Bigger ships offer advantages to both ship owners and those wishing to ship cargoes, and this trend is unlikely to change. The average size of ships has been increasing over the past several decades. Advances in production techniques, vessel materials, and growth in shoreside infrastructure are allowing bigger ships to go in and out of more locations than at any point in recorded history. However, in some shipping markets, we appear to have hit peak upper limits to capacity. We appear to be at a peak demand level now for containerized shipments in particular. Many are starting to question if bigger is always better. Looking at the numbers, it appears as though it still is.

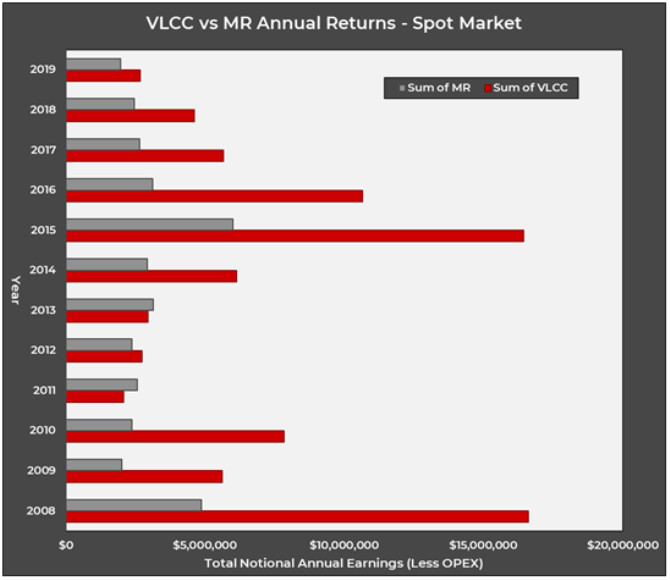

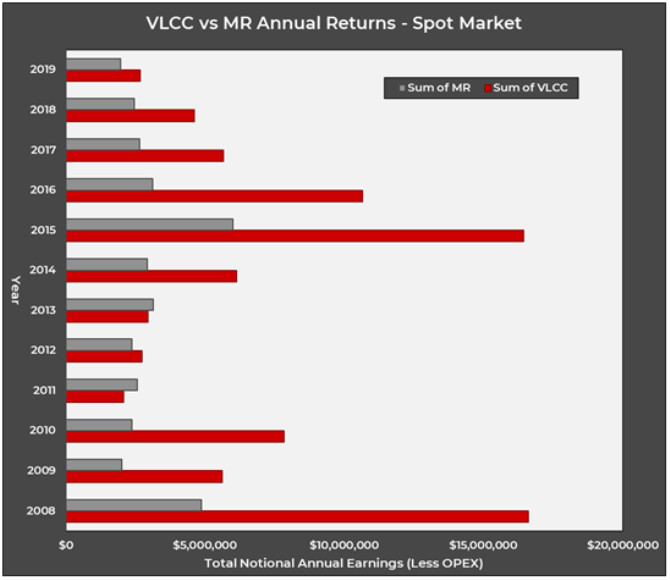

The economics of running a larger ship are clear on paper. The operating cost of a large ship is very close to a smaller ocean-going vessel. The cargo carried by the larger ships is much greater though, allowing the ship to earn more per trip. The chart below shows the spot market returns for a VLCC, the largest widely traded crude tankers, and an MR2, a smaller type of ship used to deliver clean petroleum products to a wider variety of locations. Operating costs for each ship type is removed from the returns.

The table shows that MR tankers offer steadier cash flows, but less volatility. The same holds true in most markets as there are fewer larger ships, and thin markets are subject to large price swings. Outsized returns attract far more interest as the returns from one good year can make up for the possible losses incurred from the host of other expenses a shipping company must pay outside of the vessel operating costs, such as finances, marketing, and other corporate overhead.

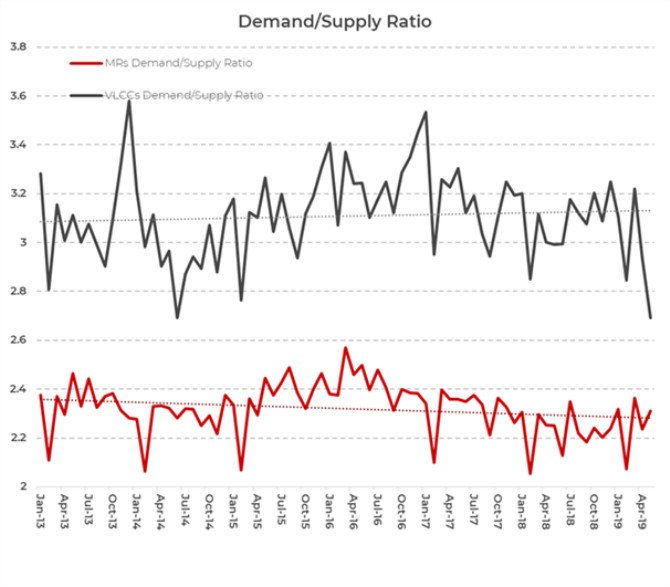

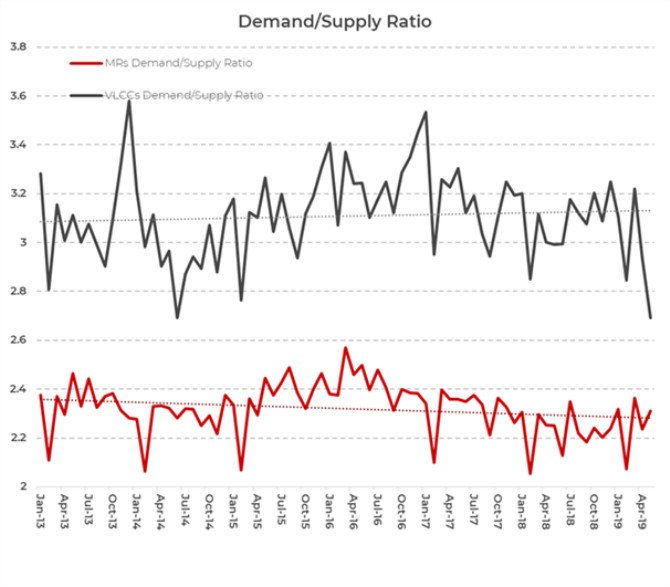

It’s tempting to say new tools are giving visibility into the markets and reducing volatility, however, trade data suggests the ratio between ship supply and demand remains volatile. The chart below shows the demand/supply ratio, which has a strong correlation with vessel earnings. When the ratio goes up, rates are likely to as well. VLCCs have experienced a more positive trend over the past 5-6 years than MRs. This supports a view that there is strong fundamental demand for larger ships in spite of the rapid expansion of the VLCC fleet over the past several years.

Opportunity can be found at either end of the size spectrum though. Smaller ships offer economic benefit when the maximum cargo size is less than the carrying capacity of a particular ship type. We’ll look at the interplay between smaller dry bulk vessels such as Supramaxes and Ultramaxes, two similar sized vessels which compete for cargoes at a later time.

Bigger still appears to be better if looking at the tanker markets. Stronger earnings multiples during peak periods make them more attractive to investors. If shipping is ever fully commoditized as a service, some of this volatility may erode, but for now the shipping cycle seems to be in place. Investor interest in most vessel types is waning, and new build prices at yards are rising. Both of these factors suggest a contraction in fleet size in the years ahead. This will set up a tightening supply in the years ahead, and in turn higher rates. Bigger remains better in the tanker markets for now.

Source:XINDE MARINE NEWS

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

admin@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar