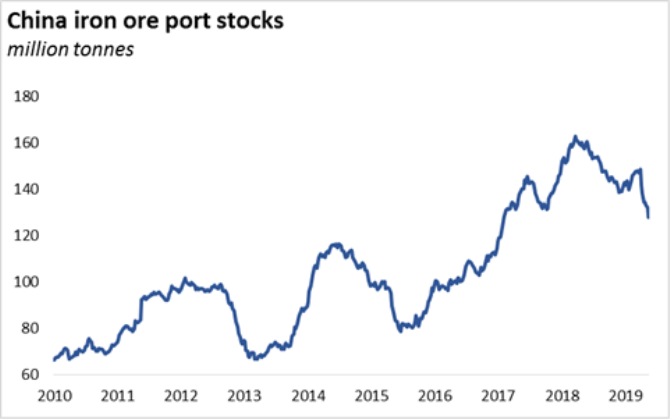

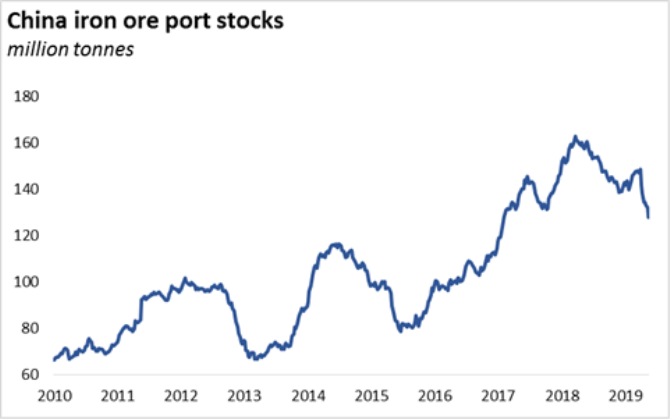

Iron ore stocks at China’s ports declined by 4.4mt last week to 127.7mt, the lowest level since Jan-17. The pace of stock draw-down in recent weeks has been the highest on record with inventories falling by 20.8mt or by about 3mt per week since the beginning of April*. That compares to a weekly average stock draw-down of about 500,000 tonnes during the three major destocking cycles since 2010.

By contrast, stocks held by steel mills increased slightly, from about 26 days of consumption at the beginning of May to an estimated 29 days this week, which is marginally above the long-term average of 27.3 days for this time of the year.

The surge in steel output on the back of strong demand from the infrastructure and property sectors in China is driving the sharp decline in port stocks. During April Chinese mills produced 85mt of crude steel, up by 11% year on year and the highest on record. Total production during the first four months was also up by 9% from 289mt in 2018 to 315mt this year.

At 127.7mt, iron ore stocks may still look high from a historical perspective. However, compared to the average monthly imports, current inventories are below the last three years’ average levels and look reasonable considering the robust demand.

In addition, we believe the ‘normal’ level of stocks has increased in recent years. There is a lot more blending activity taking place at Chinese ports compared to a few years ago. China has also become an exporter of iron ore over the past couple of years with its exports totalling 11.1mt last year, up from virtually nothing in 2016.

Furthermore, Dalian Commodity Exchange iron ore future contracts were opened to international investors last year, which led to a significant increase in trading volumes. These are physical contracts and have to be backed by physical material, which in turn requires higher stocks.

All of the above - rising blending & trading, Chinese IO exports, and increase in DCE iron ore contract volumes - require additional iron ore as ‘working capital’. Although we cannot quantify the amount, we believe the ‘normal’ level of stocks is significantly higher than it used to be a few years ago. Although we do not see an immediate need to restock at this point, we may not be too far away from a significant increase in import demand in coming months given the pace of destocking recently.

One thing that could dampen a potential surge in import demand is the multi-year high iron ore prices. Due to restricted seaborne supplies and strong demand, benchmark iron ore prices rose well above the $100pmt mark in recent weeks. By contrast, scrap prices in China remained relatively stable. To improve productivity and boost profits, steel producers may opt to increase scrap charge in the coming months.

That said, one could also argue otherwise; a possible resumption of operations in Vale’s temporarily halted mines could lift supplies in the second half of the year and lead to a sharp correction in iron ore prices. Under such circumstances, import demand would rise, and shipments could surge.

Source:Arrow

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

admin@xindemarine.com