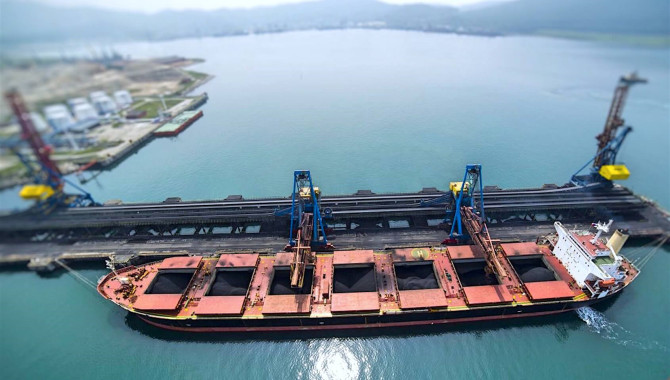

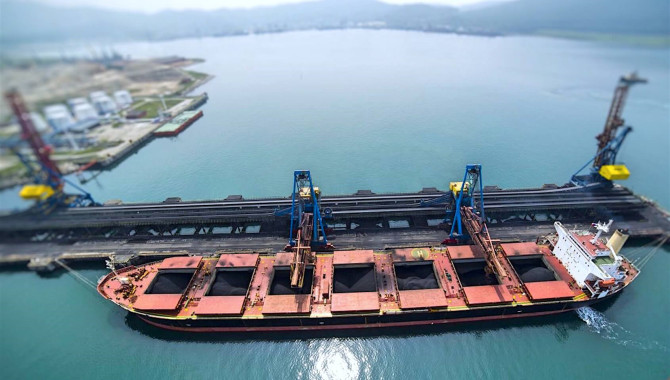

Waning Chinese demand and ongoing softness in Europe have outweighed burgeoning Indian imports to maintain pressure on Asian coal prices in the week through.

The Pacific basin’s reference price for high grade (6,000 kcal/kg) Australian coal exports to Asia last stood at USD 68.91/t, 32% below where it began 2019.

Global Coal’s Newcastle index declined marginally over the past week, though its premium to European coal blew out amid a plunge in import prices for north-western Europe.

Newcastle is trading roughly USD 15/t above Global Coal’s European benchmark.

Weak Europe, easing China

Commerzbank saw little prospect for a recovery in coal prices over the next 15 months. It forecast Europe’s API 2 coal prices to remain around USD 60/t through until at least the end of next year.

Falling European import demand and rising global supplies would offset growing demand in southeast Asia. This year’s robust Chinese imports were also likely to give way in the coming months.

“A sudden break in import momentum by the end of the year cannot be ruled out, as numerous import ports are likely to have already exhausted their annual import quotas,” the bank’s Barbara Lambertz said in a coal report this week.

A European utility coal analyst agreed, suggesting loosening internal Chinese fundamentals could pressure the government to enforce import curbs over the rest of the year.

“Port stocks are very high and the domestic spot thermal was down each day in the past month,” she said.

Coal prices on China’s Zhengzhou exchange have pushed out some of their lowest levels this year, falling another 1% over the past week to CNY 547.20/t (USD 77.68/t).

One shipping analyst noted China’s October imports were on track to come in at 25m tonnes.

This would put China on track to smash through a government target of 281m tonnes of imports this year, though the 17% month-on-month decline would also more than offset India’s rising foreign purchases.

Indian imports surge

India’s thermal coal imports are up 27% at 51m tonnes so far this year. They jumped 7% annually in September to reach 5.23m tonnes as labour unrest and monsoon flooding ravaged domestic output.

“We expect Coal India will fall short of its annual target of 660m tonnes with a huge margin and likely power demand recovery will support coal imports,” said Rupesh Sankhe, a utilities analyst for Elara Capital in Mumbai.

Production was gradually increasing as miners addressed flood damage, Sankhe said. Yet ministry data showed Coal India’s output could fall 70-80m tonnes short of its target this year if production resumed its trend of the first nine months of the year.

“The coal imports should remain high in October as well. And it should remain high till December as the winter demand kicks in,” said Rahul Sharan at ship broker Drewry.

Indian power plant stocks continued to climb over the past week, rising 8% to 18.7m tonnes. This was enough to meet 12 days of power generation, according to inventories monitored by the country’s Central Electricity Authority.

The authority reported this week India’s domestic production tumbled 15% to 37.4m tonnes in September.

Source: Montel

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

admin@xindemarine.com