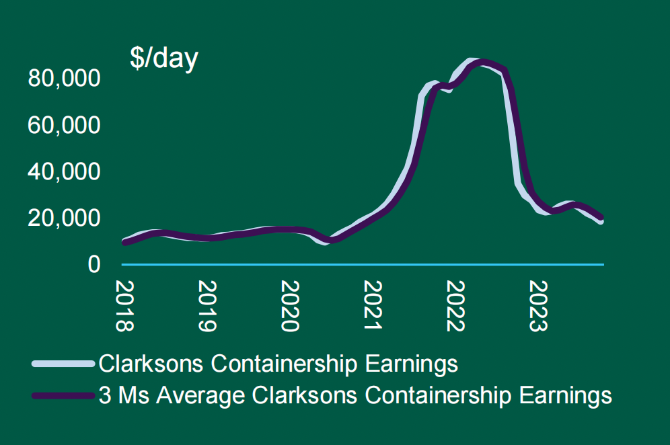

Data Resource: FT, Clarksons, Splash 247, Xinde, Hellenic Shipping News

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com